If you read nothing else, read this…

- Effective financial education programmes focus on real-life issues, such as indebtedness, rather than employees’ age.

- Face-to-face support and online modelling tools can help to deliver programme content.

- Financial stress can affect an employee’s productivity.

But ensuring that a programme addresses a workforce’s wider, multi-generational financial needs poses challenges for organisations in all market sectors.

It is easy for employers to make age-based assumptions about employees’ financial education needs.

Broadly speaking, graduates are likely to require debt management support for their student debt, followed by guidance about workplace savings vehicles, such as pensions and individual savings accounts (Isas), to help save for a deposit for their first property.

Staff in the midst of their career are likely to require a review of their finances to ensure their retirement savings strategy is on track, particularly if they have recently decided to work for longer. By extending their working lives, these employees have lengthened the period over which their investment risk can be spread. This enables them to invest in riskier assets that help to optimise their investment returns and, ultimately, their pensions pot at retirement.

Finally, employees approaching the traditional state retirement age are likely to need at-retirement support, such as information about annuities and income drawdown, or about how to continue working into older age.

Financial reality

But the reality of employees’ financial needs could be quite different. For example, not all young recruits are graduates struggling with student debt. Angus Jones, managing director of financial advisory firm Clarity, says: “You do get some sharp young employees paying quite a reasonable amount into their pensions.”

Jeanette Makings, director of financial education services at financial services group Close Brothers, adds: “You could also have an employer bringing in graduates and facing two very different sets of circumstances just in that one demographic: graduates coming in with student debt and those without. Likewise, they may have mid-career staff going through a divorce.”

Jones says employers can best align the content of a financial education programme to employees’ financial needs by segmenting their workforce into specific salary bands. This would work particularly well for higher-rate taxpayers who could be affected by the pensions tax relief changes being introduced for the 2014/15 tax year.

From April 2014, the annual tax-free allowance for pensions will be reduced from £50,000 to £40,000 and the lifetime allowance will be reduced from £1.5 million to £1.25 million.

But Jo Thresher, head of money at work at employee benefits adviser Jelf Group, says financial education programmes are most effective when focused on practical issues, such as budgeting and indebtedness, which she currently the main concern among employers she works with.

“There is a need to talk to executives and high-earners differently, but then the rest of the world, including some executives, needs basic, simple, budget-type messages about understanding what they’re trying to do with their money,” she says.

Thresher adds that the auto-enrolment requirement for employees to pay a minimum 1% contribution into their pension could be the difference between them getting into debt or not, which is why employers should be focusing on basic financial guidance, irrespective of salary band.

Variety of savings options

Employers should also ensure their education programme includes guidance on a variety of savings vehicles that support staff to save for the short and medium term, and not just long-term savings vehicles such as pensions.

For example, Isas and sharesave schemes may be more appropriate for staff that require access to their cash.

Jonathan Watts-Lay, a director at financial education provider Wealth at Work, says: “With staff that aren’t getting financial advice, there’s always the danger that they will end up thinking pensions are a waste of time and so don’t bother saving anything. Or, at the other extreme, they may think they can afford [to save] £200 and put all of it into their pension, which doesn’t allow for short-, medium- and long-term saving.”

Watts-Lay says education programmes should therefore also help to optimise affordability. “The biggest issue we come across is affordability,” he says. “We could come up with the best theoretical savings plan, but at the end of the day, staff have got to be able to afford it.”

Employers could consider benefits such as retail discount cards to help staff save money, and then offer the financial support to help them invest this money in, say, a workplace sharesave scheme.

Close Brothers’ Makings agrees, and says sharesave support was the focus of an employer she has worked with recently. “The [organisation] had a share scheme in significant profit, so staff were coming out with significant profits and exceeding their capital gains tax allowance,” she says. “They needed help about how best to plan for that, and how to use their tax allowances in the most tax-efficient way.”

Pensions education

Britt Hoffman, head of defined contribution (DC) at pensions consultancy P-Solve, goes as far as to suggest that employers should only provide pensions education for employees aged at least 40. She believes it is only then that staff are likely to be receptive to retirement information, because they are closer to the event, and typically in higher-paying jobs that enable them to make substantial contributions into their pension scheme.

“As long as employees are contributing something, by the time they get to their 40s and 50s they’ll have some accumulated saving,” she says. “So if we can improve investment return at that point, or keep assets generating a return for longer, each percent of that return will result in a bigger pound amount.

“It would be ideal if we could get staff to contribute properly from their 20s, but that’s not going happen, so what we try to do is focus efforts on where they start engaging, which is their 40s and 50s.”

Face-to-face delivery

Whatever the content of a financial education programme, advisers agree that face-to-face delivery is the best way to engage staff at any age. And this need not be expensive if offered through, for example, a flexible benefits plan.

Makings says word of mouth among employees can also support employers’ efforts. “It’s one of the best and quickest ways to get messages around organisations, particularly if employers have multiple locations,” she says.

But access to workplace savings products and services is perhaps the most important consideration in programme delivery strategies. Employers must enable staff to take immediate action with their finances following, for example, a workshop or financial modelling tool session, whether by providing product application forms or via the click of a button on a modeling tool or benefits platform.

An employer might have the best education programme in the world, but the greater the effort needed by employees to follow the guidance, the less effective the programme will be, regardless of an employee’s age.

Case study: Unilever segments financial education programme

Unilever is to run the first generation-specific financial workshops for its staff this year.

The consumer goods organisation launched a financial education programme to its workforce in 2012 as part of an overhaul of its pension scheme provision.

Unilever closed its defined benefit (DB) pension scheme in June 2012 and replaced it with a hybrid career average and defined contribution (DC) scheme , managed by Fidelity Worldwide Investment, of which about 8,000 of its employees are members.

Just 80 staff opted out of the scheme following the organisation’s auto-enrolment staging date on 1 July 2013. Unilever has contractually enrolled employees into its workplace pension since 2005.

Its education programme began with a series of pension-focused workshops and access to one-to-one advisory sessions with pension adviser First Actuarial, during which employees could discuss their pension options.

Wider financial issues

The programme was extended to focus on wider financial issues in 2013. About 1,600 employees attended workshops across 16 of Unilever’s UK sites which focused on topics such as income versus expenditure, budgeting, savings and debt management. The sessions also covered Unilever’s employee benefits package, reminding staff about the savings vehicles on offer, such as share schemes.

Andy Dunlop, pensions communication manager at Unilever, says: “We thought a generic workshop was the best way to start. This year we’re running two types of workshop. The first one is aimed at staff who are starting to think about retirement, so broadly those around 45, looking at their target income in retirement, their actual income so far and how they bridge the gap.

“The second workshop is aimed at staff who perhaps aren’t thinking about retirement just yet, so broadly under 45, and looking at savings and investments. We’re trying to demystify investment asset classes and ramp up the education of staff on savings versus debt.”

Dunlop says Unilever has yet to work out how to measure the impact of the programme , but he believes that helping to remove financial stress and worries will make for a happier and more productive workforce.

Viewpoint: Gillian Guy: Debt is a key concern for employees

In recent years, we have seen increasingly more people from all walks of life in crisis because of their debt and financial problems.

Debt problems can play havoc with an employee’s performance at work, their relationships, and their physical and mental health .

Our research shows that at least half of people with debt problems said it affected their performance at work . Of these, 54% found it difficult to concentrate when at work, and 36% found it difficult to complete their jobs to the standard required.

Three in four of those with debt problems have said their financial concerns are also having a damaging impact on their personal and family relationships, and their physical and mental wellbeing.

Employees in debt often find themselves struggling to pay essential bills, such as energy, rent, mortgage payments and childcare . In some cases, they have bailiffs chasing them for debt repayments. Half of the people who come to us with bailiff problems are in work.

Households often face pinch-points where their income doesn’t match their expenditure. This has been particularly common for employees during the recession as they have struggled with the rising cost of living.

In 2013, 1.5 million people sought online help from us about their debt problems and how to budget. In December 2013 alone, we saw a 39% year-on-year increase in people seeking advice online about their debt problems.

Employees often feel it is easier to ignore their debts, hoping that the problem will go away. But the reality is that the problem just gets worse and, as their debts increase, so too does the pressure under which they find themselves.

There are a few simple steps staff can take to tackle their debts and return to financial security, but getting advice should be their first port of call.

Gillian Guy is chief executive of Citizens Advice

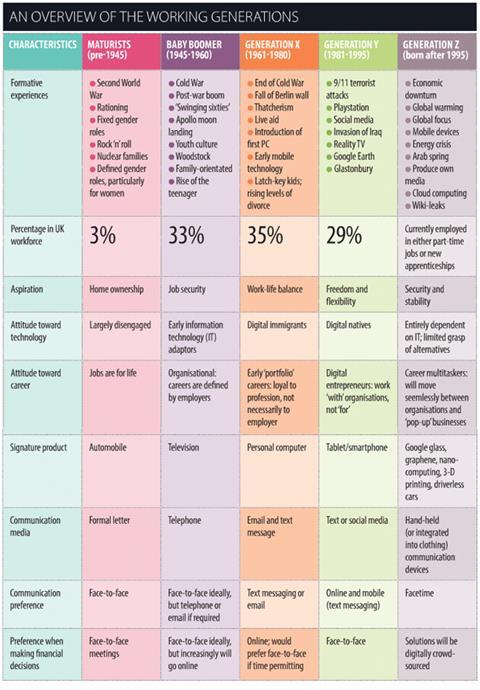

Source: Talking about my generation: Exploring the benefits engagement challenge, Barclays Corporate and Employer Solutions, September 2013