Employers that have yet to auto-enrol staff should start planning as early as possible.

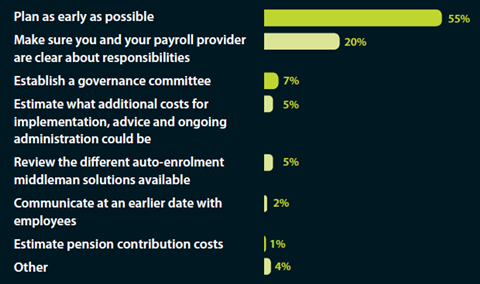

More than half (55%) of respondents to the Employee Benefits/Capita Pensions Research 2013 that have already auto-enrolled staff said this would be their top tip for employers that have yet to comply with the reforms.

A further 20% said employers should ensure that they and their payroll provider are clear about their responsibilities.

Other respondents that have already auto-enrolled staff said they would recommend establishing a governance committee (7%) and estimating what additional costs the organisation is likely to face for the implementation, advice and ongoing administration of auto-enrolment.

However, just 1% said they would advise other employers to estimate the cost of pension contributions under auto-enrolment. Yet this could be a significant change for organisations that have low pension scheme membership going into auto-enrolment or that have lower existing contribution levels than the minimum required under the reforms.

Auto-enrolment advice from employers that have auto-enrolled staff

Read full version of Employee Benefits/Capita Pensions Research 2013