Need to know:

- There are many ways of positioning total reward statements (TRS) for maximum engagement but, for this to succeed, they must be embedded in all employee-related aspects of the business.

- Timely presentation of a well-developed and detailed TRS can be an effective driver of retention, particularly when employees are considering a move.

- Highlighting all reward elements within TRS increases their appeal among a large proportion of the workforce.

Total reward statements (TRS) that highlight the value of the entire reward provision to employees can be a useful tool in an employer’s recruitment, retention and engagement strategy, as long as these are positioned to create maximum impact and communicated in the most effective way.

There are various ways of doing this and the outcome will very much depend on the organisation and its workforce demographic.

Tim Kellet, director of PayData, says: “Many employers focus on the value of specifics, for example, employee wellbeing initiatives, such as free fruit, volunteering days and bikes-for-work schemes, to highlight the employers’ caring side.”

Certain industry sectors place greater emphasis on some reward elements, compared to others; for example, car provision has historically been regarded as a ‘must have’ within the construction industry.

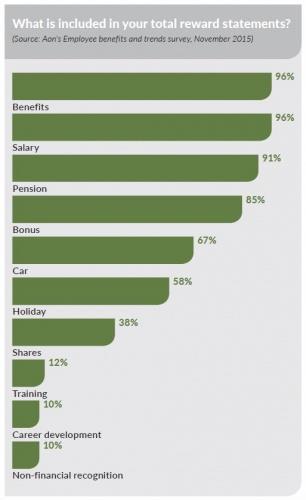

And with different generations of employee valuing different benefits, most employers choose to highlight all reward elements within TRS, so their statements appeal to as much of their workforce as possible, says Kellet.

Cost of total reward

Some employers focus on communicating benefits’ value by highlighting the difference in cost if the employee were to source the benefits themselves elsewhere, for example, on the high street.

However, Jonathan Wood, corporate pensions director at Jelf Employee Benefits, advises employers to be wary of this approach. “[Employers] don’t want to be perceived as artificially inflating the total reward value because there will always be an employee who thinks they can find the benefit cheaper,” he says. “A TRS should be supported with education to ensure employees understand the corporate discounts and/or tax/national insurance (NI) advantages of employer-provided benefits.”

Total reward messages

To ensure that staff are given the right messages about their entire reward provision, TRS must be embedded within the business, from recruitment through to job offer, pay review, promotions and financial wellbeing sessions.

And it is not just about providing details of monetary benefits, but also highlighting some of the more intrinsic benefits such as holiday entitlement and training. Benefits to which a value cannot really be attributed, for example, free tea and coffee, can be just as effective as a retention tool.

Total cash reward

However, there may be a case for focusing on the cash total that an employee receives, rather than just the benefits, on the basis that some may be more inclined to stay with an employer if they can see that the cash reward is higher than a competitor’s.

Clare Sheridan, head of online and flexible benefits at Capita Employee Benefits, says that total reward should mean just that, the total benefit in monetary terms that an employee receives.

“This should include all cash elements of reward, salary, bonus, overtime, shares, benefits, typically shown as an annualised figure,” she explains. “Depending on the type of firm, this can be very powerful. For example, in a sales environment, TRS can be used to show the potential income for an employee dependent on hitting agreed targets and can play a key part in motivating, retaining and engaging the individual.”

Highlighting the cash total or the reward total can also be effective if the timing is right. Duncan Brown, head of HR consultancy at the Institute for Employment Studies (IES), says: “Some organisations, having learned of a manager’s intention to leave, will produce a TRS for them detailing the total reward value to very good effect. Realising the true financial value of what they are already receiving can be a powerful incentive to stay put.”

But would this cash focus work in all industry sectors and for all generations of employees? TRS can be made effective for all sectors, and generational factors are irrelevant as long as TRS are delivered in a tailored way, taking an ‘audience-of-one’ concept into consideration, says Sheridan. “There are rare instances when TRS is not appropriate, such as [organisations] that have populations where no benefits or perks are provided over and above salary,” she adds.

Employers should also be mindful that in a climate of slow salary growth, communicating the full value of the reward package can cut both ways. As Brown says: “With the prospect of another year with no decent pay rise, there is the risk that people will be quite cynical about employee benefits and say they would rather have the cash.”

Simplyhealth offers its workforce a total reward overview

Simplyhealth, which employs 1,400 people, uses its reward site, My Reward, to strengthen its employee pay, bonus and benefits offering and provide a go-to place where employees can find out anything they want to know about their total reward package.

With its employee engagement relative to benefits on the increase, the organisation wanted to evolve its total reward site to become an area that employees interact with on a regular basis.

Therefore it relaunched My Reward, in partnership with Thomsons Online Benefits, to include a My pension e-community, in partnership with Aviva bringing pensions information together in one place.

Louise Wells, reward and benefits manager, says: “Before the upgrade, we primarily used My Reward to enable employees to manage their benefits such as buying and selling holiday and purchasing childcare vouchers. We offer benefits on a flexible and voluntary basis and are working towards evolving it so we can use it to provide a full flexible benefits offering.”

My Reward also allows employees to view each element of their total reward package as a percentage and the actual employer and employee cost.

Wells says: “Employees can now view the monetary value of each benefit to show the true cost to them and Simplyhealth at a high level and in great detail. We don’t offer a comparison to the cost of sourcing elsewhere because each individual’s scenario is different.

“We provide a breakdown using both percentages and financial cost so employees have as much information as possible. The more information we, as an employer, can provide, the more an employee is going to get out of the site.”