The number of employees saving adequately for retirement has hit an all-time low, yet aspirations for pension income have risen, according to research by Scottish Widows.

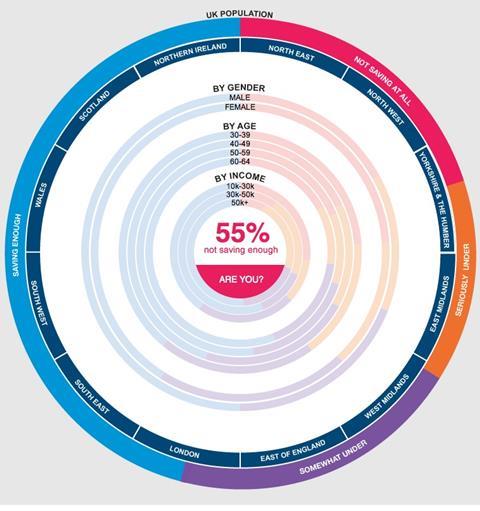

The annual Scottish Widows pensions report, which surveyed 5,200 Britons, revealed that less than half (45%) of those who could and should be preparing financially for their retirement (those aged over 30 and earning at least £10,000 a year) are currently saving enough.

One-fifth (20%) of respondents are saving nothing at all for their retirement and over a third are under-saving either somewhat or severely.

The research also found:

- The nation’s aspirations for their retirement income have increased by £700 per annum from 2012 to 2013.

- The average level of annual income respondents would feel comfortable living on at 70 years old is now £25,200, up from £24,500 in 2012.

- Almost 5.3 million (24%) respondents aged over 50 have a mortgage, over one in four (25%) have credit card debt and one in 10 (8%) have an unsecured loan.

- Out of those respondents who are already retired, a third (32%) are still paying off debts and excluding mortgage debt, the average amount owed is £5,682.

Ian Naismith (pictured), senior manager in retirement income and planning at Scottish Widows, said: “We are being hit with a triple whammy of, firstly, continued economic uncertainty making it difficult to save for the long-term; secondly, the age of first-time buyers is rising as we face troubles getting on the property ladder; and thirdly, an ageing population.

“These factors combined create a perfect storm for those heading towards retirement. While we are becoming more aware of the need to save for retirement, we must do more to ensure that we have a comfortable old age.”