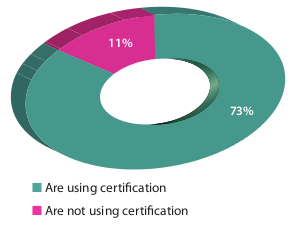

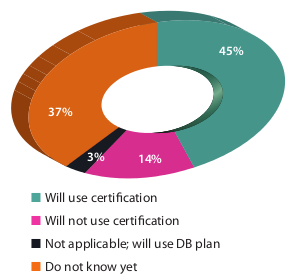

Most respondents that have auto-enrolled their staff used the option to self-certify to simplify the calculation of pension contributions, according to Employee Benefits/Capita Pensions Research 2013.

The research, which surveyed 370 HR and benefits managers, found that 73% of respondents are using this option.

Certification rules state that instead of having to use a ‘qualifying earnings’ definition, it is possible to base pension contributions on basic pay or other pay definitions.

This is primarily aimed at workforces with variable pay because of payments such as commission, bonuses or allowances.

Certification will exempt employers from having to ensure that the value of an employee’s defined contribution (DC) scheme contributions are at least equal to the statutory minimum pension contribution level over a 12-month period.

The minimum rates of contribution for certification are as follows:

- Tier 1: a 9% contribution of basic pay (including a 4% employer contribution) for jobholders in the scheme.

- Tier 2: an 8% contribution of basic pay (including a 3% employer contribution) for jobholders in the scheme, provided that pensionable pay constitutes at least 85% of the pay bill.

- Tier 3: a 7% contribution of pay (with a 3% employer contribution). All pay must be pensionable.

[2 PIE CHARTS]

Use of the certification rules to simplify administration

Read the full version of Employee Benefits/Capita Pensions Research 2013.