Need to know:

- Gig workers are revolutionising the service economy. However, employers must tread carefully when offering them benefits or risk legal action and costly reclassification exercises.

- Arm’s-length benefits arrangements are evolving, where employers act as facilitators, rather than directly contributing financially.

- The government is currently investigating how the law treats gig workers, and experts expect ‘third way’ benefits models to evolve over time.

It is Monday morning. The trains are up the creek (quelle surprise), so you hastily request an Uber to take you to work. Lunch is spent in meetings, so someone orders pizza, which arrives on a Deliveroo bicycle. You hurry home because a handyman from TaskRabbit is coming to fix that pesky leaky radiator.

Thanks to smartphones and the fast-evolving technology that connects people with services, our daily lives will never be the same. It is all thanks to the gig workers that make up a fast-growing sector of the workforce.

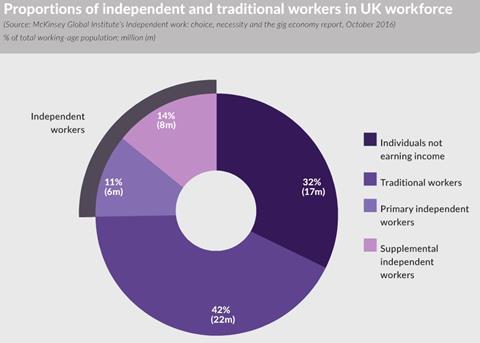

Gig workers are on the rise. In its October 2016 report, Independent work: choice, necessity and the gig economy, consultancy McKinsey estimates that 20-30% of the working-age population in the US and the UK, Germany, Sweden, France and Spain are engaged in independent work.

Yet underneath the seamless service provision that businesses like Deliveroo provide, some knotty legal issues remain unsolved. High-profile court cases such as Uber’s recent battle have highlighted the fact that grey areas exist in employment law when it comes to gig workers. Not only is it very difficult to provide self-employed gig workers with benefits but, arguably, the status quo leaves them open to exploitation.

What the law says

There are many reasons organisations might want to engage with gig workers. Employers recognise work patterns are changing, says Iain Thomson, director of incentives and recognition at Sodexo Benefits and Rewards Services. “They see their role as an employer in securing the right talent at the right time; attitudes have changed,” he adds.

There is also a question of fairness, says Thomson. He adds that a number of employers are keen to incentivise gig workers. Gig workers can become tomorrow’s full-time workers, making it all the more important to attract talent in the first place, he explains.

However, employers should tread carefully. The law discourages employers that use self-employed gig workers from offering them benefits.

Legally, there are three categories of worker: self-employed, worker, and employee. Employers do not need to provide self-employed people with any benefits other than payment in cash. At the other end of the spectrum are employees, who receive the normal suite of employment rights and benefits.

Workers fall into the middle ground. They receive three main benefits: the national minimum wage, paid holiday of 5.6 weeks per year for a full-time worker, and the right to be auto-enrolled into a workplace pension (see column). Some organisations have fallen foul of the law in recent months by blurring the line between self-employed contractors and workers.

Nick Willis, employment tax partner at PricewaterhouseCoopers (PWC), says: “If [employers] are using self-employed people, really [they] can’t go beyond giving them all of their pay in cash. Because if [they] go further, that is going to be taken as an indication of worker or employment status. The big question is, should somebody working with people in the gig economy go further than just giving them their pay? At the moment, if [employers] are maintaining [their] gig workers are genuinely self-employed, [they] don’t have the flexibility to go beyond paying them in cash or that will increase [their] risk.”

An industry in flux

The gig economy is booming. Both to protect workers from exploitation and to help employers which are keen to offer them benefits, a change in the law seems inevitable. The government is considering how employment models need to change to keep pace with modern business models: a key consideration of the Taylor review of employment practices in the modern economy, commissioned in October 2016, is the implications of the gig economy on workers’ rights.

Right now, some employers that use gig workers in the UK and US are finding ways to provide some benefits to workers.

In the UK, Uber announced in February that a series of benefits would be rolled out to staff. Drivers will be given access to advice sessions on how to maximise their earnings, flexible pay so that they can cash out their earnings before their weekly payments, free skills courses in financial planning and languages, and help saving for the future via a partnership with online investment provider MoneyFarm, among a suite of other benefits.

Uber’s benefits package treads a very careful line. The suite is closely in accordance with experts’ advice. Rather than taking on the risk of paying for benefits like pensions or private medical insurance, employers that use gig workers can act as facilitators, educators and sign-posters.

Mark Ramsook, director at Willis Towers Watson, says: “Consistently, the one thing [we] see more in the gig economy is much more voluntary [benefits] schemes and discounts. It’s employers being able to negotiate preferential access for [contractors]."

The view from across the pond

In the US, the law sounds as onerous, if not even more so, thanks to the complicating factor of federal and state laws using varying tests to determine whether gig workers are employees or contractors. Marla Kanemitsu, managing director of Tusk Ventures, a US consultancy that advises startups such as Uber and the residential cleaning services platform Handy on regulatory issues, says: “It creates this patchwork system, where [an organisation] that is operating nationally faces a lot of challenges trying to make sure that the way [it] classifies workers is correct across the country, both at state and federal levels."

Similarly to the UK, employers are hesitant to stray into territory that could end up with gig workers classed as employees. That includes giving benefits to workers. This does not mean there is not appetite to do so, however.

Some US employers are finding ways to offer benefits to gig workers, regardless. For instance, Uber has partnered with robo-adviser Betterment to help drivers reach their savings goals. The arrangement is very much at arm’s length: drivers can access Betterment through the Uber platform, but Uber will not contribute to their savings pots. However, their first year with Betterment is free.

Care.com, a site that links caregivers, from babysitters and dog walkers to carers, with people who need its services, has created what it calls a peer-to-peer benefits platform to fund up to $500 per year of benefits. Staff are given the money via pre-paid debit cards. Instead of Care.com acting as the employer, families who employ the caregivers will contribute to the benefits.

The middle ground

Yet for paternalistic organisations, these measures may not go far enough. Benefits providers could play a key role in finding a ‘third way’ for engaged employers in the gig economy, says Ramsook.

“I think we need to find a middle ground but that will probably be driven by the evolution of a lot of the individual products and insurances out there. The challenge at the moment is the benefits that corporates provide to employees are significantly cheaper than the products that you or I could buy as a consumer on the high street. Ultimately, due to the fact the risk is greater: you can’t leverage the bulk you have with employees.”

PWC's Willis adds: “If [we] look at the workforce as a whole in the UK, [we] have to suspect that more benefits are going to come from individual arrangements and benefits providers than employer-based schemes, integrating the trend of more portable benefits.”

Court ruling puts 'self-employed' status in the spotlight

Uber drivers are workers, not self-employed contractors, a UK employment court found in October 2016. The ruling in the case Aslam and Farra v Uber means the app could have to pay its drivers holiday pay, the minimum wage, and pensions, among other benefits.

The employment tribunal decision found that the drivers were employed as workers within the meaning of the Employment Rights Act, National Minimum Wage Act, and the Working Time Regulations.

It found that the claimants were engaged in 'unmeasured work' for the purposes of the National Minimum Wage Regulations, and that their working time should be calculated in accordance with the Working Time Regulations.

Uber immediately announced it would appeal. Jo Bertram, Uber’s general manager in the UK, says: “Almost all taxi and private hire drivers in the UK are self-employed. At Uber, we’re proud that we give people the freedom to choose when and where they drive. We do not set shifts or minimum hours, people can simply switch the app on and off whenever they wish to.

“The reason why we’re appealing the tribunal’s preliminary decision is because the vast majority of drivers tell us they want to remain self-employed. An ORB International poll of 1,000 drivers [conducted in September and October 2016] also found that 92% said that Uber is a good [organisation] to work with.”

However, the verdict is no surprise, says Dominic Holmes, employment partner at law firm Taylor Vinters. “The law will generally look at the reality of the relationship between the worker and the business for which they are working," he says. "It depends on who works for who.

“Uber is a great case. It said, ‘All we are doing is acting as a matchmaker between people who drive their cars and want to be taxi drivers in their spare time and passengers who want to be taken places.’ If that were the reality of the situation, they would be simply self-employed. Where it gets messy is when platforms like Uber try to have a high degree of control over what work is done and how it is done.”

If Uber were simply linking passengers with drivers, it would not manage the initial interaction between driver and passenger, control the route the driver takes, collect the money at the end of the journey or manage the complaints procedure if something goes wrong, says Holmes. The difference is that in the Uber model, the driver has very little say and therefore, is not running their own business, he explains.

Viewpoint: Workplace pensions and the gig economy

Classifying an individual as a worker instead of a self-employed contractor, as in the recent Uber and Citysprint tribunal cases, really matters from a pensions perspective.

This is because the definition of 'worker' in the pensions auto-enrolment legislation is almost identical to the one used in employment rights legislation, with little scope to argue that being a worker for the purposes of employment rights generally should not cross over into the world of workplace pensions.

The two recent cases feel like very new territory. But the question of whether someone is engaged under a short-term worker’s contract or is genuinely self-employed, is a classic legal issue that has become much more relevant since the introduction of the automatic-enrolment duties in 2012, which attribute workplace pension rights to anyone who is a worker.

A sensible starting point for employers involved in the gig economy would be to not duck pensions or assume they are eligible for a carve-out from the law. Having individuals with worker status means the employers need to think about pensions. The extent of the pensions obligations the employers then owe to a worker will depend upon their age and earnings.

There are only limited exemptions in the auto-enrolment legislation and, in fact, one of the only times an employer is allowed not to auto-enrol a worker otherwise eligible for a pension is where he or she is a member of a limited liability partnership (LLP). This exemption was introduced following the 2014 Supreme Court case of Clyde and Co., which decided that members of an LLP could be workers for employment law purposes.

But gig economy cases are different and the chances of an exemption in this area are highly unlikely. Arguably, the type of individuals covered by the Uber and Citysprint cases, and, no doubt, more like them in the future, are right within the sights of the government, in terms of the segment of the population intended to benefit from barrier-free access to workplace savings. It is very likely that the Pensions Regulator will take an interest in how this area of law develops.

Ferdinand Lovett is senior associate at Sackers

![[FisherA]_portrait_web_crop_newstyle](https://d1m12snq5oxhll.cloudfront.net/Pictures/100x67/9/2/6/108926_fishera_portrait_web_crop_newstyle_714878.jpg)