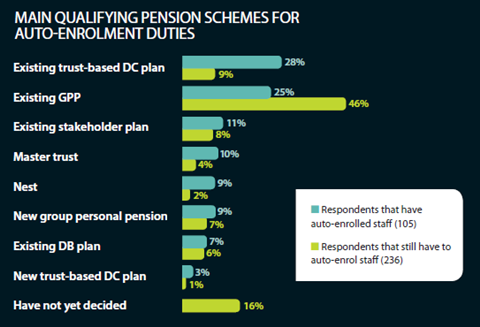

Almost two-thirds (63%) of respondents that still need to auto-enrol staff will use a group personal pension (GPP) as their primary scheme for auto-enrolment, according to the Employee Benefits/Capita Pensions Research 2013.

The research, which surveyed 370 HR and benefits managers, also found that more than a third (33%) of respondents that have auto-enrolled staff are using a GPP. (This does not include respondents that do not know).

As many as 18% of those that have gone through auto-enrolment used a master trust, such as the state-backed National Employment Savings Trust (Nest), The People’s Pension from provider B&CE or Now: Pensions. But only 6% of those still to auto-enrol plan to use a master trust.

At the time this research was conducted in June 2013, only the largest employers had auto-enrolled staff. Among this group, 28% used an existing trust-based defined contribution (DC) plan, with 3% having set up a new plan.

However, those that still have to auto-enrol are less likely to use a trust-based DC plan, with only 9% planning to do so.

One-third (33%) of respondents that have auto-enrolled set up a new scheme to do so.

Read the full version of Employee Benefits/Capita Pensions Research 2013.