Its Pensions risk survey found that the accounting deficit for FTSE 350 companies stood at £97 billion at 31 December 2013, compared to £72 billion at 31 December 2012.

Employers are using a variety of methods to fund, de-risk and manage these pension deficits.

Ali Teyyebi, head of DB risk in the UK at Mercer, said: “A lot of pension schemes are much more actively looking at the idea of dynamic de-risking, where they are monitoring market conditions or funding levels, and then trying to act quickly to capture a good piece of experience by making changes based on those factors.

“They are either doing it in their own way or through some sort of automated mechanism. If the funding level reaches a certain point, for example, they might reduce their allocation to growth assets by a certain level, providing it doesn’t impact on their expected contribution rates.”

Buy-ins, buy outs and longevity swaps

Employers are also using methods such as buy-ins, buyouts and longevity swaps to de-risk their DB pension schemes.

For instance, AstraZeneca agreed a longevity swap for its DB pension in December, hedging against the longevity risk of around 10,000 of its scheme’s current pensioners.

In January, JLT Group completed a further £85 million buy-in contract with Prudential for its £500-million DB pension scheme, while gardening product manufacturer Hozelock appointed Aon Hewitt to provide actuarial, investment and pensions management services for its £50-million DB pension scheme.

BAE Systems took a different approach, launching an online pensions tool to manage and monitor its obligations across all seven of its UK DB pension schemes. The tool, which is provided by PricewaterhouseCoopers (PWC), gives employers and trustees real-time access to information and analysis of a pension scheme’s liabilities, assets, risk and valuations.

Raj Mody, partner and head of UK pensions at PWC, added: “It’s designed to be an industry-standard approach for pension schemes to operate much more efficiently with lower cost than they have been today, and to make decisions faster and in a more informed way.”

Integrated DB framework

The move towards a more integrated framework is also a growing trend in DB pension management, particularly following The Pension Regulator’s consultation, Defined benefit consultation: setting a balanced approach, published in December.

Mody said: “We are seeing a lot of trustee boards becoming ever keener to recognise that actually they need something beyond what their conventional providers provide.

“By that, I mean they have a scheme actuary doing valuation and actuarial work, they have got an investment consultant doing asset management and risk work, and a covenant adviser doing work around the security of the employer, but actually it’s not often the case that anyone is pulling that together.

“They need, and we’re seeing a lot more of this, a strategic adviser to bring all of that information together into one consistent and coherent framework.”

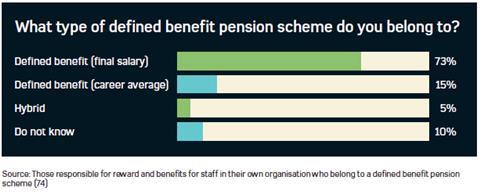

What type of defined benefit pension scheme do benefits professionals belong to?

Employee Benefits’ Salary survey, which was published in January, found that only 27% of HR and benefits professionals who responded to the survey are members of a DB pension plan. Among DB members, 73% are in a final salary scheme, 15% are in a career-average scheme and 15% are in a hybrid scheme.

How East Coast Mainline managed its DB pension deficit

This month’s employer profile features East Coast Mainline, which continues to offer a generous final salary pension scheme to staff. The pension, which is open to all new entrants, offers employees a 17.86% employer contribution on top of their own 11.9% contribution.

The scheme, which is due its triennial valuation around April 2014, avoided closure three years ago by increasing these contributions. At its 2010 valuation, it had a deficit of 7.5%.

Employer case studies

- AstraZeneca agreed a longevity swap for its DB pension in December 2013.

- BAE Systems launched an online pensions tool to manage and monitor its DB pension obligations.

- Hozelock appointed a consultant to provide its actuarial, investment and management services for its DB scheme.

- JLT Group has completed a buy-in for its £500-million DB pension.