If you read nothing else, read this…

- A business pitch should take an average of four to six weeks to create and present.

- A compelling pitch will clearly outline the objectives that a benefits professional hopes to fulfil with the benefit they are proposing to implement.

- The focus of the pitch should be tailored to the target audience of the pitch.

Stephen Bevan, director of the Centre for Workforce Effectiveness at The Work Foundation, says: “We have obviously been through a tough time in terms of the buoyancy of the labour market, and a higher proportion of employers are anxious about losing their top talent .

“If employers are trying to take advantage of the upturn in the economy, then they need to make sure that they are hanging on to the best employees who can help them do that. I think that aligning a good package of benefits and other HR interventions to make sure that those talented employees give them a few more extra years of service is something that is going to be a higher priority [for employers] in 2015 than perhaps it has been for the last two or three years.”

But success relies on benefits professionals’ ability to build a compelling business case.

Decide on a project lead

First, a benefits team needs to identify who will build the business case. Is an internal employee best placed to do so? Do they have the necessary experience to prepare and present a compelling business case for a new benefit? Or is an external adviser more appropriate to undertake the work involved and, if so, is this option affordable for the organisation?

Aon Employee Benefits offers a secondee service, which enables employers to appoint one of the benefits consultancy’s advisers to work for them in-house for a specified period of time. Secondees are typically more junior members of staff, which means that the cost of the service is likely to be substantially less than if an employer used a more senior adviser, says Jon Bryant, area director for London at Aon Employee Benefits.

“Employers end up getting very cost-effective advice because they are not paying [senior adviser] rates for work that the majority of junior consultants can do with a little bit of hand holding [from their senior Aon peers],” he adds.

Employers should expect to pay around £100 an hour for a secondee, depending on their experience, he says.

Identify stakeholders

Where organisations opt to use internal resources, benefits professionals should start by identifying their target audience, which is likely to be either their HR or finance director, their procurement team or all three stakeholders. This will enable them to tailor their pitch accordingly.

Richard McKinley-Price, head of benefits management at Jelf Employee Benefits, says: “For the finance director, [the pitch] needs to be very much focused on what the financial outputs are going to be from the proposal, while for HR directors it needs to be about notional outcomes for employees, [such as] how [the benefit] is going to improve engagement.”

Meanwhile, procurement teams tend to focus on securing the lowest price possible along with the best service , so benefits professionals need to include in their pitch how and why value for money is often as, if not more, important than the bottom line where benefits are concerned.

Language should also be jargon free, so that the pitch can be easily understood by any reader.

Set objectives

Next, clear objectives need to be set. These are critical, because they will help to explain to the target audience why a new benefit is being proposed and the value that the benefits team is expecting it to bring to their organisation.

Objectives may range from resolving an ongoing organisational issue, such as high sickness absence levels or poor employee engagement, to supporting a business strategy, such as boosting profitability or promoting a more socially responsible corporate identity.

Charles Cotton, performance and reward adviser at the Chartered Institute of Personnel and Development (CIPD), says: “[Benefits professionals] should outline what the problem or opportunity is that they are trying to meet and what is driving that.”

For example, is the driving force a workplace-related issue, an economic change, a governmental or regulatory change or something that is happening within society, such as shifting demographics and the UK’s ageing population?

Benefits professionals need to explain what their organisation needs to do in response to these challenges within their pitch, says Cotton.

“It is also about them aligning their pitch with the mission and vision and the purpose of their business and its business strategy, in terms of what employee skills, attitudes and performance are needed for the organisation to be successful,” he adds.

Gethin Nadin, head of strategic alliances at benefits provider Benefex, says: “What we would like to see more of, but do not see a huge amount of at the moment, is [employers] telling us exactly why they are looking at employee benefits. Generally, an HR or benefits manager will come to us about wanting to run a benefits scheme or a platform to put their benefits on, and one of our first questions is why they want to do that, so that we understand their motivation.”

Benefits professionals should therefore consider using internal, evidence-based research to demonstrate the need for a benefit, such as staff surveys, focus group feedback or employee data to help support their pitch.

Provide background information

Background information on what the proposed benefit is and how it works may be useful for benefits professionals to include in their business case, particularly if the proposed benefit is unfamiliar to an organisation, such as a bring-your-own-device initiative, carbon-neutral company car scheme or health cash plan.

Background information may also include case studies outlining the likely effectiveness of the benefit being proposed, evidenced by, say, the impact it may have had in a competitor organisation. These may be sourced from the relevant benefits providers.

But ultimately benefits professionals must ensure that they provide enough information to support their pitch without overwhelming their target audience. They must therefore consider what the target audience really needs to know.

Bryant says: “At this stage, [the benefits professional] is only talking at a high level. What they really need is to know [from their target audience] is whether they think [the benefit] is worth investigating in any more detail.”

Detailing the resources required to source, implement and manage the benefit in question, from staffing through to technology, will further help to support a pitch.

Explain how success will be measured

The pitch must include detail on how the impact of the benefit will be measured, be that in the form of return on investment (ROI), reduced sickness absence levels or employee take-up of the proposed benefit.

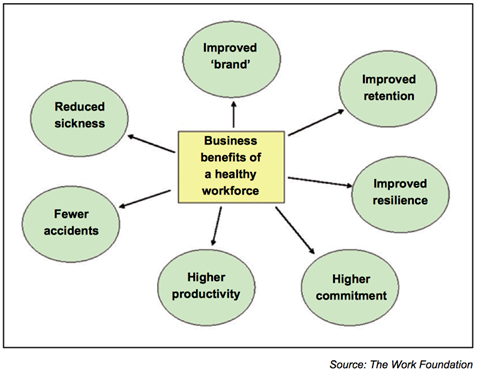

But The Work Foundation’s Bevan warns of the challenges involved. In his report, The business case for employees’ health and wellbeing , published in April 2010, he explains: “The ‘take-up’ or participation rates of employees in workplace health initiatives is too frequently the dominant, or only, measure of success. However, participation, for example in a smoking cessation initiative, does not necessarily equate to behavioural change or lead to a reduction in sickness absence.”

He adds that the speed with which business leaders expect results, particularly from workplace health initiatives, may also prove challenging. “Many employers are impatient for quick results once they have invested in a workplace health initiative, but the research is generally poor at helping us understand how long we should wait before we see the results.”

Bevan’s report was designed to examine if and how health and wellbeing initiatives have a positive impact on productivity in the workplace.

Manage stakeholders’ expectations

Benefits professionals should avoid being drawn on exactly when they expect to fulfil their objectives, however demanding their audience, to avoid setting themselves up for subsequent failure.

Bevan says: “A business case usually involves putting forward an argument that more money needs to be spent or allocated to particular activities, so part of the trick is to get [the business] to regard that as an investment rather than a cost, and to provide sober rather than widely overly optimistic arguments about where the ROI might come.

“Anyone who presents a business case with what looks like a very precise prediction is always leaving themselves open to people pointing out the inherent uncertainty of what they are arguing.”

As part of this part of the project, benefits professionals should highlight any potential risks that the benefit in question may pose. This is particularly important if a new IT system needs to be implemented, because there may be security considerations to consider, says Benefex’s Nadin.

Exploit valuable resources

Industry body CIPD offers resources, such as templates, to assist benefits professionals with building a business case, while trade publications and online resources can also help to support their efforts.

Jelf’s McKinley-Price also suggests using benefits providers and industry peers as useful sources of information.

“It is probably worth [benefits professionals] talking to two or three separate [providers], because they will all have a different stance in terms of what the best way to build the business case is, depending on what their product offering is,” he adds.

Overall, a business pitch should take an average of between four and six weeks to launch and present. “[This stage is] high level; it is simply about finding out if it is worth investigating [the benefit] at a deeper level,” says Aon’s Bryant.

Benefits professionals still in doubt could do worse than watching a few episodes of the BBC’s The Apprentice , to gain inspiration into business case building best practice from apprentices aspiring to be the next Sir Alan Sugar.

Key elements of a business pitch:

- Clear objectives

- Background information

- Possible risks

- Measures of success

- Return on investment

Case study: Goodman Masson sets staff retention as business case objective

Guy Hayward, chief executive officer of finance sector recruitment firm Goodman Masson expects any business case his benefits team presents to be unique and engaging and to have significant benefits for his workforce by helping them deal with current challenges, such as saving for their first home or repaying student debts.

“A benefit must have a directly positive impact on the life of an employee, so that they are excited about coming to work, because they believe that their employer is looking after them, so they are engaged and so their performance increases and we prosper when they stay,” he explains.

Hayward led by example when he proposed a three-year mortgage fund to the organisation in 2012 , which is due to mature next year. The organisation contributes to any deposit an employee saves through the fund, which was introduced in conjunction with a flexible benefits scheme, implemented by Jelf Employee Benefits, for three years.

An employee that saves £300 of their monthly basic salary plus £5,000 of their annual bonuses over the three-year period could expect to save around £42,000 with Goodman Masson’s contribution.

As part of the business case, Hayward identified the issue he wanted to address (high staff turnover rates), set a clear objective (to boost staff retention), proposed a new benefit to help meet the objective (a mortgage fund) and finally identified how the impact of his benefit would be measured (retention rates and return on investment).

Collectively, the 32 employees who are saving through the fund have generated just more than £2 million of profit on £7.2 million worth of sales for the organisation in the last two-and-a-half years.

“The cost of replacing employees and waiting for the productivity and performance of new staff to increase because they are in a new business is time,” says Hayward. ”If staff are staying with us, then [the fund] is money well spent.”

He advises benefits professionals to ensure that any business case that they work on clearly identifies and addresses a specific business issue within their organisation.

Goodman Masson’s staff turnover rate is less than 16% compared with his industry average of 42%.

Nick Kemsley: How to secure procurement buy-in for a benefits business case

Benefits professionals who want their organisation to part with its resources in the current economic climate, be they time, money or staff, must address all of the following considerations.

What’s the need?

The link to commercial success must be clear to all relevant stakeholders. Too many business cases look like answers looking for a question.

What’s the answer?

Benefits professionals must explain what they are proposing, along with the pros and cons and a clear rationale as to why the proposed option is recommended. This shows that they have followed a sensible process in arriving at their proposal

What is the return on investment?

A good business case shows a credible and realistic view of the overall commercial outcomes over time, and a clear mechanism by which the proposal will affect key performance indicators. Too many business cases feature tenuous links between cause and effect, and merely demonstrate the author’s lack of commercial acumen.

Is there clarity around assumptions and risks?

It is fine to make assumptions, but a good business case makes plausible ones and considers the impact of various predictable scenarios on the outcomes. Benefits professionals should consider a range of commercial outcomes in a risk-based way.

Is there modularity of the cost and benefit?

Money is a finite resource. Benefits professionals should give their audience the option to tailor the balance between cost and returns to fit the budget available.

How will success be measured?

Benefits professionals must consider the outcome and process metrics that will best show their organisation whether the aims of the initiative have been delivered.

Who is the audience?

Benefits professionals should consider whether their audience is rationally or numerically biased, as well as whether or not they are emotionally biased, or perhaps both.

Is there validation and credibility?

Benefits professionals must, like anyone building a business case, show support for their case through the use of benchmarks or external data. They can do this by, for example, engaging their finance director early on in the project to get them on side with their numbers. Failure to do so could result in them not managing to progress to slide two of their presentation.

Professor Nick Kemsley is co-director at the Centre for HR Excellence at Henley Business School