Low-paid workers are less likely to belong to a workplace pension scheme, and those that do have lower employer contribution rates, according to research by the Trades Union Congress (TUC).

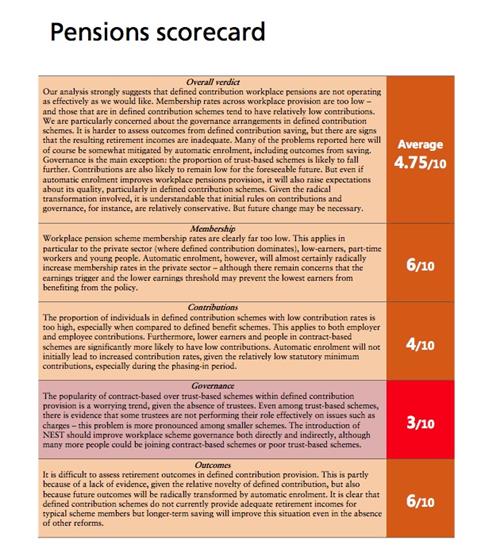

The TUC Pensions scorecard report, which examined the membership, contribution rates and governance of workplace pensions across the UK, found that 48% of employees earning less than £200 a week have total contribution rates of less than 8%. In comparison, 23% of employees earning more than £500 a week have total contribution rates of less than 8%.

The research also found that public sector workers are more than twice as likely as private sector employees to contribute to a workplace pension scheme, while those earning more than £300 a week are twice as likely to be paying into a pension as those earning less than that each week.

Brendan Barber, general secretary at the TUC, said: “It is shocking that fewer than one in four people earning less than £300 a week are saving into a workplace pension scheme.

“Even those low-paid workers who are saving are more likely to have low employer and employee contribution rates that make it far harder to build an adequate pension pot when they retire.

“Auto-enrolment will help reverse some of these worrying trends by getting more people to save, but we shouldn’t be under any illusion that it alone can deliver the level of income that most people expect when they retire.

“There are still too many low-quality and poorly-governed schemes around, which need to be policed more effectively. Further reforms are needed if we are to make more DC schemes fit to provide a decent income in retirement.”