All Pensions articles – Page 137

-

Article

Royal Mail managers vote against pension proposal

Almost one third (27%) of Royal Mail managers that turned out for a consultative ballot by trade union, Unite, voted against proposed reforms to the organisation’s defined benefit (DB) pension scheme. According to Royal Mail, around 5,660 of Royal Mail’s 8,300 managers are Unite members, and 50% of these members ...

-

Article

More SMEs are prepared for auto-enrolment

More than a quarter (27%) of medium employers have drawn up pensions auto-enrolment plans and started to act on them, compared to 13% in autumn 2012, according to research by The Pensions Regulator.Its Employers’ awareness, understanding and activity relating to auto-enrolment research, which questioned 639 employers that are due to ...

-

Article

ArticleEmployers should prepare early for auto-enrolment

Employers that have yet to auto-enrol staff should start planning as early as possible.More than half (55%) of respondents to the Employee Benefits/Capita Pensions Research 2013 that have already auto-enrolled staff said this would be their top tip for employers that have yet to comply with the reforms.A further 20% ...

-

Article

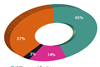

ArticleGPP top choice for pension auto-enrolment

Almost two-thirds (63%) of respondents that still need to auto-enrol staff will use a group personal pension (GPP) as their primary scheme for auto-enrolment, according to the Employee Benefits/Capita Pensions Research 2013.The research, which surveyed 370 HR and benefits managers, also found that more than a third (33%) of respondents ...

-

Article

Cobham enters bulk-annuity contract for DB pension

Aerospace and defence organisation Cobham has entered into a bulk-annuity transaction for its defined benefit (DB) pension scheme.The transaction, with insurer Rothesay Life, covers £280 million of pension liabilities.The policy, which is being held as an investment by the trustees, gives the organisation a secure, low-risk asset with additional protections, ...

-

Article

ABI launches pensions calculator for employers

The Association of British Insurers (ABI) has launched a pensions calculator designed to help employers select a pension scheme for their employees.The tool enables employers to input pension charges, including active member discounts and initial charges, to obtain a simple analysis of the impact charges will have on employees’ retirement ...

-

Article

Royal Mail reduces DB pension liabilities

Royal Mail Group has reduced the liabilities of its defined benefit (DB) pension scheme from a deficit of £2.7 billion in March 2012 to a surplus of £825 million at March 2013.The group’s Annual report and special purpose financial statements for the year ended 31 March 2013 showed that this ...

-

Article

ArticleIn-house support more prevalent in auto-enrolled organisations

Employers that have auto-enrolled staff relied more on in-house resources than respondents that have still to auto-enrol staff plan to do so.According to the Employee Benefits/Capita Pensions Research 2013, which surveyed 370 HR and benefits professionals, 52% of those that have auto-enrolled staff used in-house advice, 60% had in-house help ...

-

Article

Goldman Sachs to sell stake in pension insurer

Goldman Sach is to sell a majority stake in pension insurer Rothesay Life in the next year.Rothesay Life mitigates the financial and longevity risk of UK organisations’ defined benefit (DB) pension schemes.It was established by the investment banking and securities firm in 2007.A spokesperson from Goldman Sachs said: “The firm ...

-

Article

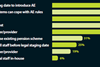

Article38% due to auto- enrol will use postponement

Respondents that have yet to auto-enrol their staff say they are less likely to use postponement than those that have already auto-enrolled.According to the Employee Benefits/Capita Pensions Research 2013, which surveyed 370 HR and benefits managers, 38% of those that have yet to auto-enrol staff plan to use postponement.Two-thirds (67%) ...

-

Article

Auto-enrolled staff have stayed in pensions

More than 90% of employees who have been auto-enrolled into a workplace pension by their employer have stayed in the scheme, according to research by the Department for Work and Pensions (DWP).Its Automatic-enrolment opt-out rates: findings from research with large employers report surveyed 50 employers, 42 of which provided opt-out ...

-

Article

Johnson Fleming launches auto-enrolment checklist

Johnson Fleming has launched an auto-enrolment checklist for employers.The pensions and benefits consultancy has designed the checklist to help with both initial project planning and as a final check for employers nearing their staging date.The checklist is broken down into six key sections:Project: Looking at the mechanics of how to ...

-

Article

FTSE 100 pension deficits at £43bn

Pension deficits in the FTSE 100 stood at £43 billion at 30 June 2013, compared to £42 billion in 2012, according to research by financial and actuarial consultancy Lane Peacock and Clark (LCP).Its 20th annual Accounting for pensions report provides an analysis of FTSE 100 defined benefit (DB) pension schemes ...

-

Article

ArticleFirst auto-enrollers less likely to wait for staging date

The first organisations to auto-enrol staff were more likely to do so before their staging date than those that have still to do so, according to the Employee Benefits/Capita Pensions Research 2013.The research, which surveyed 370 HR and benefits professionals, found that just over half (53%) of those that have ...

-

Article

DOD’s blog: how auto-enrolment strategies are shaping up

This week Employee Benefits published a major piece of research into what employers have done with their auto-enrolment strategies to date.The Employee Benefits/Capita Pensions Research 2013 drew responses from 370 employers, 31% of which have gone through auto-enrolment.At a point in time when we are beginning to see pension suppliers ...

-

Article

TPR investigating 89 employers for auto-enrolment non-compliance

The Pensions Regulator (TPR) has opened 89 investigations into possible non-compliance of auto-enrolment by large employers.Its Automatic-enrolment: Commentary and analysis report includes information on the first six months of auto-enrolment, between October 2012 to the end of March 2013.The investigations, which numbered 89 at 31 March 2013, are focused on ...

-

Article

Standard Life partners LEBC for SME auto-enrolment

Standard Life has partnered LEBC to provide a packaged auto-enrolment product to LEBC’s small and medium-sized employer clients. The package includes:Access to online resources for employers to administer their scheme and for employees to join and manage their pension.A suite of member communications to help promote the benefits of the ...

-

Article

ArticleThree-quarters of employers using certification for contributions

Most respondents that have auto-enrolled their staff used the option to self-certify to simplify the calculation of pension contributions, according to Employee Benefits/Capita Pensions Research 2013.The research, which surveyed 370 HR and benefits managers, found that 73% of respondents are using this option.Certification rules state that instead of having to ...

-

Opinion

Rachel Brougham: Employers need to consider auto-enrolment costs

If these are not available, employers will start to incur costs in cleaning up their data and deciding what contributions to pay. But, as so many commentators have pointed out, auto-enrolment is not just a pensions problem.For example, Whitbread recently reported having spent more than £1 million on implementation alone. ...

-

Opinion

John Chilman: How can employers see a return from pensions?

It’s sad, as a pensions manager, that inertia is the main thing responsible for the boom in pension savings, but ultimately inevitable, when the engaged have already joined or taken the active decision to opt out.So now we’re faced with the challenge of articulating the value of a benefit to ...