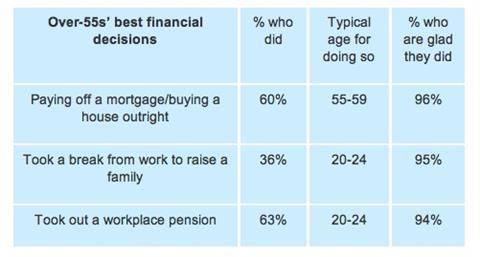

The majority (94%) of respondents aged over 55 who participate in a workplace pension scheme are glad they opted to do so, according to research by Aviva.

Its Real retirement report, which surveyed almost 18,000 UK consumers aged over 55, examines the financial pressures affecting the UK’s three ages of retirement: those between the ages of 55 and 64 (pre-retirees), those between the ages of 65 and 74 (the retiring), and those over 75 (the long-term retired).

The research found that 38% of respondents would recommend starting a workplace pension earlier than they did, with only 35% opening one before they were 30.

It also found that more than a quarter (27%) of respondents aged over 55 cited having money to live comfortably in retirement as the most important factor, more so than sharing retirement with a partner (17%) or a happy family life (12%).

The research also found:

- Among the over-55s, just 15% chose their original or main career because of salary, with men (19%) far more likely than women (10%) to have done so.

- Half (50%) of over-55s would advise their younger self to save more on a monthly basis, with 40% emphasising the importance of making better use of savings products, such as independent savings accounts (Isas).

- 51% of over 55s see freedom from stress as the most important benefit of financial stability in later life.

- 48% have had to sacrifice their original retirement plans, such as travelling or holidays.

- Almost one in five (16%) have had to continue working part-time as a direct result, and a similar number (15%) have had to continue working full-time.

Clive Bolton, managing director of the At Retirement business at Aviva, said: “Some people may be tired of hearing about the importance of saving for retirement, but listening to those who know what it means to be retired in 2013 leaves little doubt that financial stability can, in fact, buy happiness, and certainly help towards a stress-free lifestyle.

“These findings suggest there is no magic recipe or secret formula that works better than regular saving and prudent decision making, whether that means taking steps towards paying off a mortgage or seizing opportunities to pay into pension schemes.

“Clearly, the pressure of living costs and economic difficulties mean some over-55s find themselves in a less-than-comfortable position and harbour regrets about the past as retirement looms.

“It is important to remember there is a range of financial choices open beyond the age of 55 that can work to steer their finances back on track and help deliver the stress-free retirement they aspire to.”