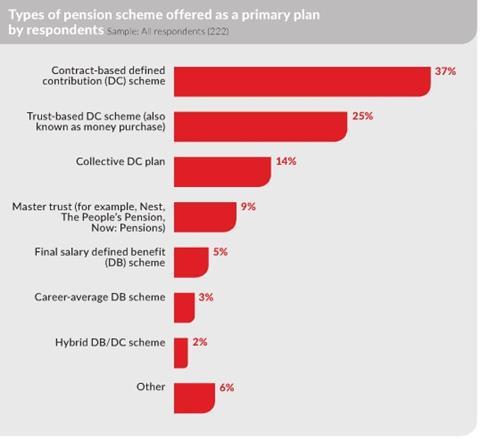

EXCLUSIVE: More than a third (37%) of employer respondents offer a contract-based defined contribution (DC) pension as their organisation’s primary scheme, according to research by Employee Benefits and Close Brothers.

The Employee Benefits/Close Brothers Pensions research 2016, which surveyed 250 employer respondents, also found that 85% of respondents which offer a contract-based DC pension as their primary pension plan provide a group personal pension (GPP) plan as their primary scheme.

Although the numbers have fluctuated somewhat over the years, GPPs have consistently topped the list of the most commonly offered type of pension scheme since 2005.

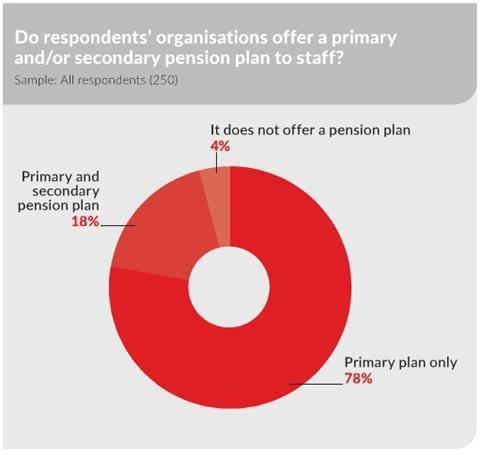

Overall, more than three-quarters of respondents (78%) offer a primary pension scheme for staff, while a further 18% offer both primary and secondary schemes. Where organisations offer more than one scheme, it may be that one comprises a historical defined benefit (DB) arrangement, which is now closed to new entrants and/or future accrual. Alternatively, employers may have introduced a second type of arrangement for auto-enrolment purposes for certain sections of their workforce. This is borne out by the results of this year’s research, which show that trust-based DC schemes and master trusts (such as the National Employment Savings Trust (Nest)) are the most commonly offered types of secondary scheme.

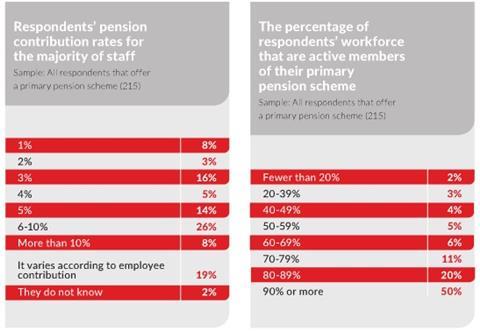

Employer contribution levels have also remained fairly stable over the past few years. Just as in 2013 and 2014, a 6-10% contribution remains the most commonly awarded level from respondents. It is encouraging to see that this has not been levelled down as employers deal with increasing pension costs resulting from auto-enrolment, for example, and begin to go through the re-enrolment process for the first time.

Watch Employee Benefits Wired: Maximising pensions potential. The 30-minute panel discussion can be viewed online anytime on EB TV.