Despite major reforms to how employees can access pension savings with the introduction of pension flexibilities in April 2015, many respondents are not seeking to address financial wellbeing as part of their overall employee wellbeing strategy.

Just 24% of employers offer some, or all, of their employees financial wellbeing support, according to the Employee Benefits/Close Brothers Pensions research 2015. The wider variety of options now available to employees, however, may mean that more now require some support from their employer.

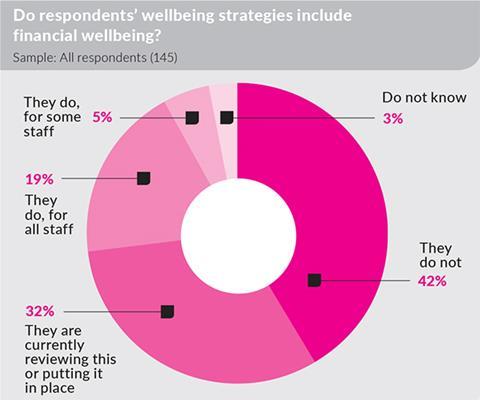

Although 42% of the 145 respondents do not include financial support in their wellbeing strategy, the proportion of employers that do so may well increase, with approximately a third of respondents (32%) currently reviewing this or putting plans in place.

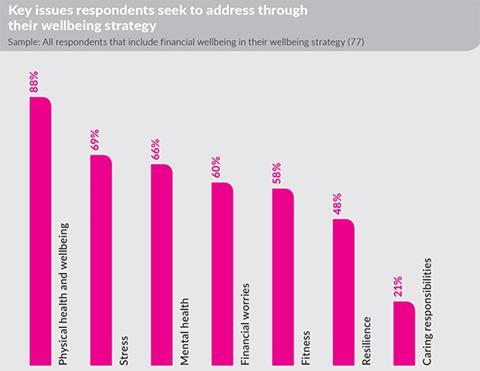

The 77 respondents that include, or are considering including, a focus on financial wellbeing rank it as one of the top four key wellbeing issues, behind physical health and wellbeing, stress and mental wellbeing.

Yet, respondents expect that staff will have to work for longer in order to rely on their current assets in retirement. Two-thirds of respondents (67%) believe this will be the case in their organisation, while only 26% expect staff will save more.

Employee Benefits will be hosting a live webinar, Employee Benefits Wired: the changing pensions landscape, at 1pm on Tuesday 1 December. Tune in to EB TV to watch the session and send your questions by tweeting #EBWired.