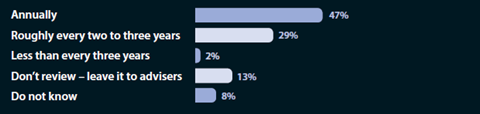

Just over half (47%) of respondents review the investment strategies and aims of their default investment fund at least annually, according to Employee Benefits/Capita Pensions research 2013. (This does not include respondents that do not review their own strategies, or those that do not know).

The survey, conducted among 370 HR and benefits managers, found that 40% review the investments less frequently, while 8% do not know if the investments are reviewed.

This is despite 87% of respondents having more than 50% of their members invested in the default option. (This does not include respondents that do not know).

The research figures for the survey largely track those of the 2012 survey.

As employers auto-enrol staff into a pension scheme, so the proportion of pension scheme members in the default fund increases.

Most (85%) employers that have auto-enrolled staff find that more than 75% of pension scheme members are in the default fund.

This is considerably higher than among employers that have still to auto-enrol staff, with 64% having more than 75% of their members in a default fund. (These percentages do not include respondents that do not know).

Frequency with which organisations review their investment strategies and aims of their default investment option

Proportion of scheme members that invest in their organisation’s default investment option

Read the full version of Employee Benefits/Capita Pensions Research 2013.