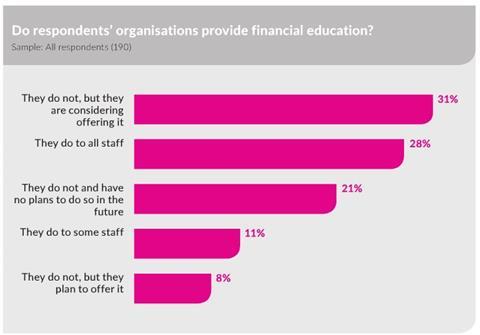

EXCLUSIVE: More than a quarter (28%) of employer respondents provide financial education for all staff, compared to 32% in 2015, according to research by Employee Benefits and Close Brothers.

The Employee Benefits/Close Brothers Pensions research 2016, which surveyed 250 employer respondents, found that a further 31% of respondents are considering introducing some form of financial education for staff. It will be interesting to see if this converts into action given 32% of respondents to last year’s survey said they were planning on introducing some form of financial wellbeing support but this does not yet appear to have occurred.

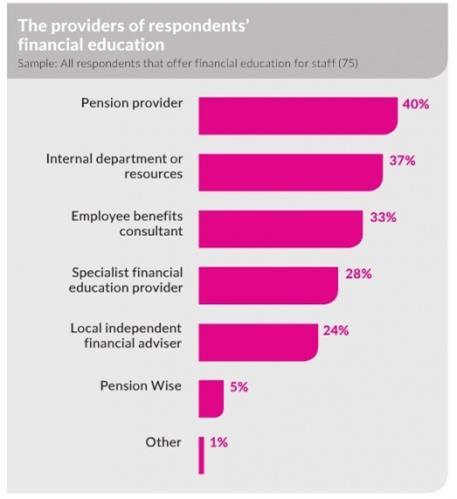

This year, however, there has been a shift in the type of organisation respondents are using to provide financial education to their staff. Last year, the most popular option was to use an independent financial adviser (IFA) or wealth manager, followed by the organisation’s pension provider and internal department or resources. This year, IFA’s appear to have fallen significantly in popularity, being replaced at the top of the chart by pension providers.

The use of financial education specialists also appears to have grown in popularity, being used by 28% of this year’s respondents, compared to 15% in 2015.

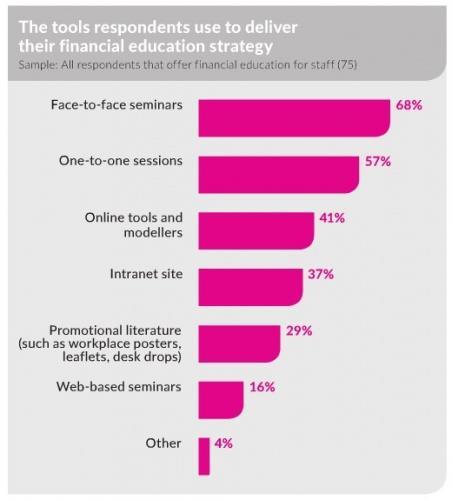

There has also been a change in the most popular method of providing financial education for staff, with face-to-face sessions increasing significantly in popularity year on year.