If you read nothing else, read this…

- 72% of pension professionals are not prepared to deal with the consequences of the pension flexibilities. (Aon Hewitt)

- Financial education could become a prominent feature of benefits packages to help employees plan for retirement.

- Employers will have to adapt working arrangements to cater for flexible retirement.

- Default investment strategies should also be reviewed.

The changes should also prompt employers to revamp and enhance their benefits strategies to offer more flexibility, and adapt HR policies for employees who are working longer.

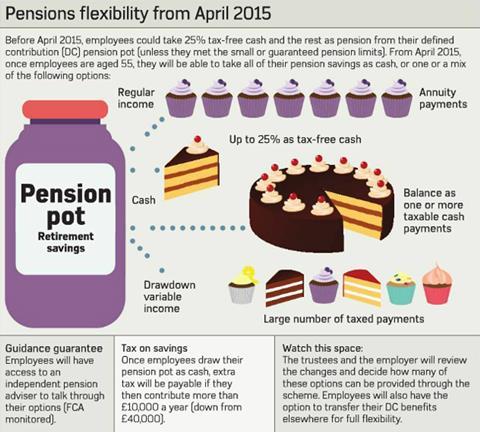

Chancellor George Osborne’s 2014 Budget gave employees in DC schemes greater flexibility around how they can use their pension pot at retirement. From April 2015, staff will no longer be required to buy an annuity, but can choose to take their pension wealth as a lump sum, drawdown or an annuity (see p25 - link to come).

But according to research published by Aon Hewitt in August, just under three-quarters (72%) of respondents [pension professionals] say they are not fully prepared to deal with the consequences of the pension reforms .

The study also found that one in five (20%) respondents say they would need significant extra resources, in time, money and external support, to implement the changes.

Iain Chadwick, consultancy director at Johnson Fleming, says: “It is a challenging time for employers. These are fundamental changes to their schemes and they should be looking at the need to educate and communicate to employees.”

A priority for employers is to rethink their at-retirement communication and education strategies .

Education is also vital for HR and benefits staff who will be talking to employees coming up to retirement, planning flexible retirement policies and facing workers who are daunted by the choices they must make.

Aegon’s Retirement readiness survey, published in August, highlights this as an area where employers could improve, with more than one-third (39%) of employee respondents not having a financial plan for retirement .

Other research by Jelf Employee Benefits, published in July, found that one-third (33%) of respondents expect employers to have to fund financial guidance for their entire workforce following the pension reforms announced in the 2014 Budget.

Lifetime of education

Jo Thresher, head of money at work at Jelf Employee Benefits, says: “The reforms should lead employers to revamp their strategies, especially where they have not changed how they deal with employees planning for retirement. They need to put policies in place to provide a lifetime of education.”

For example, employers can implement financial education tools for employees that highlight what the changes are, help them achieve a good income in retirement, help boost pension contributions and communicate other workplace savings tools.

“It all depends on the age profile,” says Thresher. “If [employers] have employees that are aged 55-plus, they need to be communicating with them now and providing support, such as courses, to get them to understand how they can take their pension from April.”

The government’s guidance guarantee, which promises retirees free and impartial guidance on how to take these flexible retirement options, will be introduced in April 2015, but many believe it will only go so far.

Damian Stancombe, head of employee benefits at Barnett Waddingham, says: “It is fundamental that education is given at the time employees start to shape what their retirement may look like, not at the point of retirement. It is farcical.

“Suddenly, offering financial education because of the changes will become part of employers’ corporate objective.”

Tim Perkins, director of financial education provider Nudge Global, adds: “This is key to what organisations need to do. They recognise that employees will be asking for more support and they will want to give more in the hope that staff are maximising their pensions and not still hanging around at the age of 75 or 80.”

Flexible-working arrangements

The Office for Budget Responsibility’s Fiscal sustainability report , published in July, found that future generations of UK employees will have to work until the age of 69 or 70 before they receive the state pension . This statistic, combined with employees’ ability to take their pension wealth as a 25% tax-free cash lump sum (with any lump sum above this amount subject to their marginal income tax rate), should prompt employers to revisit their policy on flexible working.

Paul Macro, partner and client leader of Mercer’s UK defined contribution and savings team, says: “One of the options for employees is to retire or cut their working hours and use their DC pot as a bridging gap until they reach state pension age.

“Employees have not easily been able to do that and it will encourage people to request to work flexibly. This could have implications for employers, especially if most of their employees are around the age of 50 and above, but it also allows them to ease the transition into retirement.”

Employees may expect to be able to access their pension savings and carry on working, so employers also need to look at how this fits with other benefits. They will have to consider several key questions, including: Will they want employees to take their existing pension savings and then simply rejoin the scheme? Most employees who take their benefits early will still qualify for auto-enrolment, so will employers offer them just the minimum, or will they offer more? And are death benefits tied to membership of the pension scheme?

Transition to retirement

Faith Dickson, a partner at law firm Sackers, says: “Allowing employees to take their benefits and continue working can help them transition to retirement. But, equally, there will be employees who take cash in their 50s to meet financial demands and then won’t be able to afford to retire in their 60s or 70s.”

Another area where the new retirement options are driving change is in schemes’ default investment strategies . According to research by asset management firm SEI, published in August, two-thirds (66%) of trustee respondents are looking to change their pension scheme’s default strategy within the next 18 months .

SEI’s Defined contribution pensions survey , which canvassed trustees and employers about their current approach to DC pension governance, also found that 52% of respondents operating a trust-based scheme are planning to implement new retirement solutions after the removal of compulsory annuitisation in April 2015.

Jeanette Makings, head of financial education services at Close Brothers, says: “Some employers are looking at de-risking their scheme because it is not the right strategy. It is causing employers to go back and communicate to employees the various investment options.”

Makings says employers should also be reviewing their annuity providers.

However employers revamp their benefits strategies in the light of the changes, a key consideration is for messages to be communicated appropriately to staff, whether by offering financial education or hosting financial wellbeing events.

Martha How, partner, reward and benefits, at Aon Employee Benefits, says: “All this points towards employees being more concerned about their retirement and employers can no longer say they will not give financial advice. Employers are waking up and beginning to provide the necessary tools because of these changes.

“It has clearly led to a revamp of strategies, with more awareness sessions made available. There is a quiet revolution going on in the workplace.”

Case study: Bristol Myers Squibb

Global biopharmaceutical organisation Bristol Myers Squibb has taken proactive steps to educate employees about their retirement options ahead of the pension reforms in April 2015 .

It has informed staff about the changes following the closure of its defined benefit (DB) scheme in 2012 and the introduction of a group personal pension plan .

The employer has also launched an online retirement planning tool , provided by Aspire to Retire, which is available to employees who are five years from their default retirement age.

Daphne Lucas-Lee, UK associate director, compensation and benefits at Bristol Myers Squibb, says: “When we opened the DC [defined contribution] scheme, we had a number of concerns from employees that they did not know enough about pensions.

“We have done a lot of education to improve this and, as a result, have started to inform employees about the coming changes to DC schemes.”

The scheme gives staff information about the importance of saving, access to information about their retirement options , interactive tools specific to their pension scheme and telephone access to consultants.

The organisation aims to engage employees with their pensions and offer advice and guidance that goes beyond the government’s guidance guarantee.

Lucas-Lee adds: “As employees near retirement, a number of decisions will need to be made. It is important that we give advice and guidance to employees so they understand the options available to them, especially after next year.

“We wanted to prepare them adequately for the changes. The tools and what we do is about keeping them engaged.

“We have made sure our communications are timely and understandable because pension legislation is complex. We do not want employees to be caught further down the line not realising about the decisions they make because advice was not given.”

Ros Altmann: Older workers benefit businesses and the economy

The UK is facing a fundamental shift. Our society and our workforce are ageing and employers need to respond. Helping people stay in the workplace for longer is likely to be increasingly important for businesses.

Over the next 10 years, forecasts suggest there will be 700,000 fewer people aged 16 to 49, but 3.7 million more people between 50 and state pension age. To avoid labour shortages, extending working lives and embracing flexible retirement options will be an important part of the future workplace.

Redefining traditional retirement represents a tremendous opportunity to boost economic growth, as well as benefiting long-term corporate performance. Government changes are helping businesses embrace this opportunity.

Ending the default retirement age and extending the right to request flexible working to all employees can help retirement become a process of cutting down working hours, rather than no work at all. A phase of life when older people are still working, but less than before, still contributing to the economy and their own future finances, is better for most people than suddenly stopping completely.

Keeping older workers in work will also, ultimately, mean more jobs for younger people, because it will increase the spending power of the economy.

As a part of my role as the government’s business champion for older workers , I am meeting successful employers and seeing first-hand the business benefits of retaining and recruiting older staff.

For example, coach operator National Express, where one-third of the workforce is over 50, is happy to employ older workers on a part-time basis and finds that combining older and younger staff helps the less experienced learn and develop. It believes older workers often better understand the needs of older customers and that this is benefiting its bottom line.

Negative stereotypes about older workers are starting to evaporate, with organisations across the country seeing the benefits of an age-diverse workforce. As people are healthier for much longer and want a better standard of living in later life, flexible retirement offers a win-win for all. Better for business, better for individuals and better for the economy in future.

Dr Ros Altmann is the government’s business champion for older workers