All Pensions articles – Page 158

-

Analysis

AnalysisStep-by-step guide to auto-enrolment compliance

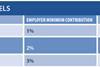

IF YOU READ NOTHING ELSE, READ THIS…Employers should identify their staging date as soon as possible.A project team should be appointed to manage systems and processes.Any systems developed or redesigned for auto-enrolment purposes should be future-proofed.Auto-enrolment communications must be clear and easy to understand.1. STAGING DATEEmployers must first ascertain their ...

-

Analysis

AnalysisLegal issues around auto-enrolment

IF YOU READ NOTHING ELSE, READ THIS…Employers cannot agree to provide alternative benefits on the understanding an employee opts out of a pension scheme.Qualifying earnings include various components of pay, including salary, wages, commission and bonuses.Employers must ensure they identify workers correctly under auto-enrolment.Ian Curry, associate, Wragge & CoQ: I ...

-

Analysis

AnalysisKnow the facts on auto-enrolment

There are key facts that all employers planning for auto-enrolment should know. Gillian McNamara, policy lead, employer compliance regime at The Pensions Regulator (TPR), says: “There is one crucial figure to know even before developing a plan to comply with the new duties, and that is the number of people ...

-

Case Studies

Morrisons helps employees to save money

The programme, ‘Save your dough’, provides the retailer’s 135,000 employees with information on saving in general and for retirement. It includes in-store champions who are armed with further information on saving, two booklets about saving money and one on retirement saving, and a website.A monthly employee survey found that 45,000 ...

-

Analysis

Pros and cons of absolute return funds

IF YOU READ NOTHING ELSE, READ THIS…Absolute return funds (AFRs) have grown in popularity on the back of volatile equity market performance.ARFs are relatively expensive and, despite their name, can still lose money.Employers tend to use ARFs in conjunction with a more passive fund for their default investment option.Absolute return ...

-

Article

Lorica adds Aviva’s auto-enrolment product to portal

Lorica Employee Benefits is to integrate Aviva’s online auto-enrolment modelling and compliance product into its auto-enrolment portal Simplicity.The product, Auto-enrolment Manager for Employers (AME), provides employers with a way to prepare for and manage their responsibilities around auto-enrolment. This includes keeping up to date with compliance duties such as employee ...

-

Article

ITM to partner PensionsFirst for data audits

ITM, a pension data specialist, is to partner PensionsFirst to offer its Pfaroe risk management platform to enhance its data risk audit service for defined benefit (DB) pension schemes.The organisation will use the platform to assess the potential liability impact of data and benefit errors discovered during employers’ data risk ...

-

Article

Majority of employers aware of auto-enrolment

The majority (88%) of respondents to research by the Chartered Institute of Personnel and Development (CIPD) are aware of their requirements to auto-enrol staff into a pension scheme.Its Labour market outlook: Focus on pension auto-enrolment, which surveyed more than 1,000 employers, found that more than half (59%) of respondents have ...

-

Article

Employers to rely on existing technology for auto-enrolment

More than 50% of respondents said they expect to rely on their existing payroll and HR systems to fulfil their auto-enrolment duties, according to research by JLT Benefit Solutions.The latest JLT 250 club survey, which polled around 250 private sector employers, looked at the role of technology in the provision ...

-

Article

Local government pensions need better investment governance

The future of local government pension schemes (LGPS) in London is potentially blighted by weak oversight of investment governance, according to research by the Pensions Institute.Its report, An evaluation of investment governance in London local government pension schemes, identifies fundamental flaws in the investment governance of the majority of London’s ...

-

Article

Lyreco prepares for pensions auto-enrolment

Lyreco has brought forward its auto-enrolment staging date, switched pension providers, and set up administration software between its payroll and pension provider.The workplace products distributor will use Cerdian’s auto-enrolment administration software, which automatically identifies and enrols employees into the chosen pension scheme.The software aligns the exchange of payroll information from ...

-

Article

Johnson Fleming expands auto-enrolment offering

Johnson Fleming has partnered with the national employment savings trust (Nest), Now: Pensions and The People’s Pension to offer a two-tier auto-enrolment option for employers.The agreement enables employers that require a two-tier option to use a single administration and communications platform, rather than running more than one platform.Simon Fletcher, client ...

-

Analysis

Ferdinand Lovett: Typical legal queries from HR

Ferdinand Lovett, solicitor at Sacker and Partners, and legal expert at Employee Benefits Live 2012, tells Debi O’Donovan, editor of Employee Benefits, the common questions he and his law firm are being asked by HR and benefits managers with regards to pensions auto-enrolment.Lovett flags up the common legal areas that ...

-

Article

Consultation on lifting Nest restrictions

The government has published a call for evidence on the impact of two statutory restrictions on the National employment savings trust (Nest).It is seeking views and evidence on whether the annual contribution limit and transfer restrictions on Nest are influencing employers’ choice of auto-enrolment pension scheme in a way that ...

-

Article

Booker Tate completes pensions buyout

Booker Tate has completed a pension insurance buyout for its defined benefit (DB) pension scheme.The transaction, carried out in conjunction with Pension Insurance Corporation (PIC), covers £20 million of pension liabilities.The organisation, which provides development, management and technical services to the sugar, ethanol and bio-energy market, was advised by Barnett ...

-

Article

DB pension deficits hamper investment

High levels of defined benefit (DB) pension scheme deficits are hampering organisations in investing in their businesses, according to research by the Institute of Chartered Accountants in England and Wales (ICAEW) and Mercer.The Living with defined benefit pension risk report, which surveyed finance directors and other senior leaders on DB ...

-

Article

BT's pension deficit increases to £3.1bn

BT Group’s final salary pension scheme deficit has increased from £1.9 billion to £3.1 billion since March 2012.The telecommunications firm published the figure in its financial results for the second quarter and half year to 30 September 2012.The higher deficit reflects the impact on liabilities of a reduction in the ...

-

Article

JLT to take over Aegon’s DB pension portfolio

JLT Benefit Solutions will take over the ongoing provision of services to Aegon’s portfolio of defined benefit (DB) pension schemes.The portfolios have an asset value of £710 million and contain 25,000 members.The partnership will see 100 Aegon staff transfer to JLT in early 2013.Duncan Howorth, chief executive at JLT Benefit ...

-

Article

Prudential partners Nest and Now: Pensions

Prudential UK has partnered with the National employment savings trust (Nest) and Now: Pensions to offer pension auto-enrolment options to employers.The financial services provider is working with Nest and Now Pensions to provide organisations with diverse workforces the option of a dual-scheme approach to complying with auto-enrolment.David Caw, head of ...

-

Article

Over-50s too optimistic about DC pension pots

Over-50s with defined contribution (DC) pension schemes are too optimistic about the amount of retirement income they will receive, according to research by the Institute for Fiscal Studies (IFS).The report, Expectations and experiences of retirement in defined contribution pensions: a study of older people in England, supported by the National ...