If you read nothing else, read this…

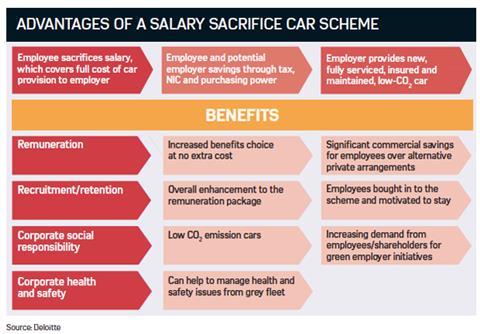

- Salary sacrifice car schemes are typically low-cost or cost-free for an employer to introduce.

- Low-emission cars are popular in schemes because of available tax breaks.

- Employers can put buffers in place to protect themselves from early termination fees and long-term absence of scheme members.

Knowing how to build a business case, how to implement a scheme successfully and determining how it benefits employees and the organisation, can all boost take-up rates.

Paul Hollick, chief commercial officer at provider Alphabet, says: “Employers really need to know what the likely uptake is, the internal costs of implementing a scheme and what their provider will be able to offer in terms of launching the scheme.

“It’s about how much a salary sacrifice car scheme will benefit an employee as much as an employer.”

Building a business case

Before implementing a scheme, employers must understand the facts in order to build a business case. This can be a complex task, but there are essential matters to consider.

One of the most important is that schemes are typically cost-free for the employer.

Another is that schemes can be managed by the chosen provider. Most providers can manage all aspects of car maintenance, including servicing, breakdown cover and insurance, and handle ongoing communications about, for example, driver and car safety. This can be built into the business case for a scheme.

Hollick says the best schemes are not set up just to save employees money. “A business case can include that it’s cheap and that employees get a brand new, fully maintained car, but that is just half of it,” he says. “The best schemes are set up to tick an organisation’s green agenda and help cut organisational costs.”

Gary Killeen, fleet services commercial leader at GE Capital, says project plans can run to several hundred pages, so it is essential to make documentation as watertight as possible.

“Done correctly, detailed work on scheme modelling, design structure and policy decisions, with no gaps and no ambiguity, will pay dividends,” he says. ”Correct documentation from a legal and tax compliance perspective is also, of course, essential.”

As part of building a business case, an employer has to obtain HM Revenue and Customs (HMRC) approval for its scheme.

Tax breaks

In a salary sacrifice car scheme, an employee forgoes a portion of their gross salary in exchange for savings on tax and national insurance (NI).

The employee will save tax and NI on the sum that has been sacrificed, and the value of the car benefit is subject only to benefit-in-kind (BIK) tax.

The most recent change to BIK tax structure, in April 2013, saw the low tax band of 5% applied to all cars emitting 75g/km of carbon dioxide (CO2) or less. This will drop to 50g/km for the 2014/15 tax year.

A salary sacrifice scheme also produces savings for employers, on NI contributions and corporation tax. Although the employer still has to pay NI contributions on the provision of the car, this will normally be much less than the employer NI contributions that would have been due on the portion of salary sacrificed.

Employee communication

When implementing a scheme, the best way for employers to boost take-up is regular communication to staff.

Communication methods could include a benefits portal, an intranet, a staff magazine or e-newsletter, email bulletins, text messages, roadshows, forums, posters, payroll communications and open days.

Mike Moore, director at Deloitte Car Consultancy, says constant communication will keep a scheme fresh in employees’ minds.

“There are two reasons why [employers] have to get it right,” he says. “Firstly, so employees are aware of it and understand the implications.

“Also, there is a duty of care for the employer to let staff make informed decisions. Employers should not give personal and tax advice, but should inform employees that they are giving up salary and are getting a benefit for it, but this could impact other things, such as tax credits and their state pension entitlement. Communications have to be clear.”

What to watch out for

Two major issues often overlooked by employers considering a salary sacrifice car scheme relate to parental leave and the cost of early termination .

When an employee goes on maternity or paternity leave, their employer is contractually obliged to continue to provide all the benefits of a salary sacrifice scheme, despite the possibility of an absent employee suffering a significant drop in salary, or even being on unpaid leave.

Moore says: “One of the issues organisations are reluctant to put in [to schemes] are conditions for unpaid leave. Employers can build things into their policy, such as pots of money to cover any costs incurred. Most organisations try to keep the scheme design simple.”

Roddy Graham, commercial director at Leasedrive, says that despite the risk of early termination fees, offering a car as a benefit can help employers retain staff, with contracts usually lasting two to three years.

“If an employee leaves, they either give up the car and pay the early termination fee, but most tend to stick with their employer,” he says. “Essentially, it is another way of locking in to an employer. However, they could choose to buy the car outright.”

Scheme administration

Introducing a car salary sacrifice scheme brings extra administration for employers, especially when tax changes occur. Employee contracts will need to be updated in relation to any increase in VAT or NI contributions.

Providers can help employers work through the administration details. Dennis Dugan, car fleet manager at consulting engineers WSP, says: “Most of this can be auto-piloted by providers. But organisations need to be aware of the administration processes they need to go through and have the procedures in place to cope.”

Popular cars

Employers should also note current buying trends in car schemes, which lean towards cars that are more fuel-efficient and greener.

Damien James, chairman of the Association of Car Fleet Operators (ACFO), says the most popular models are those with CO2 emissions of 94g/km or less, which enable employees to take advantage of the 10% and 13% BIK tax brackets. “Low CO2 emission cars are best suited to salary sacrifice schemes and the numbers are increasing day by day,” he says. “As emission laws change, I can only see the pool of [greener] cars getting bigger.”

Electric cars are also becoming more common in salary sacrifice schemes, with a number of providers offering thse as an option. The attractions of an electric car include a government grant of up to £5,000, low recharging costs and no BIK tax, rising to 5% in 2015-16.

Overall, a salary sacrifice car scheme is straightforward to introduce and offers employers a low-cost option to reward staff. Alphabet’s Hollick adds: “It makes sense to introduce and it works, but there is scepticism that it is too good to be true and hard to communicate. But it’s a win-win for both employer and employee.”

Case Study: Leicester City Council’s car salary sacrifice scheme offers cost-effective benefit

Leicester City Council introduced a salary sacrifice car scheme in November 2013 for 13,600 eligible employees.

The scheme, operated by Tusker, includes motor insurance, servicing and maintenance, roadside assistance, tyres and glass, plus protection against redundancy, resignation and maternity leave .

Before implementing the scheme, the organisation wanted to reduce the cost of its employee benefits, having previously offered a central user allowance for employees to travel to work in their own car.

Cory Laywood, HR, pay and benefits manager at Leicester City Council, says: “The first case was to identify a need for the scheme, and we did, because we wanted to reduce benefits costs and come up with something more cost-effective as an alternative for employees. We wanted this to be beneficial to the organisation.”

A salary sacrifice car scheme fitted the bill because the council felt it was offering employees more than just a car. “We are supplying staff with a car that is brand new and saves the employee tax and national insurance,” says Laywood. “That formed a large part of the business case.

“We also informed staff that the car was not only insured, but it would be fully maintained with roadside recovery. We wanted everything to safeguard the employee while they have the car.”

The council has set a CO2 emissions cap of 120g/km to encourage staff to choose fuel-efficient and more environmentally-friendly cars.

But the stand-out point of the business case was that the scheme improved the authority’s green credentials and kept business local, says Laywood.

“A big thing for us, because we are a council, is localism. What Tusker is able to do, where possible, is to supply cars from local dealers and maintain them locally, so that business stays in the area.”

Communication was also key, and was carried out via emails and intranet messages.

“We built a communication strategy to tell staff about the scheme and how it related to the employee, which aroused interest in the benefit before it went live and we continue to communicate the scheme to staff,” says Laywood.

Alastair Kendrick : Tax savings can be made on salary sacrifice car schemes

The main driver for a company car salary sacrifice scheme is the tax savings for the employer and employee.

The major saving arises for the employee because they no longer pay tax and national insurance (NI) on the earnings that are being sacrificed.

Instead, they pay income tax on the benefit in kind on the car. So if an employee is selective over the car they take , there are savings that can be achieved.

Savings for the employer relate to the NI on the earnings sacrificed and the Class 1A NI arising on the benefit in kind. But it should be remembered that the taxation of company cars changes every year and those doing the estimates of cost savings need to bear this in mind.

Also, it is often overlooked that the employer can enjoy a saving on mileage allowances paid, depending on their policies, because the employee is no longer using their own car for business travel.

The employee cannot enjoy the approved mileage allowance payment, currently 45p per mile up to 10,000 miles in a tax year and 25p per mile thereafter, but instead get reimbursed at the advisory fuel rate, the amount of which varies according to the car’s engine capacity.

Depending on levels of business mileage, this can deliver significant savings for the employer.

The employer can make another saving by recovering 50% of the VAT on lease and maintenance costs. HM Revenue and Customs has issued detailed guidance on this.

Alastair Kendrick is tax director at MHA MacIntyre Hudson