If you read nothing else, read this…

- Global employers must consider costs in the context of employees’ locations.

- The design of a benefits scheme can help to contain costs.

- Multinational pooling can save an employer money on insured benefits.

One of the key challenges for global employers is the specific healthcare needs of staff in different locations around the world and the variation in associated costs.

Nic Brown, global head of distribution at expatriate healthcare insurer Aetna International, says: “Because of the nature of global employment, different employers’ situations can be very different in terms of the costs they are up against.”

For example, a mining or oil organisation will have employees in far-flung, often remote, parts of the world, so issues such as evacuation and repatriation are critical, and expensive.

Brown says just one or two healthcare claims a year from employees working in remote locations can have a huge impact on an employer’s healthcare insurance premiums, compared with claims from staff working in metropolitan locations where the cost of private medical treatment is likely to be lower.

That is why employers should first consider employees’ locations, and the medical treatment available to them locally, when assessing how to maximise cost efficiencies in a benefits scheme, says Brown.

Global scheme design

Employers can also achieve cost efficiencies through the design of their global benefits scheme . For example, they could consider introducing excesses, higher deductibles and co-payment in medical insurance schemes .

Jeremy Hill, director of the international consulting group at Towers Watson, believes scheme design is as important as the benefits offered.

“Quite often, [employers] get caught up in the operational practicalities of benefit provision and find it difficult to get beyond that,” he says.

“Some of our current thinking is about how employers can improve on the operational piece to be able to get beyond that and really execute on the strategy. It’s about providing the right benefits through the right mechanism.”

Hill cites insurance solutions and practical approaches that can help employers deal efficiently with the day-to-day management of benefits.

Multinational pooling

Multinational pooling, a mechanism used for insured benefits, is one example. Pooling can help employers maximise cost efficiencies, but it will not suit all organisations and is not offered by all benefits providers.

Hill says many employers do not exploit the full benefits of multinational pooling and resort to local benefits schemes, so cost efficiencies can be lost.

Adam Maher, business development director, total reward and flexible benefits at Willis Employee Benefits, says employers can reduce their healthcare premiums by 10-15% through multinational pooling, depending on their claims history.

“By moving to a pooling arrangement, [an employer] still has the contracts written locally, can still meet local needs and can make this potential saving if its claims experience is positive,” he says. “But it’s not a riskier arrangement; it’s not bearing any additional risk if its claims experience is not positive.”

A major attraction of pooling is the ease with which employers can implement it, particularly those with a global workforce, says Maher.

Risk management

Pooling can also help employers tackle the financial risks of possible fraudulent claims in the insured benefits market, particularly within private medical insurance (PMI) .

Doug Rice, director of international service at Jelf Employee Benefits, says: “There is now much more focus [among employers] on ensuring there are appropriate networks in place, direct billing and quality advice around that, and recognising that certain territories are more prone to [possible fraudulent claims] than others.

“From a cost containment point of view, HR decision-makers are becoming much more savvy about the total risk and trends that are emerging, rather than just the immediate costs of medical inflation, for example.”

Centralising global benefits

Pooling also lends itself to employers’ growing desire to centralise the management of global benefits, but they must ensure staff are adequately prepared to manage efficiency drives.

Towers Watson’s Hill says: “The total number of staff involved in benefits in [an organisation] tends to be a falling number, but at the same time they are being asked to do more with less. They are looking to fulfil a stronger centralised role than they have previously been asked to.”

Employers must also ensure global benefits efficiency drives are aligned with the corporate culture, particularly where there are regional differences.

Holger Hjortlund, vice-president of Willis Global Solutions (Employee Benefits), says: “What is important is that there is a rationale behind each of the differences.”

Employee engagement

Employee engagement is also important, says Hjortlund.

“A lot of employers’ focus is on cost management and there are key areas that multinational [organisations] focus on,” he says. “There is the continued trend from defined benefit to defined contribution pensions , and it is becoming more common for healthcare to be provided by employers, not governments.

“So there is an increased cost [to employers], and it is important to manage that cost in such a way that employees are engaged.”

A wellness initiative can help employers to engage staff while driving efficiencies. Such programmes can reduce employers’ medical insurance premiums by educating staff about how to look after their own health.

So, when driving global benefits scheme efficiencies, employers must take care how they manage the process and be sure to communicate any changes to staff every step of the way.

Read also Is it feasible to globalise a flexible benefits scheme?

Cushman and Wakefield seeks consolidation

Commercial real estate broker and consultant Cushman and Wakefield is reviewing the benefits it offers to staff in each country in which in operates across Europe, the Middle East and Africa (EMEA).

The review was driven by a desire to provide a more consistent benefits offering for its 2,500 employees working across the region.

The organisation is working with global adviser, Willis Employee Benefits, to assess its current benefits provision, to identify potential cost efficiencies and look at the governance of each scheme.

Cushman and Wakefield uses a global pool for its 16,000 global staff. This replaces the regional pool it used for benefits such as medical schemes, until it concluded that this approach was not the best fit because of the size of its EMEA workforce.

Provider relationships

The organisation is also assessing its benefits provider relationships as part of the review.

Neil Fitzgerald, head of reward, EMEA at Cushman and Wakefield, says: “One thing we’re looking at is our company car scheme: is there one lease provider across Europe that we could potentially use? Because again, each country is doing its own individual thing: some are leasing cars, some are buying them.

“We want to make sure we’re being consistent and that someone with expertise is looking at it. So we’re just trying to bring that regional overview and expertise.”

Before working with Willis, Cushman and Wakefield appointed two or three brokers to manage its benefits in the UK, and separate brokers in each of the countries in which it operates.

“We are really trying to consolidate everything together under Willis,” says Fitzgerald. “We’ve just got one point of contact and are hopefully leveraging our purchasing power now.”

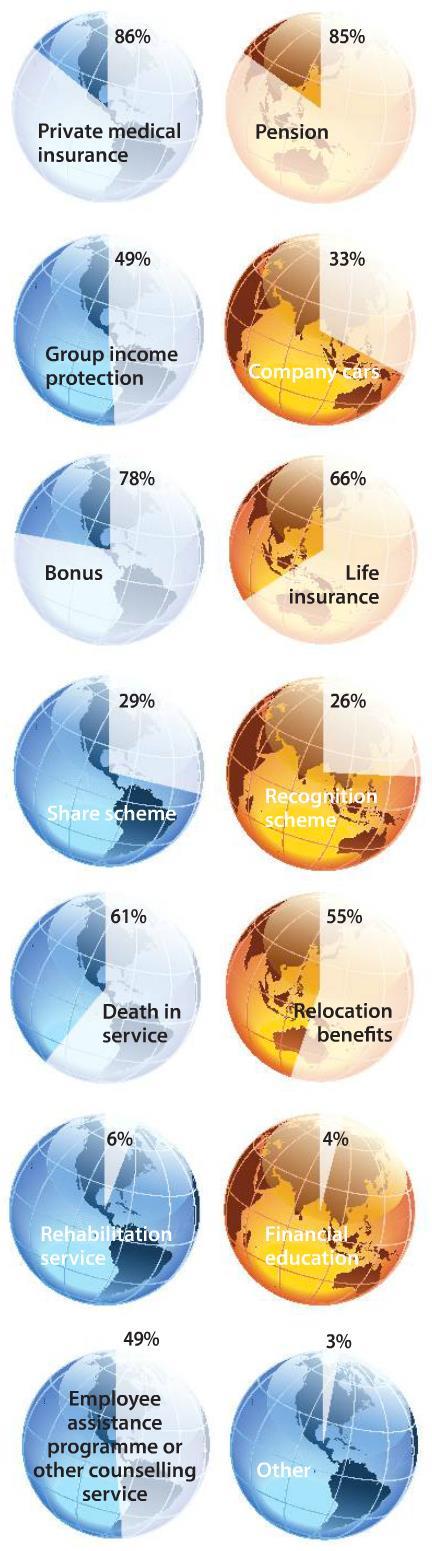

Benefits offered to staff based outside the UK

Sample: Respondents responsible for compensation and benefits in their own organisation, which offer benefits to staff based outside the UK (80)

Source: The Benefits Research 2013, Employee Benefits, published May 2013.