In 2008, international markets, including the London Stock Exchange, suffered their biggest falls since 11 September 2001.

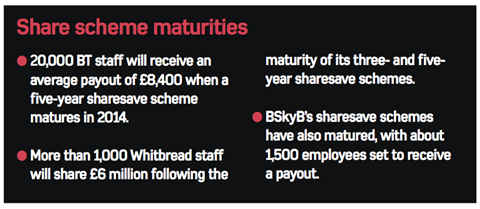

When BSkyB launched its five-year sharesave scheme in 2008, the option price was £3.72. When the scheme matured in January 2014, the share price stood at 888.75p. About 1,500 employees are set to receive a payout.

Elsewhere, 20,000 BT staff will receive an average payout of £8,400 when a five-year sharesave scheme matures in 2014, and more than 1,000 Whitbread employees will share £6 million following the maturity of the organisation’s three- and five-year sharesave schemes.

This year is an ideal time for employers to promote their share schemes to staff. From 6 April 2014, the investment limits for sharesave schemes and share incentive plans will increase for the first time in 20 years.

Malcolm Hurlston, chairman of the Employee Share Ownership (Esop) Centre, said: “Organisations are looking at whether it’s a good idea to go up in one go to the new limit or take it more slowly, since it took 20 years to increase the limit.

“We haven’t seen much evidence of what the answer will be yet, but there is great enthusiasm from employers and employees around how and when to do it.

“In terms of the actual number on the payout, it’s going to be game-changing.”

Research published by share scheme provider Equiniti in March, which surveyed its employer clients that provide sharesave and share incentive plans (Sips), found employers are already reorganising their 2014 share plan launches around the new legislation.

Among Equiniti’s employer clients that provide a sharesave scheme, six are delaying this year’s launch date until after 6 April to use the new limit. Also, 14 employers that provide a Sip have confirmed their dates to move to the new £150 per month limit.

The research also found that, among employers that provide sharesave schemes, 54% intend to increase monthly savings limits. Among employers that provide Sips, 88% intend to increase employees’ savings limits for partnership shares.

Jennifer Rudman, manager, employee share plans product development at Equiniti, said: “Employers are working out when is the first time employees can go in and make a payroll change and it will impact after 6 April.

“If we’re doing a deduction in April, the payroll cut-off might be anywhere from the beginning of the month or the end of March.

“That is what we’re going through at the moment. We’re discussing with [employer] clients when it is better for them to make the change in relation to their payroll systems, the cut-offs and the notifications.”

Aside from the legislation around the new savings limits for share schemes and improvements in the stock market, there has also been a flurry of rumoured initial public offerings (IPOs) in 2014.

A number of employers, such as Pets at Home and Poundland, have confirmed they are considering an IPO this year.

Merlin Entertainments, which became a publicly listed company on the London Stock Exchange in November 2013, launched its first three-year sharesave scheme in February, and 3,000 global staff joined up.

Esop’s Hurlston added: “When we had our [Global Employee Equity Forum] in Davos [in February 2014], I put the question to everybody there: ‘Are you feeling more confident now than you were at this time last year?’

“We had 100% of people present, mainly from the UK, saying they were more confident. The current flurry of IPOs reflects confidence, and we should see some pretty big ones.”

In the meantime, the government’s changes to the sharesave and Sip limits are on target to make employer share schemes even more attractive.

“As I see it at the moment, the increase in the limit was more than people were expecting in one stroke,” said Hurlston.

“But quite a few members of share schemes are already bumping up to the personal limit, so there is quite a strong demand from employees for the increased limit to be used.

“We are expecting to see pretty heavy use of the new limits.”