Need to know

- The cost of benefits is increasing due to changes such as those impacting pensions auto-enrolment contributions, salary sacrifice arrangements and insurance premium tax.

- A risk-based approach taking in everything from financing mechanisms to claims controls can help secure the optimum benefits package for an organisation.

- Communicating benefits pushes up employee engagement, enhancing the value of an employer’s spend.

Employee benefits have an important role to play in motivating a workforce. But, with a series of financial pressures set to push up the cost of providing benefits, employers must strike a balance between employee engagement and affordability.

Mark Witte, senior healthcare consultant at Aon Employee Benefits, says: "Cost is a massive issue. Employers will need to budget for a higher benefits bill or find ways to mitigate the increases."

Cost pressures

Several increases came into effect in April 2017. These include changes to the tax and national insurance (NI) advantages on some salary sacrifice arrangements, and the new rates for the national living and minimum wages, which pushed minimum hourly pay for a 25-year-old to £7.50, up from £7.20 in March.

Further cost pressures are waiting in the wings. From June, insurance premium tax (IPT) will go up to 12% from its current rate of 10%. But, possibly the most significant increase comes from pensions auto-enrolment, with employer contributions shifting from 1% to 2% in April 2018 and then to 3% the following April.

Many also believe further increases are coming. For example, IPT could rise again, says Rachel Riley, managing director at WPA Protocol. "It's a bit of a soft target," she says. "There have already been three increases since 2015 when it was 6% and speculation suggests it could reach 20% by 2020."

Controlling costs

Faced with rising costs, there is a temptation for employers to slash benefits. But while this will save money, this approach can seriously backfire. Jonathan Wood, corporate pension director at Jelf Employee Benefits, says: "It will often cost an employer a lot more in lost productivity than the savings that are realised. A risk-based approach is much more effective."

This takes a strategic look at what employers provide and the value it brings. As well as assessing whether an organisation has the most appropriate, or cheapest, provider, it will also look at its financing mechanism. For example, an organisation could self-insure some benefits if it is large enough or consider pooling if it is global.

The design of the benefits package also comes under scrutiny, to ensure it is fit for purpose and in line with an organisation’s peers. "We'd also look at whether we could make a risk perform better," says Witte. "For instance, if a business introduces a health and wellbeing programme it can reduce the likelihood of claims on its group risk and health insurance benefits. This creates savings and a much more sustainable proposition."

Securing savings

Given the depth of this approach, it can make financial sense to hire a benefits consultant. "[Employees] need to look beyond the price and analyse how [their] benefits package affects business performance," says Wood. "This can be difficult to do [alone] or with a broker which focuses on price."

But whether employers go for a consultant or direct to a provider, it is also sensible to present an organisation as attractively as possible, especially when it comes to group risk benefits. Katharine Moxham, spokesperson at industry body Group Risk Development (Grid), says: "If [an organisation] does anything that could potentially reduce the risk of a claim, tell the insurer because it could improve the premium."

All sorts of health-related products and initiatives could be taken into account, such as employee assistance programmes, private medical insurance (PMI), and mental health first aid training. "I worked with [an organisation] once that was able to secure a discount on group life and group income protection by demonstrating all the hard work it put into health and safety," says Moxham.

Targeted savings

While these strategies can help to mitigate the effects of some of the incoming cost pressures, with some products, it is also possible for an organisation to shield itself from the full force of the increase without having to forfeit any benefit.

Take pensions auto-enrolment as an example. While it is perfectly legal to restrict contributions to qualifying earnings, set between £5,876 and £45,000 in 2017-18, cutting back will not be popular with employees, says Kate Smith, head of pensions at Aegon. "The only way to save money legally is to use salary sacrifice," she adds. "It's not a great solution for lower-paid employees, because it could affect their state benefits if they lose their job, but it can work well for higher-earning employees, especially if [employers] pass back some of [their] national insurance savings."

IPT exemption

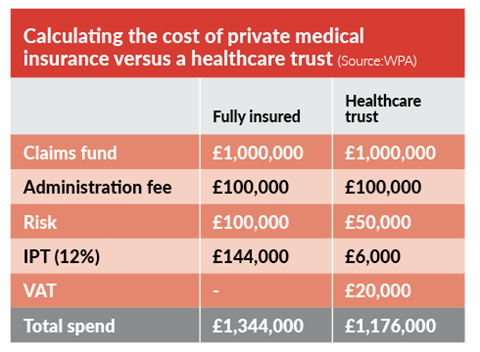

Organisations could also shield themselves from the IPT increase by moving from a PMI scheme to a healthcare trust. With this, the employer sets aside a claims fund to cover employees' healthcare needs. As this is not insurance, it is not subject to IPT.

Instead, employers pay VAT on any administration or trustee fee plus IPT on any stop-loss insurance. But, because these are lower-cost items, the overall tax charge is much smaller than if they had taken out PMI (see box 1).

While the set-up costs, typically around £10,000, mean employers need at least 500 employees to make a trust cost-effective, smaller groups could consider a master trust or a product such as WPA's Corporate Deductible or Aviva's Corporate Excess. These also use a claims fund, so there is no IPT liability on the bulk of the expenditure, but have simpler administration and no set-up fee.

But, whether employers fine tune existing benefits or move to something cheaper, communication is essential to get the most value from their spend. "Tell employees what [is offered to] them when they have life changes such as a promotion or a new home," says Wood. "This really helps with employee engagement, which drives up productivity and reduces absence. It's a much more sustainable approach than shopping around for cheaper benefits."

Read more:

Ten Group offers a range of benefits on a modest budget

![[FisherA]_portrait_web_crop_newstyle](https://d1m12snq5oxhll.cloudfront.net/Pictures/100x67/9/2/6/108926_fishera_portrait_web_crop_newstyle_714878.jpg)