Need to know:

- Pensions differentiation does not have to be all about contribution levels. The first step is to help employees understand the benefit.

- Master trusts can provide great tools and the complete panoply of post-retirement options.

- Behavioural science can be harnessed to improve pensions engagement, because employees are more receptive in certain environments.

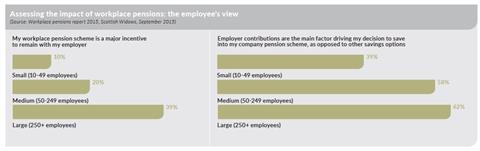

Workplace pension provision has been transformed in the last few years as employers that previously have not offered pensions comply with the auto-enrolment regime. Where the scheme introduced the bare minimum, the homogeneity of contribution levels means employers must look to other features to differentiate their benefits in order to offer an attractive package to retain talented staff. In effect, contributions of 8% will eventually become the new zero.

Few employers contribute more than the minimum to auto-enrolled schemes. In fact, the number of employers levelling down their contributions towards staff pensions has increased slightly, according to the Department for Work and Pensions (DWP) Automatic-enrolment evaluation report 2015, published in November 2015, which reveals that the average amount saved per employee fell from £6,370 in 2012 to £4,673 in 2014. Partly, this reflects increased participation levels among lower earners, but the proportion of eligible savers experiencing some form of levelling down by their employers also rose slightly, from 6% before automatic-enrolment was introduced to 8% in 2014.

Attractive retirement options

However, stumping up higher contribution rates is not the only way to mark up a scheme. Some schemes offer the full raft of post-retirement freedoms. Around 50% of employers have chosen a multi-employer master trust rather than make their own arrangements, according to The Pensions Regulator's Automatic-enrolment commentary and analysis, April 2014–March 2015, published in July 2015, and these schemes increasingly offer options at retirement such as income drawdown. Ken Anderson, Head of [defined contribution] DC Solutions at Xafinity, argues that it is prudent to offer post-retirement services because if members leave at retirement to go into a self-invested personal pension (Sipp) or income drawdown plan elsewhere, that arrangement will carry retail charges, as opposed to lower institutional charges, creating a tenfold increase in fees and some very unhappy pensioners.

The battle can also be won on user-friendliness and compelling financial planning tools. For example, master trusts from Aon and Towers Watson include tools allowing members to aggregate all their pensions, and other savings such as individual savings accounts (Isas) that they may want to use for funding their retirement, and in this way to come up with creative strategies. Members also receive guidance on the most tax-efficient order in which to encash various investment holdings.

Behavioural science techniques

In communication terms, understanding of behavioural science is improving all the time. Mark Rowlands head of DC services at Mercer, says: “One of the reasons pensions communications fail is that people are hit by 2,500 marketing stimuli per day. We need to cut through the noise of too much information, and then empower people to take action.”

He explains that Mercer is working with behavioural science expert Shlomo Benartzi to explore ways to overcome employee inertia. One central tenet is that any call to action must include an opportunity to sign on the dotted line there and then. If, on the other hand, employees attend a pension seminar and come out saying they need to increase their contributions, then unless they can sign up immediately, evidence suggests that six months down the line only 14% will have done so.

Auto-escalation also works particularly well if employees are asked to agree to automatic increases in contributions in the month of January, something behavioural scientists call ‘fresh-start syndrome’. Individual communications on birthdays are similarly effective.

Responsiveness also varies according to the time of day. Employees are typically more receptive to ideas in the afternoon compared with the morning when they often arrive at the workplace with a pre-set list of things to do.

Improve pensions understanding

Tessa Wishart, senior consultant at Towers Watson, says: “There is so much in the press about pensions, but this does not mean people understand it. The job of employers is to help people get to grips with understanding pensions generally.”

That includes hikes in the state pension age and other changes such as the disappearance of the ability to inherit a spouse’s state pension, which could come as a shock to women who have not built up a pot for themselves.

“People need very simple steps, and not to be overwhelmed with information,” adds Wishart. “Pensions are not the number-one attraction that makes a person work for a specific [organisation] but if positioned as part of a deal and as part of the brand of an organisation, then employees will value it.”

Employee perception of pensions

Others have noticed a marked shift in perceptions about pensions as a benefit, however. Damian Stancombe, partner at Barnett Waddingham, says that a straw poll the firm conducted at a recent National Association of Pension Funds (NAPF – now the Pensions and Lifetime Savings Association) event suggests that the standing of pensions for attracting and retaining staff has fallen back from its previous position as second only to holiday entitlement, as people now have ‘more here-and-now’ issues, such as debt and concern about keeping their jobs.

Lee Hollingworth, head of DC consulting at Hymans Robertson, says: “A complete change in approach is required. The sooner it’s accepted that the majority of employees will never fully engage with their pension and make informed decisions, the sooner we can move on to an effective ‘help-me-do-it’ approach.”

In this world, for example, investment funds would be selected on behalf of each member.

Perhaps the industry is heading to a place where pension providers and consultants should give up trying to help members make informed decisions and actually make the decisions for them.

Viewpoint: Pension changes present an opportunity for employers to engage staff

Many employees are unconcerned about the value of their pension scheme, if they have a scheme at all, until they are close to retirement. Indeed, many employees are hard pressed to specify the benefits their workplace pension scheme offers.

Two things are changing this situation. First, changes to the rules regarding when people can access their pension fund, which came into effect in April 2015. This means that from age 55 onwards people can get access to as much of their pension money as they like, when they want it.

Second, the advent of auto-enrolment, making it compulsory for all employers to offer a pension scheme. The government has set minimum levels of contributions that must be paid to the workplace pension scheme by the employer and employee.

These changes are a golden opportunity for employers to emphasise the benefits of a staff pension scheme at a time when the topic is constantly in the media. With the labour market tightening and good staff in short supply, a staff pension scheme will be viewed as a significant additional benefit. Such schemes may also prevent existing staff from leaving for other employment. This is particularly the case if the scheme provides benefits better than the auto-enrolment scheme.

One message employers need to emphasise is with staff likely to be working until their 70s, pension contributions by an employee in their 20s have nearly 50 years to accumulate benefits. This is a compelling argument that employers need to make.

Clive Lewis is head of enterprise at the Institute of Chartered Accountants in England and Wales (ICAEW)