News – Page 85

-

Article

Auto-enrolled staff have stayed in pensions

More than 90% of employees who have been auto-enrolled into a workplace pension by their employer have stayed in the scheme, according to research by the Department for Work and Pensions (DWP).Its Automatic-enrolment opt-out rates: findings from research with large employers report surveyed 50 employers, 42 of which provided opt-out ...

-

Article

Johnson Fleming launches auto-enrolment checklist

Johnson Fleming has launched an auto-enrolment checklist for employers.The pensions and benefits consultancy has designed the checklist to help with both initial project planning and as a final check for employers nearing their staging date.The checklist is broken down into six key sections:Project: Looking at the mechanics of how to ...

-

Article

FTSE 100 pension deficits at £43bn

Pension deficits in the FTSE 100 stood at £43 billion at 30 June 2013, compared to £42 billion in 2012, according to research by financial and actuarial consultancy Lane Peacock and Clark (LCP).Its 20th annual Accounting for pensions report provides an analysis of FTSE 100 defined benefit (DB) pension schemes ...

-

Article

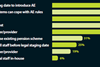

ArticleFirst auto-enrollers less likely to wait for staging date

The first organisations to auto-enrol staff were more likely to do so before their staging date than those that have still to do so, according to the Employee Benefits/Capita Pensions Research 2013.The research, which surveyed 370 HR and benefits professionals, found that just over half (53%) of those that have ...

-

Article

DOD’s blog: how auto-enrolment strategies are shaping up

This week Employee Benefits published a major piece of research into what employers have done with their auto-enrolment strategies to date.The Employee Benefits/Capita Pensions Research 2013 drew responses from 370 employers, 31% of which have gone through auto-enrolment.At a point in time when we are beginning to see pension suppliers ...

-

Article

TPR investigating 89 employers for auto-enrolment non-compliance

The Pensions Regulator (TPR) has opened 89 investigations into possible non-compliance of auto-enrolment by large employers.Its Automatic-enrolment: Commentary and analysis report includes information on the first six months of auto-enrolment, between October 2012 to the end of March 2013.The investigations, which numbered 89 at 31 March 2013, are focused on ...

-

Article

Standard Life partners LEBC for SME auto-enrolment

Standard Life has partnered LEBC to provide a packaged auto-enrolment product to LEBC’s small and medium-sized employer clients. The package includes:Access to online resources for employers to administer their scheme and for employees to join and manage their pension.A suite of member communications to help promote the benefits of the ...

-

Article

ArticleThree-quarters of employers using certification for contributions

Most respondents that have auto-enrolled their staff used the option to self-certify to simplify the calculation of pension contributions, according to Employee Benefits/Capita Pensions Research 2013.The research, which surveyed 370 HR and benefits managers, found that 73% of respondents are using this option.Certification rules state that instead of having to ...

-

Article

Best and worst pension annuity providers revealed

The Association of British Insurers’ (ABI) Annuity Window comparison tool has found that there is a 31% difference between best and worst conventional annuity rates.The tool, which is compulsory for all ABI members selling annuities to the public, also found (based on a level annuity for a 65-year-old man, living ...

-

Article

ABI launches annuity initiative

The Association of British Insurers (ABI) is to publish specimen annuity rates offered by its members to highlight the importance of shopping around for the best deal when it comes to buying an annuity.The publication is part of the ABI’s Code of conduct on retirement choices, which was launched in ...

-

Article

L&G sees 5% auto-enrolment opt out

EXCLUSIVE: Legal and General has only seen 5%, 11 of 207, auto-enrolled employees opt out since its staging date on 1 April.Prior to staging, 700 employees were in a defined benefit (DB) pension scheme that is closed to future accrual and all but 207 of the remainder of its 7,500 ...

-

Article

Gerald Eve sees increase in pensions take-up

Gerald Eve has seen an 11% increase in its pension membership and almost a quarter (24%) of employees have increased their pension contributions since it introduced a workplace savings platform in May.The platform, which is provided by Hargreaves Lansdown, provides the national firm of chartered surveyors and property consultants’ employees ...

-

Article

The Pensions Trust consults on DB pension closure

The Pensions Trust is consulting with employees about closing its career average defined benefit (DB) pension scheme to future accrual.The consultation began on 1 July and will run until the end of September.The scheme has been closed to new joiners for the past two years.If it is closed, the scheme’s ...

-

Article

PQM to explore setting standard for default funds

The Pension Quality Mark (PQM) is to explore setting tough new minimum standards for default investment funds.The PQM, which is a benchmark for good-quality defined contribution (DC) pension schemes, was introduced by the National Association of Pension Funds (NAPF) in 2009.It wants to add default funds to its list of ...

-

Article

LEBC Group auto-enrols staff one year early

LEBC Group has auto-enrolled its workforce almost a year before its staging date.The independent financial advice firm and employee benefits consultancy opted to auto-enrol on 1 July 2013, rather than 1 May 2014, to ensure it fully understood, from practical experience, the actual issues its employer clients’ HR and finance ...

-

Article

University of St Andrews launches master trust

The University of St Andrews has launched a master trust to comply with its auto-enrolment duties.It has appointed Now: Pensions to provide the scheme for its 460 eligible employees, who were auto-enrolled on the university’s staging date of 1 July 2013.The University of St Andrews is the second university to ...

-

Article

TPR launches guides on choosing pensions for auto-enrolment

The Pensions Regulator (TPR) has launched a suite of new guides to help employers with limited pensions experience select a good-quality pension scheme for auto-enrolment.An employer’s guide to selecting a good-quality pension scheme for automatic-enrolment helps employers evaluate whether a scheme is well run, offers value for money and protects ...

-

Article

Man United and FA receive Pension Quality Mark Plus

Manchester United and football’s governing body, The Football Association (FA), have become the latest employers to receive the Pension Quality Mark (PQM) Plus for their defined contribution (DC) pension schemes.Manchester United is the first football club to attain the standard for its £578 million trust-based pension scheme, which has around ...

-

Article

DHL consults on DB pension closure

DHL is consulting on the closure of its defined benefit (DB) pension scheme to future accrual.The scheme, which covers around 3,500 employees, is scheduled to be closed at the end of 2013.Its Voyager defined contribution (DC) pension scheme, which covers 16,000 employees, will not be affected by the consultation. Employees ...

-

Article

ArticleYoung people could lose £100,000 on pensions

Young people who delay saving for a pension until they reach middle age could lose up to £100,000 in employer pension contributions and tax relief, according to research by pension consultancy Barnett Waddingham.The research found that a 25-year-old, earning £25,000 per year, who delays joining a generous workplace pension scheme ...