Employee Benefits is hosting a live webinar, Employee Benefits Wired: the changing pensions landscape, at 1pm on Tuesday 1 December. Tune in to EB TV to watch the session and send your questions to the panel by tweeting #EBWired.

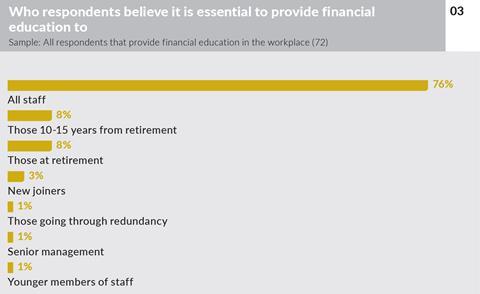

EXCLUSIVE RESEARCH: More than three-quarters (76%) of respondents believe it is essential to provide financial education to all staff, yet just 32% do so, according to the Employee Benefits/Close Brothers Pensions research 2015.

The research, which surveyed a total of 259 respondents in September, also found that 9% of respondents offer financial education to some staff and 7% offer it to those at retirement.

Half of respondents (50%) do not offer financial education in the workplace.

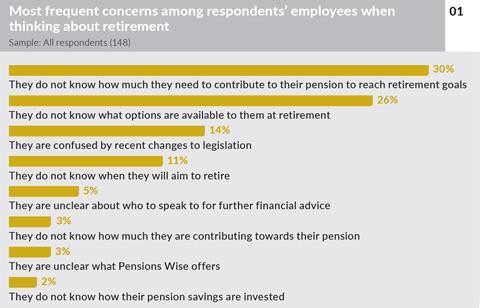

However, although almost half (48%) of respondents do offer financial education support in the workplace, there is still confusion among employees when thinking about retirement, demonstrating that perhaps the education is not delivering its intended goals. Nearly one-third (30%) of respondents’ employees do not know how much they need to contribute to their pension prior to retirement, and a quarter (26%) do not know the options available to them at retirement.

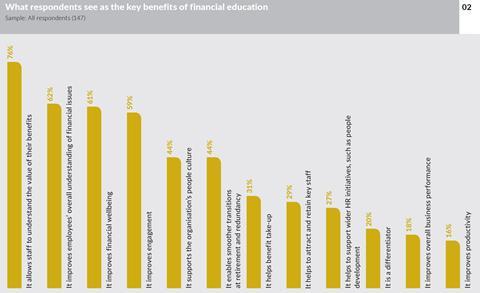

Employers see the provision of financial education as key to helping improve an employee’s overall financial understanding. Respondents cited the top reasons for providing financial education in the workplace as allowing staff to understand the value of their benefits (76%), improving employees’ overall understanding of financial issues (62%) and improving financial wellbeing (61%). Financial education is also seen as key in strengthening an employer’s talent management strategy, for example, by improving engagement (59%) and aiding the attraction and retention of key staff (29%).