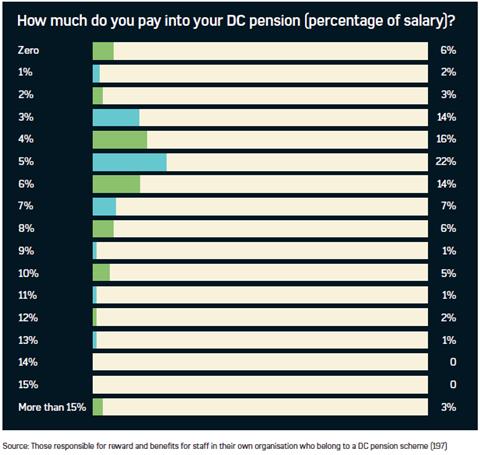

The Employee Benefits Salary survey 2014 , which questioned 361 people who are responsible for managing benefits and reward in UK organisations, found that 9% pay in 10% or more of salary.

Under auto-enrolment legislation, current minimum contribution levels are set at 1% for employees and 1% for employers. But from 2017, contributions will gradually increase, which may be a shock for the 6% of respondents who currently pay nothing into their DC scheme.

Three-quarters (75%) of respondents are members of a DC pension scheme , with the majority (59%) being members of a group personal pension (GPP) plan , 18% members of trust-based money purchase plans, and 13% members of a stakeholder pension.

It is surprising that 5% of respondents who know they are in a DC pension do not know what type of scheme it is, given that HR and benefits professionals are expected to support their workforces through auto-enrolment with financial education and communication exercises.

Less worrying is the fact that just 2% of respondents do not know how much their employer contributes to their pension.

Are you an active member of a defined contribution pension scheme?

Yes 75%

No 26%

Source: Those responsible for reward and benefits for staff in their own organisation (266)

Which type of defined contribution pension scheme do you belong to?

Group personal pension plan 59%

Trust-based money purchase plan 18%

Stakeholder pension 13%

Group self-investment personal pension 5%

Hybrid scheme 1%

Do not know 5%

Source: Those responsible for reward and benefits for staff in their own organisation, who are members of a defined contribution pension scheme (197)

How much does your employer contribute into your DC pension plan (as a percentage of your salary)?

Zero 1%

Up to 3% 7%

4% 9%

5% 11%

6% 12%

7% 8%

8% 12%

9% 5%

10% 17%

11% 1%

12% 9%

13% 2%

14% 2%

15% 1%

More than 15% 4%

Do not know 2%

Source: Those responsible for reward and benefits for staff in their own organisation, who are members of a defined contribution pension scheme (197)