All Employee Benefits articles in Web Issue – Page 628

-

Article

Time to pimp your company cars

Something for the weekend…new ways for fleet managers to both control costs and ‘upgrade’ cars.Fleet managers may be feeling the eco-(un)friendly pinch with the recently introduced company car fuel tax level and a ultra low emission company car tax.So maybe they could take tips from an extravagant eco-friendly Leicester man ...

-

Article

Engage Mutual enhances its health cash plan product

Engage Mutual has enhanced its employee-paid health cash plan product.It has removed the excess payable on a range of treatment areas, added an extra premium level, and added an option for employees to pay by direct debit.The enhancements include:The excess payable has been removed when claiming on consultation and diagnostics, ...

-

Video

Debbie Harrison: Size of charges have huge impact on pensions

Debbie Harrison, senior visiting fellow at the Pensions Institute talks to Debi O’Donovan, editor of Employee Benefits, about the impact of higher charges on the eventual pension an employee will receive in retirement.“Value is much more difficult. This is where employers and their advisers really need to look at what ...

-

Article

Employers consider scrapping childcare voucher schemes

More than a third (36%) of respondents that currently offer a childcare voucher scheme are considering scrapping it before the new system is finalised or available, according to research by Jelf Employee Benefits.The research, which questioned 124 organisations, follows the government’s proposal to introduce a new childcare voucher system, which ...

-

Article

DC pension schemes offering wider investment choices

Defined contribution (DC) pension scheme investors are now being offered a wider choice of funds, according to research by the Pensions Regulator (TPR).Its Scheme governance survey 2013 found that:The proportion of schemes offering just one investment fund has fallen from 32% in 2009 to 18% in 2012.In the past year, ...

-

Article

Government to set out plans for collective DC pensions

The government’s report on defined ambition pensions, which is expected this summer, will set out plans to introduce collective defined contribution (DC) pension schemes in the UK.The Department for Work and Pensions (DWP) has confirmed that pensions minister Steve Webb (pictured) has met with large employers that have expressed an ...

-

Video

VIDEO: Jonathan Lipkin: Take DC governance seriously

Governance in defined contribution (DC) pension schemes is going to move to the top of employers’ agendas as auto-enrolment accelerates, said Jonathan Lipkin, director of public policy at the Investment Management Association (IMA), during an interview with Debbie Lovewell, deputy editor at Employee Benefits at the Employee Benefits Pensions and ...

-

Article

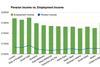

ArticleIncome drop expected for third of retirees

Retirees can expect their regular income to fall by 40%, according to research by annuity provider Partnership.Its analysis of HM Revenue and Customs (HMRC) data also revealed the regions where retirees are most likely to see their income drop, with London (-48%), the east of England (-40%) and the south ...

-

Article

More UK employees saving into share schemes

The number of employees who choose to take up shares in the organisation for which they work has risen in the past year, according to new research by IFS Proshare.The annual IFS Proshare Employee share plan survey has found increases in the participation of both sharesave schemes and share incentive ...

-

Article

Employers launch flexible working forum

Twenty-two employers, including BT Group, B&Q, Ford, ITV and Lloyds Banking Group, have joined forces to launch the Agile Future Forum (AFF), which aims to develop practical support to increase flexible working practices across the UK.As part of its launch, the AFF has published a report, Understanding the economic benefits ...

-

Article

Philips launches retirement guidance service

Philips UK has launched a financial guidance service to support employees nearing retirement.The service, provided by OpenRetirementClub, is delivered online and via employee forums.The forums feature expert opinion from providers of retirement income and investment services. Employees can then seek specific financial advice or make informed decisions themselves.Nina Platt, reward ...

-

Article

Lack of understanding leads to lack of pensions saving

Half (50%) of respondents believe the main reason people do not save in pension schemes is because they do not know what retirement income their pension will give them, according to research by pensions and benefits consultancy Hymans Robertson.The research, which surveyed 101 UK employers, also found that:90% of respondents ...

-

Article

Lloyds TSB pension scheme sells securities portfolio

Lloyds TSB’s Group Pension Scheme No.1 has sold its share of a portfolio of re-securitised US residential mortgage-backed securites for £1.16 billion.The defined benefit (DB) pension scheme’s trustees were advised by law firm Sackers in the disposal of the portfolio. Law firm Slaughter and May worked alongside Sackers, advising the ...

-

Article

The Platforum publishes workplace savings platforms update

The Platforum has published a workplace savings platform market update for employers.Download Guide for employersThe guide brings together the latest research and feedback from employers and adoptees of the platforms, as well as details of existing and new propositions.With 237 employers using platforms, The Platforum estimates that there are now ...

-

Supplier article

Health Shield receives 'Healthcare and Wellbeing Provider' award nomination

The non-profit-making Friendly Society, which aims to provide affordable healthcare support to the widest possible community, has been shortlisted for ‘Healthcare and Wellbeing Provider of the Year’. It will go head to head with other industry players at an awards ceremony in October.The Workplace Savings and Benefits Awards recognise both ...

-

Article

Axa PPP launches employee dental plan

Healthcare insurer Axa PPP Healthcare has launched a dental plan for employers to provide to staff.The plan offers a choice of six levels of cover of staged reimbursements per treatment.Employees will have telephone access to dental nurses, and can also obtain information about how to maintain good dental health through ...

-

Article

HMRC targets minimum wage cheats in Corby

HM Revenue and Customs (HMRC) has targeted job agencies in Corby in a minimum wage crackdown.A three-day operation uncovered a possible £100,000 owed to 3,000 employees in the area.Officers from HMRC and the Department for Business, Innovations and Skills (Bis) visited 34 employment agencies between 28 and 30 May 2013.HMRC ...

-

Article

Cost of providing health benefits rising across EMEA

The cost of providing health-related benefits for organisations in Europe, the Middle East and Africa (EMEA) rose by an average of 3.6% in 2012, according to research by Mercer Marsh Benefits.Its EMEA health care survey, which questioned more than 500 organisations across 16 countries in EMEA, found that the biggest ...

-

Article

ArticleBonus culture in the City on the decline

Bonus culture in the City has declined with a 14% drop in employees receiving bonuses for 2012/13, according to research by Morgan McKinley Financial Services.Its 2012/13 Bonus satisfaction survey, which questioned financial services professionals in London, found that 68% were paid bonuses in 2012/13, compared to 82% in 2011/12.The research ...

-

Article

ArticleUK employees not saving enough for retirement

The number of employees saving adequately for retirement has hit an all-time low, yet aspirations for pension income have risen, according to research by Scottish Widows.The annual Scottish Widows pensions report, which surveyed 5,200 Britons, revealed that less than half (45%) of those who could and should be preparing financially ...