IF YOU READ NOTHING ELSE, READ THIS…

- Cash plan providers cover myriad benefits.

- Costs start from £1 per employee per week.

- Not-for-profit health cash plan providers dominate the market.

- Dental and optical are the most common benefits on which providers pay out.

- There has been an increase in corporate health cash plan subscribers.

Health cash plans are an increasingly popular employee benefit and the corporate-paid market is the main source of business growth.

A study by research consultancy TNS on behalf of PMI Health Group, published in November 2012, found that 35% of full-time staff ranked health cash plans in their top three preferred benefits. Of those respondents, 11% placed a health cash plan as their most valued benefit, behind pensions (25%), life insurance (15%) and private medical insurance (12%).

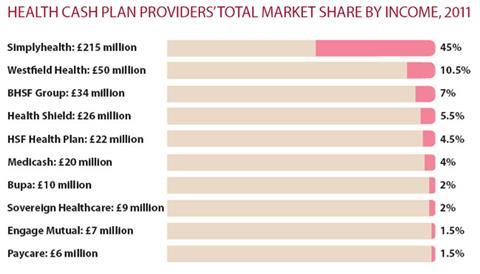

As of 2011, there were about 25 health cash plan providers in the market, according to Laing and Buisson’s Health cover UK market report 2012, published in August 2012, and 18 of these were not-for-profit organisations.

Largest market share

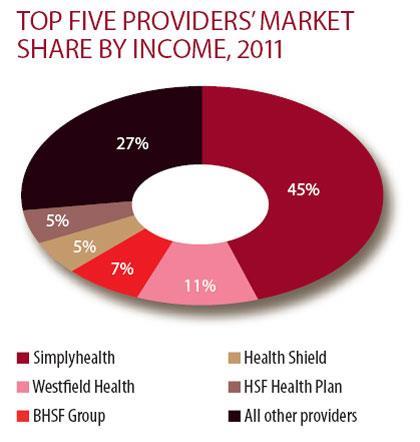

Simplyhealth has the largest market share, 45%, for both corporate and individual plans. Howard Hughes, head of employer marketing at Simplyhealth, attributes this, in part, to the combined success of the business with which the group was formed. This has left it with a large legacy of clients, especially direct business, but he attributes Simplyhealth’s current growth to the employee-paid sector.

The second largest health cash plan provider is Westfield Health, with an overall market share of 10.5% and a 38.7% share of the corporate market, according to the report. Paul Shires, executive director, sales and marketing at Westfield Health, says an important factor in its success was early entry into the corporate paid sector. “We were innovators and created a plan with one eye on the employee and one eye on the employer’s needs,” he says.

Focus on core benefits

By stripping back the traditional cash plan, removing benefits such as in-patient benefits, which encourage hospital stays and so are not appealing to employers, to focus on core benefits such as dental and optical, the provider appealed to both employer and employee, says Shires.

BHSF Group is the third largest UK cash plan provider with a market share of 7% and fourth is Health Shield, with 5.5%. HSF Health Plan is next with 4.5%, and Medicash with 4%. Simplyhealth and Westfield Health saw their market share fall a little from 2010 to 2011, with Simplyhealth losing 0.5% and Westfield Health 1%. BHSF Group has retained its 7% share.

Laing and Buisson’s report showed that Health Shield and Engage Mutual, which had the ninth largest market share in 2011, were the only providers to have grown their share that year. Health Shield increased its share from 4.5% to 5.5% and Engage Mutual rose from 0.5% to 1.5%. The report suggests this increase is due, in part, to Engage Mutual’s acquisition of several small providers.

Philip Wood, executive director of sales and marketing at Health Shield, says: “Mainly, if it is a company-paid plan, we will work with anyone with three-plus staff , and can quote for up to 5,000-plus employees for bespoke schemes. We have a voluntary corporate scheme if employers don’t want to fund the plan.”

The largest commercial cash plan providers are Axa PPP Healthcare and Chartis UK. The not-for-profit organisations that dominate the cash plan market had a combined share of at least 86%, according to the report. Not-for-profit organisations reinvest any surplus income back into the business.

Corporate plans drive growth

The report showed providers are finding corporate health cash plans to be driving growth in the sector, with a 13.5% rise in corporate plan subscribers at the start of 2012, reaching 510,000 corporate paid contributors spending a total of around £49 million a year. Simplyhealth’s Hughes says: “Growth in absolute terms is more in the employee-paid area because [organisations] are beginning to realise the value of health cash plan benefits.”

Westfield Health’s Shires adds: “The corporate market has gone from strength to strength and much of our success is there.”

Providers have also grown their income by other means. Health Shield’s Wood says: “We have focused on the business-to-business space and have achieved organic growth. Other providers have had different strategies, for example mergers and acquisitions and a focus on private medical insurance.”

Employers can choose from corporate-paid or employee-paid plans and each provider offers different levels of reimbursement and benefits, and a variety of cover. For example, most health cash plans will include a dental benefit, but some providers allow claims for teeth whitening and others do not. In 2011, the biggest proportion of cash benefits paid out, an estimated 31.2% of total benefits, was for dental care, followed by optical care at 27.8%, according to the Laing and Buisson report.

Many providers now offer tailored cash plans to enable employers to choose a range of benefits that best suits their workforce.

Facts and figures on the UK’s top four health cash plan providers, based on income and market share for 2011:

BHSF

HISTORY Started in 1873 as the Birmingham Hospital Saturday Fund.

About 3,000 corporate clients, around 70% of which are SMEs

Source: BHSF

TWO CORPORATE HEALTH CASH PLANS:

- Corporate health cash plan: typical benefits include dental, optical, diagnostic consultation, hearing aids, screening, hospital stays, maternity, personal accident. Premiums range from £1.35 per week for the policyholder to £8.98 per week.

- Healthscheme: benefits include dental, optical, physiotherapy, chiropody, homeopathy, day-case surgery, recuperation, hearing aids, health care helpline. Premiums range from £5 to £46 per month.

- Tailored health cash plans.

- Premiums can be either employer-paid or by voluntary payroll deduction.

HEALTH SHIELD

HISTORY Started in 1877

150,000 members, 20% share of the company-paid market in 2011

Source: Health Shield

CORPORATE HEALTH CASH PLANS:

- Tailored schemes.

- Essentials and Essentials Plus schemes: off -the-shelf products for employers. 100% cashback on all benefits, such as dental, optical and physiotherapy. Costs start at £1 per week.

- Corporate scheme: 100% cash back on all benefits, including PMI excess. Costs start at £1.35 per week.

- Elements and Elements Plus: designed for SMEs. Costs start at £1.35 per week per employee.

- Flexible schemes: four different flexible benefits schemes designed to fit into flexible benefits platforms, on an employee or employer-paid basis.

SIMPLYHEALTH

HISTORY Formed by several providers, including Leeds Hospital Fund, Healthsure and HSA. Became a legal entity in June 2006.

28% corporate-paid health cash plans

72% employee-paid plans

Source: Simplyhealth

CORPORATE-PAID HEALTH CASH PLAN PRODUCTS INCLUDE:

- Dental and optical.

- New child payment.

- Prescriptions, vaccinations and inoculations.

- Absence management benefits: employee assistance programme (EAP), complementary therapies, helpline and gym discounts.

- Health screening and health risk assessments.

- Consultations, GP fees and hospital cover.

- Private medical insurance excess cover.

EMPLOYEE-PAID HEALTH CASH PLAN PRODUCTS INCLUDE:

- Dental and optical.

- Physiotherapy, chiropractic, acupuncture, homeopathy, chiropody and podiatry.

- Diagnostic consultation cover.

- Full body screening.

- Hospital benefit.

- New child payment.

- European cover.

- Five levels of cover: employee and up to four children, costs start at £2.40 per week and from £4.80 a week for staff partner and up to four children.

- Reimbursement levels from 75% to 100%.

WESTFIELD HEALTH

HISTORY Started in 1919 as the Sheffield Consultative and Advisory Hospitals Council.

8,000 organisations offer staff cash plans through Westfield Health, 38.7% share of corporate paid market

Source: Westfield Health

HEALTH CASH PLANS OFFERED

- Company-paid plans: Foresight, with four levels of cover and costs starting at £1 per week per employee, nine benefits including dental, optical and an EAP;

- Mosaic, available for 20-plus staff, costs start at £1 per week per employee, 19 benefi ts available;

- Advantage Corporate, with five levels of cover, costs start at £1.06 per week per employee, with 22 benefits available;

- Chamber, for members of the British Chamber of Commerce, from £1.10 per employee per week.

- One employee-paid plan: Advantage, with five levels of cover. Costs start at £1.06 per week per employee.

- Corporate or employee-paid plan: Westfield Flex.