If a median earner saves only at the minimum contribution rate of 8% of a band of earnings, required under auto-enrolment legislation, throughout their working life, they will have less than a 50-50 chance of achieving an adequate retirement income, according to research by the Pensions Policy Institute (PPI).

Its report, What level of pension contribution is needed to obtain an adequate retirement income?, which analyses the effect that contribution rates to defined contribution (DC) pensions could have on overall levels of retirement income, was funded by the Association of British Insurers (ABI) and the Defined Contribution Investment Forum (DCIF).

The report found that:

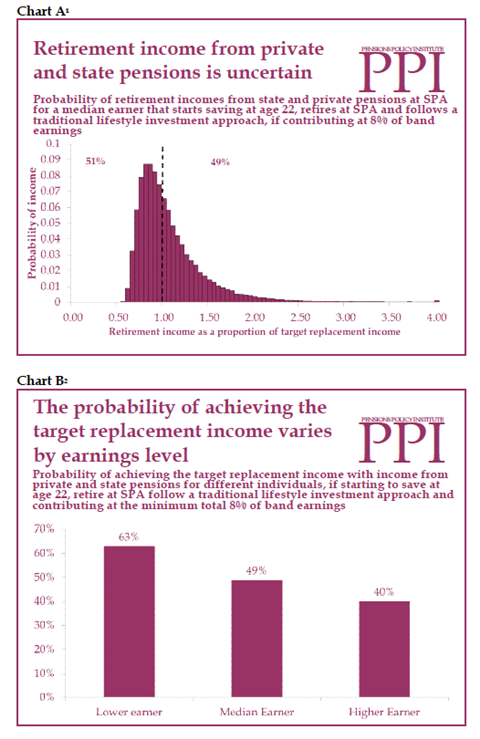

- Retirement income from private and state pensions is uncertain. The target replacement income for a median earner is 67% of their pre-retirement earnings. In 49% of the cases generated in the modelling a median earner could reach their target replacement income with private and state pensions income, if starting to save at age 22, retiring at state pension age (SPA), following a traditional lifestyle investment approach and contributing at 8% of band earnings (see chart A below).

- Saving at the minimum contribution rate of 8% of band earnings may not be enough for some individuals. In more than half of the scenarios modelled, income is below the target replacement income and, in 25% of the scenarios, income from private and state pensions was less than 75% of the target replacement income.

- Lower earners have a higher probability of achieving their target replacement income than median or higher earners. (see chart B below). Under the baseline scenario of starting to save at age 22, retiring at SPA and following a traditional lifestyle investment approach, a lower earner has a 63% probability of achieving their target replacement income, compared to 49% for a median earner and 40% for a higher earner. Lower earners have a higher probability of achieving their target replacement rate because the single-tier state pension, introduced from 2016, will represent a higher proportion of lower earners’ pre-retirement earnings than for median or higher earners.

- Adequacy will be sensitive to the indexation mechanism used for the single-tier state pension. Currently, the basic state pension is up-rated by the triple lock of the higher of changes in average earnings, changes in the consumer prices index (CPI) or 2.5%. Current legislation stipulates that the basic state pension must be up-rated at least in line with changes in average earnings. Once the single-tier pension is introduced in 2016, it will be up to the government to decide whether anything more than average earnings is needed. Adequacy is much harder to achieve if the single-tier state pension is increased in line with average earnings rather than triple locked.

- The contribution rate needed to achieve an adequate retirement income will be sensitive to investment approaches and charges. Under auto-enrolment, many individuals will stay in default funds, with a pension scheme chosen by their employer. This default fund could be based on one of a number different investment approaches. Different investment approaches would entail different levels of annual management charges (AMC) applied to an individual’s fund.

Chris Curry (pictured), director of the PPI, said: “The analysis shows that the outcomes from being automatically enrolled into a defined contribution workplace pension are highly uncertain.

“In general, individuals will need to contribute more than the minimum level at which they are likely to be automatically enrolled to have a good chance of achieving an adequate retirement income.

“For example, a median earner who starts saving at age 22 and contributes continuously until reaching state pension age will need a total contribution from employee, employer and government of 11% of band earnings to have a two-in-three chance of receiving an adequate retirement income.

“However, there is not a single contribution rate that will mean that everyone will have an adequate retirement income. Lower earners may be able to contribute less than the hypothetical median earner, because a greater proportion of their income is provided by the state. But higher earners, those who opt-out early in their career, and individuals with career breaks need to contribute more than the median earner to have a two-in-three chance of achieving an adequate income in retirement.

“What happens to the single-tier state pension has a significant impact on the chances of achieving an adequate retirement income. If the single-tier pension is increased each year in line with average earnings growth – the minimum level set out in the current Pensions Bill – rather than the triple lock of the higher of earnings, prices and 2.5% that the [Department for Work and Pensions] has used in illustrations, the contribution needed by the median earner to have a two-in-three chance of an adequate retirement income is 14% of band earnings, rather than 11%.”