If you read nothing else, read this…

- Some insurers now offer the option to restrict consultant choice for claimants.

- Exact terms differ significantly between insurers.

- This approach can reduce costs and improve quality.

- But claimants unable to access consultants of their choice can be disappointed.

- Effective communication programmes are essential.

Instead of claimants being able to choose their own consultant, which has traditionally been a core advantage of PMI, they are normally designated a single consultant or a choice of two or three consultants by their insurer.

This approach helps to control costs, which is a high priority with medical inflation running at about 10% a year. Insurers also say it improves quality by simplifying the claims process and ensuring claimants see only suitable consultants, because insurers maintain that the data they have on consultants makes them better placed than many GPs to select the most appropriate ones.

James Glover, PMI performance director at Simplyhealth, says: “Open referral recognises that relationships between patients and GPs are different from five or 10 years ago. In the old days, GPs knew all consultants in their area, but now they don’t and they also don’t have such strong relationships with patients.”

Open referral also ensures that employees are fully covered for all their consultants’ fees. A major perceived disadvantage of the traditional PMI approach is that some consultants are covered only up to stated maximum limits, leaving claimants to make up shortfalls out of their own pocket.

Charles Alberts, senior consultant at Lorica Employee Benefits, says: “The huge positive of open referral is that insurers are starting to report increases in member satisfaction as a result of there being no shortfall. This was previously the biggest source of annoyance with PMI.”

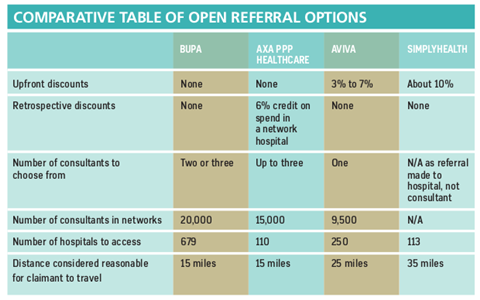

Bupa, Axa PPP Healthcare, Aviva and Simplyhealth all offer open referral as an option on their corporate books, although the exact terms and conditions can vary significantly (see box below). Cigna, WPA and other smaller players do not offer it and, although PruHealth can provide it as an option to employees at the point of claim, it does not offer employers the option to enforce it for all scheme members.

Charlie MacEwan, corporate communications director at WPA, says: “If you agree that the prime reason for purchasing medical insurance is to extend choice and control, then imposing such restrictions undermines all that customers expect of it. Decisions about medical treatment should be made by medical people, not insurers with commercial incentives.”

Gaining momentum

Although Simplyhealth has been operating a form of open referral for about a decade, the approach has gained real momentum only since it was introduced by Bupa in January 2012. Axa PPP Healthcare and Aviva followed suit with formal launches in October 2012 and July 2013, respectively. The jury is therefore still out on its effectiveness, particularly with regard to its ability to reduce costs.

Some insurers offer initial discounts to employers that use this approach (see box), and Axa PPP Healthcare effectively provides a retrospective discount in the form of a 6% credit for any spend in a network hospital. But the extent to which open referral will reduce future claims bills, and therefore PMI premiums, will not be clear for several years.

JLT Benefits Solutions has renewed several Bupa open referral schemes, but says it has no data to support the notion that the approach reduces premiums. On the other hand, the results of informal research into a sample group of 20 employers carried out by Stephen Hackett, head of health and risk at Aon Hewitt, are encouraging. All had switched to open referral in 2011/12 and 80% of them achieved far lower premium rises in 2012/13 than they had seen the previous year.

Even if cost savings do prove significant, open referral will never suit all employers because some regard choice of consultant as a highly important issue.

Claire Linaker, director at JLT Benefits Solutions, says: “Typically, healthcare trusts do not take it because they don’t want to restrict choice and some [employers] with on-site occupational health departments can also prefer to make their own referrals. About 70% of our mid-corporate [organisations] with access to open referral are taking it, but the proportion is only about 20% with our large corporates. Access to the option is not driving decision- making, and no clients are switching insurer to get it.”

The most obvious potential downside of open referral is that it could lead to disappointment at the claims stage if an employee particularly wants to see a consultant they are not offered. In practice, however, this problem is reduced by the fact that all providers say they are prepared to be flexible and depart from the standard restrictions in exceptional cases where rare expertise is required.

Communication vital

However, for more standard cases, employees that have had good previous experience with a particular consultant could be upset to find they cannot use them again. So employers that introduce open referral must conduct an effective communication programme. Ideally, this should take place three months before the introduction or, as an absolute minimum, six weeks before.

Elliott Hurst, director of health consulting at Axa PPP Healthcare, says: “It is essential that HR and reward professionals appreciate the importance of both initial and ongoing communications to employees. Open referral has worked very well when employers have been good at this model, but where they have been reactive, the results have been more problematical.”

It seems there is also scope for insurers that offer open referral to improve their own communication programmes. Chris Cannon, business development manager at Jelf Employee Benefits, says: “Insurers are saying it’s all about quality, and it’s true they have built up data on consultants which, in some cases, could be better than that available to GPs.

“But insurers should be more transparent about their motives, which are at least partially cost-cutting. The feedback I get from experienced consultants is that they are missing out because insurers are giving their business to younger, less experienced alternatives.”

Most experts agree that open referral is here to stay and should eventually become the norm, and Axa PPP Healthcare and Simplyhealth are already considering extending it to their smaller employer books. On the other hand, WPA, PruHealth and Cigna have no plans to offer it as an option to employers, although Cigna does not entirely rule it out in the future.

Viewpoint:

Colin Boxall: One size does not fit all

When open referral was introduced, a number of my colleagues said: ‘Only Bupa could do this.’ Bupa’s market share and influence can, arguably, enable it to mould medical insurance thinking more effectively than other insurers. Its bold approach to managing treatment costs, in turn managing client premiums, has been validated to some degree by the recent Competition Commission findings highlighting that hospital costs in some areas should be lower.

Where Bupa led, others followed, seeing the value of open referral to their customers. Implementation and flexibility does play a part in success, however.

When open referral was introduced to our clients, some immediately saw the logic and benefit, while others viewed it less favourably. Certainly we have found no employers have chosen to move to an insurer because they want open referral, but we have seen some move away. The decision as to whether this fits depends on the culture and aims of the organisation.

At Advo, we wholly support the concept and see it as a positive step forward, but it is important to understand that one size does not fit all. Indeed, the very essence of medical insurance is choice and empowerment, something that open referral perhaps removes to some degree.

Insurers that advocate open referral will say choice remains, but with the added benefit of outcome certainty and lower claim costs. But some employers insist it should be up to their employees to select the consultant to look after them. Private medical insurance has always been about choice, the ‘who, where and when’; restricting the ‘who and where’ does not sit comfortably with some employers, regardless of the possible merits.

It is true that insurers with open referral will allow choice; some make it easy, others less so. I commend Bupa for introducing positive innovation, but urge all insurers to continue to allow employees the choice to select what is best for them.

Colin Boxall is commercial director at Advo Group