If you read nothing else, read this…

- Segmentation of communications is an approach largely used by retailer employers.

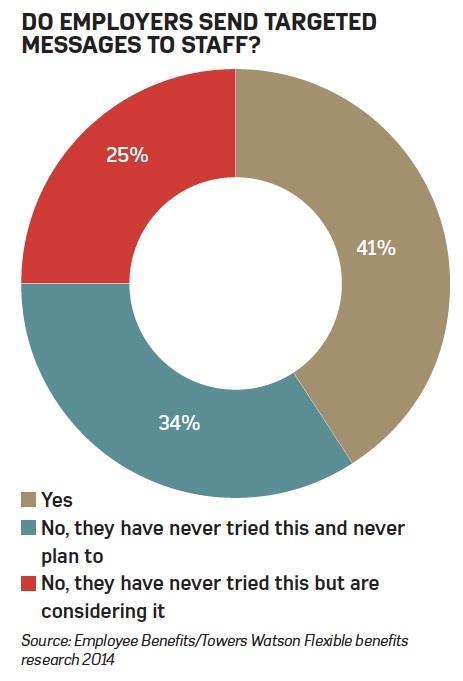

- 41% of respondents to the Employee Benefits/Towers Watson Flexible benefits research 2014 send targeted messages to staff.

- Segmentation can be done by age, job role, salary or demographic.

- A main driver of workforce segmentation for benefits purposes is to aid staff retention and boost benefits take-up.

This is achieved via an approach to customer profiling known as segmentation. Customers are categorised according to certain criteria on which the organisation bases its business strategies, from marketing through to procurement.

Amazon is one example of a retailer that uses a customer’s purchasing history to make recommendations based on the purchases of other customers buying similar items in a bid to tempt shoppers to spend more.

Employers can use similar methods to increase engagement with, and take-up of, flexible benefits during the communication process.

According to the Employee Benefits/Towers Watson Flexible benefits research 2014, published in April, 41% of respondents send targeted messages to staff about their flexible benefits scheme. A further 25% have never tried segmentation, but are considering doing so.

Such targeted communications enable employers to promote the most appropriate benefits for different demographic groups in their workforce. This can be key for employers to achieve their key people objectives.

Nick MacDuff, senior consultant at Towers Watson, says: “The main driver behind segmentation for employers is staff retention. It is about finding different ways of getting messages across to a diverse workforce to help the employer remain attractive. But while employers are finding better ways to communicate benefits to enhance their value proposition, they should not put restrictions on those accessing certain benefits.”

There are various ways of segmenting flexible benefits communications, for example by gender, age, location, salary, job role and whether an employee has dependants.

Alex Tullett, head of benefits strategy at Capita Employee Benefits, says: “Segmentation could go down to the level of looking at an individual’s circumstances, how old they are, what are they working on, where they are [based] regionally, how much they earn and whether they are married and have children.

“It is not about taking a blunt approach and saying whoever is generation X, Y or Z would be interested in life insurance, it is about going much deeper than that. Each individual person has slightly different perspectives.”

Capita’sEmployee insights report 2014 , published in May, highlighted the fact that different employees want different things at different times in their working life.

For example, if most of an organisation’s staff are female and aged over 55, it may have little use for childcare vouchers. Similarly, an employer with a younger workforce might find a stronger preference for retail vouchers.

Capita’s research, which surveyed 3,000 employees, found that 41% of those aged 16 to 24 preferred retail vouchers, compared with 29% of those aged 55 to 64. And while 46% of those aged 55 to 64 found critical illness appealing, only 29% of those aged 16 to 24 felt the same. Such findings can be used as the basis for targeted communications campaigns.

Once they have decided to segment their workforce to tailor benefits communications, employers must first research their workforce demographics. This involves identifying their employee base, what motivates them, and what they do and do not like.

A crucial part of this process is for employers to ensure the data they hold is correct and up to date.

Sadie Edwards, consultant at communications firm Shilling, says: “Data integrity is vitally important to ensure the right employees receive the right message. By getting to grips with data, employers can understand employees’ habits and opinions about benefits, which creates higher engagement.”

But segmentation is just the first step. Once a workforce has been segmented and divided into groups, employers must ensure their message content is relevant and that the appropriate communication channels are used.

Edwards adds: “We would recommend a mixed-methods approach to ensure each subgroup is communicated to in several ways.”

Some online benefits portals can help employers target certain workforce populations and make communications more personal for each employee.

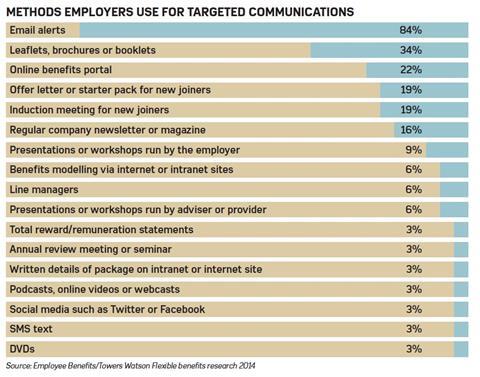

The Employee Benefits/Towers Watson Flexible benefits research 2014 found that emails are still the most popular communication method. Some 84% of respondents use emails to target communications around flexible benefits, followed by leaflets and brochures (34%) and online benefits portals (22%).

Capita’s Tullett says: “It is interesting to see the different methods, but what is interesting is that employees would still prefer paper information when they start a job so that it is something to hold on to. Employers then target communications quite quickly by using information from an online benefits portal, and then send messages via mobile phones or emails.”

When sending targeted communications to different groups of staff, employers should ensure the messages still appear personal to attract and keep employees’ attention.

Richard Morgan, director of consultancy services at Vebnet, says: “Systems can get different tailored messages out to employees. These systems hold a lot of data about employees, they know which benefits have been selected, and they know who has been into the portal or not. Employers can then set up emails to target specific staff who have not been in the system, not selected their benefits, and so on.

“It is now about making it more personal. Segmenting and targeting communications can drive up take-up rates for benefits that are relevant to certain employees.”

This approach has been followed by a number of organisations. For example, when Bibby Financial Services (see box below) introduced targeted messages for flexible benefits in 2013, it saw take-up rise by 5%.

And when car manufacturer PSA Peugeot Citreon used segmented communications to encourage its staff to register for its online benefits portal, 72% did so within six months.

But segmenting a workforce to provide tailored flexible benefits communication is not just about marketing the benefits available; it is also a key dialogue between an organisation and its employees. But employers should remember there is a fine line between being seen to be helpful and being invasive, says Shilling’s Edwards.

“The real measure of success is not benefit take-up, it is greater employee understanding,” she says. “Retailers have long used consumer marketing techniques to delve into our spending habits, using loyalty cards to predict our future spend and sending us targeted communications. But employers have to remember that employees are not their customers and they are not selling benefits to them. It is a conversation.”

There is also no point in sending tailored messages if staff do not appreciate the benefits offered, says Capita’s Tullett. “It is about providing benefits that employees want and segmenting to tailor what is of interest to staff,” he says “Employers have to spend money on the right form of communications so they will have better control over how the information is delivered.”

Viewpoint: Ben Davis: Why is segmentation useful?

It is fairly obvious why the segmentation of a database of contacts can be a smart idea. In short, we are all different, and what motivates me might not motivate you.

These differences encompass the obvious ones, geography for example, or our demographics, such as what gender we are, how old we are and our shoe size or any other attribute one might ask for.

We also differ in lifestyle. If I was a pregnant woman, you might reasonably be expected to guess at some of the things I’ll be prioritising over the next year and beyond.

Most pertinently, we differ in our behaviour. This is marketing bread and butter. Communicating the same messages to lapsed customers, prospects, active buyers and your big spenders would be madness.

This thinking is not new, of course. Way before email came along, mail-order companies used the measures of recency, frequency and monetary value to determine who would be sent which letter or catalogue. This was as much to prevent wasted spend as to encourage sales.

In the last 10 years, technology has enabled many organisations to use fairly sophisticated marketing automation. Segmented communication to customers is rules-based and can therefore be automated. If I leave an online checkout without buying, it can be followed up with a related email. If I am a new registrant, I could be sent a series of welcome emails depending on the information I have disclosed.

Even with anonymous users, tracking technology can personalise advertising across the web, depending on all these characteristics.

So, how to segment in workplace communications? Well, the general principles hold. What are your goals? What data do you have and what data you need in order to target effectively? Is the data stored efficiently in one place and easy to use and update?

Remember, the more you segment, the more time you will have to spend setting up messages. However, over time, these templates can be accrued and used again, perhaps automated. In the end, there is no limit to how advanced you can be with segmentation. Just start slowly and with attributes you think will remain fairly stable over time. Then you can move on to the clever stuff.

Ben Davis is content and community producer at Econsultancy (also part of Centaur Media, owner of Employee Benefits ).

Case study: Bibby Financial Services

When Bibby Financial Services introduced a flexible benefits scheme provided by Thomsons Online Benefits in 2012, it struggled to communicate the plan effectively to its 700 employees.

The organisation over-communicated the launch by sending out messages to staff and repeated emails reminding them that the deadline to sign up to the flexible benefits scheme was looming, despite a number having already done so.

Following employee feedback, Bibby sent out targeted communications in 2013 and 2014 using a variety of methods, including emails and text messages to employees with company mobiles.

Vicky Smith, HR project manager at Bibby, says: “In the first year, we got feedback that we had overdone it. We started to send out communications before the enrolment window, but before it closed we sent out a reminder only to those employees that had not logged into the system and made an action. Employees liked that.”

This year, Bibby’s targeted communications strategy took a step further. It segmented employees according to those that had dependants, using data in the HR system. This enabled it to send targeted communications about childcare vouchers to employees with children.

“We did this because we felt this benefit was just not relevant to those that do not have children,” says Smith. “The targeted approach has really worked and we have been able to increase take-up in a number of areas of our flex scheme, including pensions.”

Bibby’s targeted approach to communications has also boosted employee participation in flex from 92% of the workforce in 2012 to 97.5% this year.

The organisation will continue to use a targeted approach, but will not go as far as to suggest benefits that an employee may want to subscribe to.

Smith adds: “I do not believe it is HR’s role to assume employees will like a benefit because they are in a certain job role, are a certain age, or are male or female. Being that judgemental could be discriminatory.

“But with the feedback we get, we are able to know what works for them and use targeted messages to those working in different fields. It is great when employees personally thank me, because I know that segmentation and targeted messages have worked.”