All Pensions articles – Page 131

-

Article

DWP launches consultation on money purchase pensions

The Department for Work and Pensions (DWP) has launched a consultation on money purchase pension schemes.The consultation, which is open to pension industry bodies, trustees or scheme managers, pension scheme members and employers, seeks to clarify the definition of money purchase included in section 29 of the Pensions Act 2011.The ...

-

Article

Standard Life Investments to launch new default fund

Standard Life Investments is to launch a new default fund for defined contribution (DC) pension scheme members.The Enhanced-Diversification Growth Fund (EDGF) is a lower volatility diversified growth fund, which is designed to generate equity-like returns with lower volatility than investing in equity markets.The fund, which will be launched in the ...

-

Article

Standard Life moves wealth division into investments

Standard Life Wealth is to move within the Standard Life group to its global fund manager Standard Life Investments with effect from 1 January 2014.Richard Charnock, chief executive officer of Standard Life Wealth, who will report to Keith Skeoch, chief executive officer of Standard Life Investments, will be appointed to ...

-

Article

Pension funds are unaccountable to savers

Pension funds are unaccountable to the savers whose money they invest, according to a report by ShareAction, the public campaign for the ethical investment of UK pension funds. Its Our money, our business report found that, although company directors are increasingly expected to be accountable to their shareholders, shareholders themselves, ...

-

Article

ArticleGuaranteed pensions would see higher staff take up

Six out of 10 respondents said there would be a significant difference in the number of employees who would consider joining, or staying in, a defined contribution (DC) pension scheme or who would pay higher contributions if the qualifying default fund secured a guaranteed pension income building up year on ...

-

Article

Lloyd’s Superannuation Fund insures DB pension

The Lloyd’s Superannuation Fund (LSF) has concluded a pension insurance buyout for its defined benefit (DB) pension scheme.The transaction, in conjunction with provider Pension Insurance Corporation, covers £40 million of pension liabilities.The LSF is a multi-employer pension scheme that was established in 1929.Its members are employees and former employees of ...

-

Article

FTSE 350 pension deficit decreases

The pension deficits of the FTSE 350 reduced from £115 billion at 31 July 2012 to £58 billion at 31 July 2013, while aggregate market caps increased from £1,800 billion to £2,100 billion over the same period, according to research by Hymans Robertson.Its annual FTSE 350 pensions analysis report found ...

-

Article

Lorica adds master trust to auto-enrolment product

EXCLUSIVE: Lorica Employee Benefits has partnered Now: Pensions to add a master trust to its integrated auto-enrolment and pensions product, Littleblue.Littleblue, which also includes a group personal pension (GPP) plan, is designed to suit employers with between five and 250 employees, but can be used by both larger and smaller ...

-

Article

Pension Protection Fund reports £1.8bn surplus

The Pension Protection Fund (PPF) has reported a surplus of £1.8 billion in its 2012/13 annual report.It also stated the probability of meeting its long-term funding target by 2030 has increased to 87%, an increased from 84% at 31 March 2012.According to the PPF report, its performance owed much to ...

-

Case Studies

Case StudiesMitie Group integrates employee benefits across businesses

This has posed a significant challenge for the strategic outsourcing organisation which, historically, has grown through a cluster of smaller businesses that have been allowed a degree of autonomy, including in the benefits offered to employees.Katherine Thomas, group HR director, says: “When you start to bring that all together to ...

-

Case Studies

Arriva chooses lifestyle strategy for default fund

The scheme’s default fund uses Standard Life’s lower-to-medium-risk lifestyle strategy, which aims to provide long-term growth whilst investing in a diversified portfolio of assets. This is the second lowest risk level of the five risk-rated lifestyle strategies Standard Life has developed, so employers can select the risk appetite that is ...

-

Analysis

AnalysisDe-risking pension investments in the run-up to retirement

If you read nothing else, read this…Members of DC pension schemes face critical investment choices in the run-up to retirement.Employers can provide financial guidance to help employees make informed decisions.Employees can choose different investment approaches based on level of risk.However, the numbers are set to rise. Some 400,000 people applied ...

-

Article

Ipswich Town FC to launch master trust

Ipswich Town Football Club is to launch a master trust to comply with pensions auto-enrolment.From 1 November, Now: Pensions will provide the pension, which will be available to the football club’s 600 eligible employees, including office staff and match-day stewards.Denise Booth, management accountant at Ipswich Town Football Club, said: “We ...

-

Article

Employers should provide wider insurance benefits

The majority (92%) of respondents believe employers have a role to play in the provision of wider insurance benefits, according to research by Swiss Re.Its Insurance report 2013: Connecting generations – protecting generations found that, although two-thirds of respondents see the value of insurance, many of them find financial services ...

-

Article

NAPF launches Stewardship Disclosure Framework

The National Association of Pension Funds (NAPF) has launched a Stewardship Disclosure Framework.It aims to provide pension funds with greater transparency around the stewardship policies and activities of the 206 asset managers who are signatories of the Stewardship Code.The framework, which is based around the seven principles of the Stewardship ...

-

Article

Webb says government will get tough on pension charges

Pensions minister Steve Webb (pictured) hinted that the government is to take a tough stance on pension charges in an upcoming consultation, which will respond to the Office of Fair Trade’s (OFT) paper on the defined contribution (DC) pension market.During a speech at the National Association of Pension Funds’ (NAPF) ...

-

Article

DOD’s blog: Time to stop screaming about an auto-enrolment crunch

This week I have been talking pensions, largely of the auto-enrolment variety, up at the National Association of Pension Funds’ annual conference in Manchester.What has been great is the positive attitude to how well auto-enrolment has gone to date.But with typical British cynacism, pensions experts are wary as to how ...

-

Article

Interface Europe changes DB pension adviser

Carpet tile manufacturer Interface Europe has appointed KPMG to provide a range of trustee services for its defined benefit (DB) pension scheme.These include actuarial and investment consulting, as well as administration and payroll services.The scheme, which is closed to future accrual, has around £100 million of assets and 1,400 members.Simon ...

-

Article

48% will stay in pension post-auto-enrolment

Almost half (48%) of respondents will remain in their employer’s pension scheme once they have been auto-enrolled, according to research by information specialist EDM Group.Its research, which surveyed 1,586 employees, found that less than a quarter (23%) have either immediately opted out of their employer’s pension scheme post-auto-enrolment or plan ...

-

Article

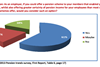

Confidence in pensions rises to 59%

Confidence in pensions among employees has risen in the past 12 months, according to research by the National Association of Pension Funds (NAPF).Its Workplace pensions survey, which measures employees’ perspectives on workplace pension savings and their preparations for retirement, found that confidence, particularly among staff already saving into a pension ...