Need to know

- Reductions in pensions savings limits could make workplace individual savings accounts (Isas) an attractive savings vehicle for those contributions previously made to a workplace pension.

- Targeted at younger members of the workforce, the launch of the lifetime Isa (Lisa) next April could prove to be a catalyst for engaging younger employees with saving for their future.

- Even if employees do use the Lisa for retirement saving, most will still rely on saving into a good-quality pension scheme to meet their retirement income needs.

Workplace individual savings accounts (Isas) were first introduced in 2008 as a flexible way for employees to kick-start their savings habit and supplement their pension pot at the same time.

Among the various workplace savings schemes that employers offer to their staff, however, workplace Isas have enjoyed mixed fortunes, never quite taking off in the way that providers were hoping, perhaps because many individuals do not like the idea of their employers knowing what personal savings they are making and prefer to choose their own provider.

But things could be about to change for the workplace Isa, says Kevin Wesbroom, senior partner at Aon Hewitt. “The much-reduced pension limits, down to £10,000 per annum for the high earners, and much increased Isa limits, up to £20,000 or £40,000 for a couple, from next year will make Isas much more attractive,” he explains.

Financial wellbeing

With financial wellbeing now considered an important part of the workplace wellness strategy, savings schemes and other benefits that support employees’ financial awareness can play a key role in an employer’s overall engagement strategy. The popularity of workplace Isas will increase in line with a growing awareness among employees that retirement income is not going to be provided solely through pensions, says Sue Pemberton, head of defined contribution (DC) and wealth at Xerox HR Services. “The reductions in annual allowance and lifetime allowance mean that employers and employees should start to look at alternative savings vehicles for those contributions previously made to a workplace pension,” she says.

“Employers put pensions in place to help provide individuals with a means to support themselves in their retirement. While providing a cash alternative to those who are going to breach the new annual allowance and lifetime allowance limits does not satisfy these objectives, giving employees an alternative savings vehicle goes some way to continue to do so.”

The Isa route also provides for short- and medium-term savings goals to be achieved where pensions do not, while encouraging the savings habit.

Lifetime Isa

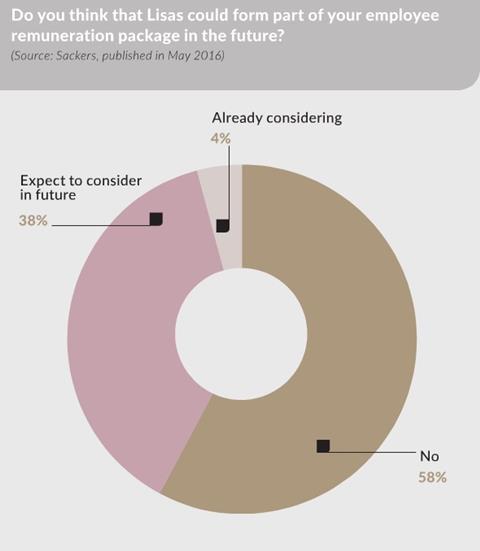

However, April 2017 will also see the launch of the government’s new lifetime Isa (Lisa). Whether this will assist the anticipated resurgence of workplace Isas, or end up replacing these is a subject of debate. Lisas are aimed at those aged between the ages of 18 and 40, and will therefore appeal to a different demographic; younger workers.

“They will focus on government incentives to help them save for that first house and we believe employers will increasingly see that money invested in Lisas for the young is more value than money invested in pensions,” says Wesbroom.

While that does not solve the potential for under-saving into pensions, it does raise financial awareness among younger employees. The fact is that given the demise of final-salary schemes, the state pension age being pushed back, low interest rates, and the reality of longer life expectancy and the prospect of a longer length of time in retirement, it is the Lisa generation that will have to save more for their future.

But Elliott Silk, head of employee benefits at Sanlam, believes it is unlikely that the Lisa will increase savings through the workplace. “The under-40 age restriction will make it more complicated for online benefit systems to administer Lisas through the workplace,” he says. “Employers have already commented to us that they will find it difficult to incorporate them ethically when they are not available to the entire workforce, and some fear that they could be challenged as being discriminatory.”

Lisas may well attract saving for those looking to pay in more after having already maximised their entitlement to an employer contribution, but the real area of interest will be those younger employees who have yet to buy a home, says Nathan Long, senior pension analyst at Hargreaves Lansdown. “We think the powers of inertia and the valuable employer contribution on offer will keep younger members of staff in their workplace pension,” he says. “The Lisa could instead act as a catalyst for these young people to kick-start their savings habit. Employers offering staff access to Lisa may well pique the interest of 20-somethings who are often seen as difficult to engage.”

For the majority of employees, however, retirement income needs may still be best served by good-quality pension schemes, with automatic-enrolment to encourage joining, employer contributions, and well-governed default funds.

As Alistair Byrne, senior DC strategist at State Street Global Advisors, says: “Where individuals do use the Lisa for retirement saving, it will be important to ensure an appropriate investment strategy. The majority of Isa subscriptions end up being held as cash, which gives individuals peace of mind, but will fail to generate the long-term growth that is needed to fund retirement.”

Case study: Reed Smith uses Isa to engage staff with retirement savings

International law firm Reed Smith introduced a workplace individual savings account (Isa) in 2012, launching the scheme alongside its auto-enrolment roll-out as a way of boosting staff engagement with the new pension scheme.

Claire Gibbens, HR manager, says: “We had just signed up with a new provider, Hargreaves Lansdown, and [it] implemented both schemes. The Isa really came into play when we launched our flexible benefits scheme in April 2013, which was on the back of a major communications strategy, with a benefits fair attended by individual vendors proving to be a key move in driving take-up.”

Since the launch, there have been four enrolment periods at Reed Smith, and among the firm’s 550 eligible members of staff, take-up currently stands at around 13%.

“We are really pleased with the results and the feedback, and put it down to our efforts to provide financial education to our staff, particularly to new joiners and trainees, so they understand the real value of what is available,” says Gibbens.

She adds that education will also be key to the success of the Lisa when it is launched. “It is a flexible way of saving for a different group of people, but as with any area of financial wellbeing, education will be the key to a high take-up within the workplace.”