All Financial wellbeing articles – Page 127

-

Opinion

Jonathan Watts-Lay: Staff need wide view of savings options

The financial world has changed a lot in the last few years, with many employers saying it is down to staff to decide, from the benefits on offer, which ones are right for them and how to maximise their value.The example often quoted is the move from defined benefit to ...

-

Article

Unaffordable retirement will impact firms' ability to recruit staff

According research by Hymans Robertson two-thirds of respondents to believe that almost half their workforce will be unable to retire at the state pension age due to inadequate pension savings.Its research, conducted among 200 HR directors and managers, found that 78% of respondents have considered the impact this would have ...

-

Article

Lincoln Uni educates staff on personal allowance

EXCLUSIVE: The University of Lincoln is piloting financial education sessions for its senior management to ensure they are informed about their options around the annual and lifetime allowances for pensions saving.The sessions, which are part of the university’s financial education programme with Wealth at Work, started with a session for ...

-

Video

Yvonne Braun: Decision on annuities is critical

Ensuring employees have the tools to make the right decision about buying an annuity is critical, said Yvonne Braun, head of savings and retirement at the Association of British Insurers (ABI), during an interview with Tynan Barton, features editor at Employee Benefits at the Employee Benefits Pensions and Workplace Savings ...

-

Article

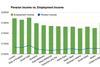

ArticleIncome drop expected for third of retirees

Retirees can expect their regular income to fall by 40%, according to research by annuity provider Partnership.Its analysis of HM Revenue and Customs (HMRC) data also revealed the regions where retirees are most likely to see their income drop, with London (-48%), the east of England (-40%) and the south ...

-

Article

Philips launches retirement guidance service

Philips UK has launched a financial guidance service to support employees nearing retirement.The service, provided by OpenRetirementClub, is delivered online and via employee forums.The forums feature expert opinion from providers of retirement income and investment services. Employees can then seek specific financial advice or make informed decisions themselves.Nina Platt, reward ...

-

Article

The Platforum publishes workplace savings platforms update

The Platforum has published a workplace savings platform market update for employers.Download Guide for employersThe guide brings together the latest research and feedback from employers and adoptees of the platforms, as well as details of existing and new propositions.With 237 employers using platforms, The Platforum estimates that there are now ...

-

Analysis

AnalysisHymans Robertson offers staff flexibility in saving

Because employee benefits are at the heart of its business, Hymans Robertson recognises the importance of giving its staff access to workplace savings schemes that will engage them and suit different lifestyle needs.The pensions and benefits consultancy invites all employees to join a group personal pension (GPP) plan and a ...

-

Article

Optimism about retirement low across the globe

Only 12% of respondents globally are very optimistic that they will have enough money to live on when they retire, according to research by Aegon and Transamerica Center for Retirement Studies.The Aegon retirement readiness survey 2013, which polled 12,000 workers and retirees in 12 Asian, European and North American countries, ...

-

Article

AWD Chase de Vere rebrands as Chase de Vere

Independent financial advice firm AWD Chase de Vere has been re-named as Chase de Vere as part of a large re-branding exercise.Stephen Kavanagh (pictured), chief executive of Chase de Vere, said: “We have made huge progress in the past four or five years, transforming our organisation into a high-quality, client-focused ...

-

Article

Pot-follows-member pension launched for film industry

A pot-follows-member group personal pension (GPP) scheme has been launched for the film industry to comply with auto-enrolment legislation.The Film Industry Pension Scheme, which will be operated in partnership between Helm Godfrey and Scottish Widows, is designed to address a series of industry-specific issues when it comes to pension administration, ...

-

Supplier article

The Benefits Research 2013

The research covers benefits technology, company cars, employee engagement, financial education, flexible benefits, share schemes,health and wellbeing, pension schemes, voluntary benefits and international benefits.The report also examines employers’ benefits strategies and changes over the last few years, plus planned changes for the year ahead.Topics include:Why respondents offer benefitsThe issues shaping ...

-

Article

Employees not confidant their pension will deliver adequate income

More than half (57%) of respondents are not confident their pension will deliver an adequate retirement income, according to research by consultancy Hymans Robertson.Its research, which surveyed 500 UK adults who save into a defined contribution (DC) pension scheme, found that 23% of respondents do not know how much of ...

-

Analysis

Doug Taylor: How to engage staff in saving for retirement

Doug Taylor, financial services chief advocate at Which?, talks to Clare Bettelley, associate editor of Employee Benefits, about how employers can better engage employees to save for their retirement.Taylor explains how employers need to “start from where the individuals are” when encouraging them to save, as well as creating the ...

-

Analysis

AnalysisKey points to tell staff about annuities

IF YOU READ NOTHING ELSE, READ THIS…Employers should encourage staff to consider their retirement options five to 10 years before their retirement date.By disclosing information about their lifestyle, for example whether they are overweight or a smoker, employees could get a more beneficial annuity rate.Employees should be encouraged to shop ...

-

Article

Employers must change attitude on ageing employees

This follows the report’s finding that 10.7 million people in the UK can currently expect inadequate income in retirement.The report also recommended that the government establish a commission to work with employers and financial services providers to improve pensions and savings.Jonathan Watts-Lay, director of Wealth at Work, said the government ...

-

Analysis

AnalysisBright future for workplace savings platforms

IF YOU READ NOTHING ELSE, READ THIS…Workplace savings platforms can offer a range of savings products.The platform market is young and providers are at various stages of product development.Employee take-up of fi nancial products via savings platforms remains low.Ask most workplace savings providers and employee benefits consultants about the future ...

-

Case Studies

Glenmorangie finds right platform for pension communications

Ian Drysdale, HR director at Glenmorangie, says: “As an employer, we were very keen to increase membership of our scheme.”Take-up of its DC scheme was 53% higher than that of its previous defined benefit scheme, which closed in 2002. The rise was credited to the communications strategy, which included employee ...

-

Article

Henderson launches retirement advice

EXCLUSIVE: Henderson Global Investors has introduced employer-funded one-to-one financial advice sessions, targeted at employees who are around 15 years away from retirement.Jeremy Mindell, former senior reward and tax manager at Henderson Global Investors, said: “There’s an element of saying: ‘What are you going to do with your money? Is this ...

-

Article

House of Lords reports on ageing society

More than 10 million people in the UK can currently expect inadequate retirement incomes, according to a report by the House of Lords’ Select Committee on Public Service and Demographic Change.According to the report, Ready for ageing?, the UK will see a 50% rise in the number of people over ...