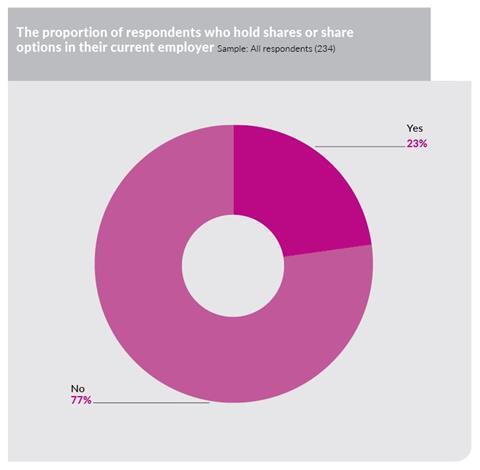

EXCLUSIVE: Less than a quarter (23%) of HR and benefits professional respondents hold shares or share options in their current employer, according to research by Employee Benefits.

This figure has changed little since the Salary survey was conducted in 2009 and 2008, when 26% and 25% of respondents, respectively, received shares as part of their remuneration package or through an employee share scheme.

The Salary survey 2017, which surveyed 249 HR, reward and benefits professionals in December 2016, also found that there is a slight discrepancy between the proportion of respondents who identify as female who hold shares or share options in their organisation (18%) and the proportion of respondents who identify as male (33%).

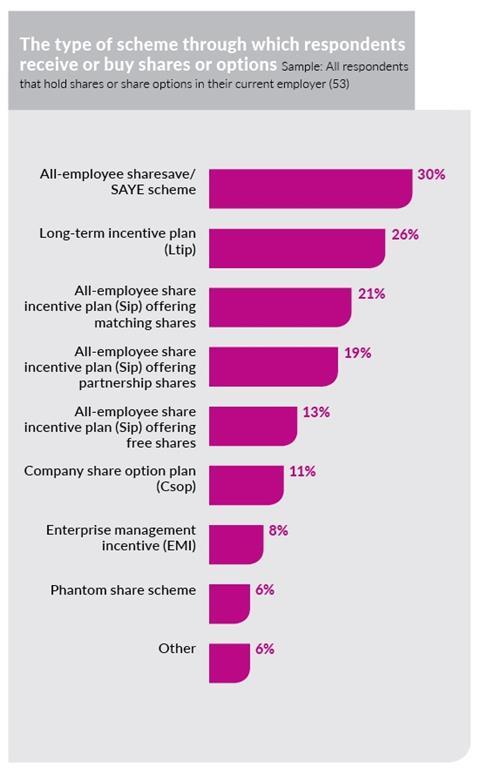

Among all respondents, almost a third (30%) receive shares through an all-employee sharesave scheme, and just over a quarter (26%) receive shares through a long-term incentive plan (L-tip). This figure rises to 42% among male respondents, while 11% of female respondents receive shares through an L-tip.

The most common all-employee share incentive plan (Sip) through which all respondents receive shares is one that offers matching shares (21%). This is closely followed by a Sip offering partnership shares (19%). Just over one in 10 (13%) respondents who hold shares in their current employer do so through a Sip offering free shares.

Click to download the full Employee Benefits Salary Survey 2017.