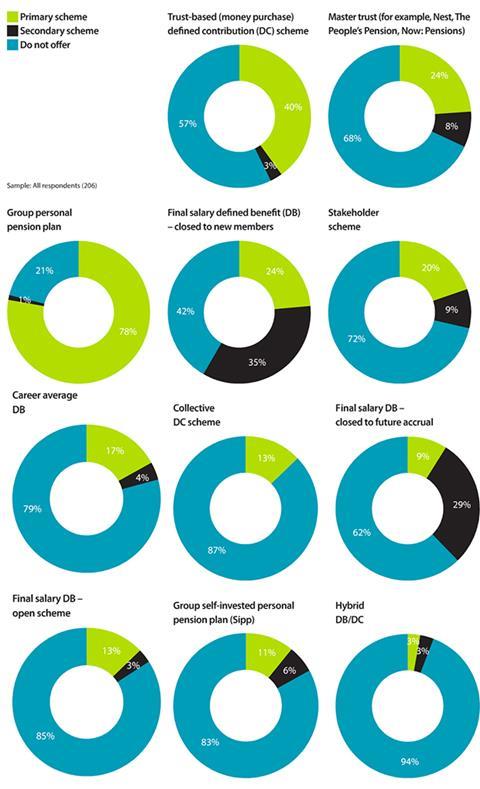

Group personal pension (GPPs) plans remain the most commonly offered type of scheme by employers.

More than three-quarters (78%) of respondents now offer a GPP as their primary pension scheme, according to the Employee Benefits/Close Brothers Pensions research 2014, which surveyed 216 respondents in September 2014.

Although the numbers have fluctuated over the years, GPPs have consistently topped the list of most commonly offered schemes since 2005.

Master trusts have seen a significant rise in popularity over the past year. A year ago, just 3% of respondents offered a master trust as their primary pension scheme. This has now risen to just under a quarter (24%).

This change can be largely attributed to auto-enrolment. All but the smallest of employers have now had to auto-enrol eligible employees into their workplace pensions scheme in the two years since the pensions regime was introduced in October 2012. A large number of organisations have done so using the National Employment Savings Trust (Nest).

When it comes to employer contribution rates, the majority of respondents are putting in more than the 1% minimum required under auto-enrolment legislation. Nearly a third (32%) contribute 6%-10% of salary for the majority of staff, while 18% put in 5% of salary and 14% more than 10% of salary.

It is encouraging to see that auto-enrolment has not prompted a large number of employers to reduce their contributions for staff as many feared in the run up to the legislation taking effect.

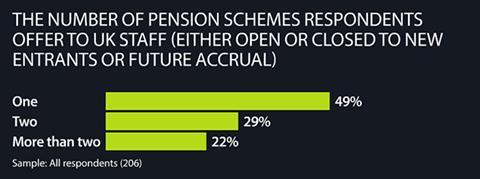

Sample: All respondents (206)

The type of pension schemes offered by respondents

Sample:All respondents (206)

Sample: All respondents (206)