All Company cars articles – Page 16

-

Article

ArticleCO2-emissions limit top driver of car choice

Nearly two-thirds (62%) of respondents cited a carbon dioxide (CO2) emissions limit as the top criteria for employee’s company car choice, according to research by GE Capital’s fleet services division.Its Company car trends research, which surveyed 200 fleet decision makers, found that other criteria included the car’s fitness for purpose ...

-

-

Analysis

AnalysisTop ways to save on car running costs

If you read nothing else, read this…Savings can be made by choosing the right cars to offer employees.Fuel is the biggest area where savings can be made.Car telematics can monitor how employees drive.Driver training can teach staff driving techniques that can save on costs such as fuel. Short and long-term ...

-

Article

Capital One awarded best staff travel policy

Capital One won the award for Best staff travel policy at the Employee Benefits Awards 2014.Read why the organisation won the award.The Employee Benefits Awards 2014 were held on 27 June 2014 at the Artillery Garden at the HAC London.

-

Article

ArticleGuide Dogs Association launches salary sacrifice cars

The Guide Dogs for the Blind Association has launched a salary sacrifice car scheme for 1,200 eligible employees.The UK-wide charity has signed a four-year contract with Leasedrive, which will supply its Mycar scheme to the organisation.As a registered charity, Guide Dogs is also able to make use of the benefits ...

-

Case Studies

Case StudiesAsda makes savings with company car scheme

The retailer has more than 150,000 staff and introducing the scheme, provided by Zenith, has helped the organisation and its employees to save on car running costs.To date, Asda has saved about £6,000 per company car compared to the cost of providing a cash allowance. Savings are made on fuel, ...

-

Article

Article89% of fleet drivers have faked mileage claims

Nine out of 10 (89%) respondents have submitted an inaccurate mileage claim to their employer, according to research by car hire organisation Flexed.co.uk.Its research, which surveyed 1,200 company car drivers, found that 63% of respondents had added personal miles to their work driving total for personal gain.The research also found:20% ...

-

Article

ArticleHMRC loses company car tax case

Six companies in the Newell and Wright group, including Apollo Fuels, provided cars to managers and salesmen under an arrangement whereby it leased the cars to the workforce in an ’arm’s length’ hire rental.Employees were paid for business mileage at the same rate as colleagues who used their own cars ...

-

Article

ArticleKFC launches salary sacrifice car scheme

EXCLUSIVE: KFC has launched a salary sacrifice car scheme for more than 950 eligible employees.The restaurant chain has included an emissions cap at 130g/km to help improve the organisation’s green credentials and help employees to make tax savings.The current lowest tax band, of 5%, is applied to all cars emitting ...

-

Analysis

AnalysisSummer driving tips for employees

If you read nothing else, read this…Employees who drive abroad should perform essential car maintenance checks, such as oil, cooling fluid and tyre pressure.Drivers should familiarise themselves with the driving rules in the countries they plan to visit, which can vary. A leasing firm can advise an employee on the ...

-

Article

Rugby union shortlisted for best travel policy

Capital One and The Rugby Football Union are among the employers that have been shortlisted for the award ‘Best staff travel policy’ at the Employee Benefits Awards 2014.For this award, the judges were looking for a successful strategy that has made company cars and travel benefits effective in an organisation.The ...

-

Case Studies

The benefits offered by Fujitsu UK and Ireland

PensionA trust-based defined contribution (DC) scheme with employer-matched contributions up to a maximum of 10%.Two legacy defined benefit (DB) schemes, closed to new entrants and to future accrual.One DB plan that is selectively open to new members, such as staff that transfer to Fujitsu from the public sector. HealthcarePrivate medical ...

-

Article

ArticleHay Group reviews benefits to fund auto-enrolment

EXCLUSIVE: Hay Group has undertaken a full review of its employee benefits to help fund the cost of auto-enrolment.The global management consultancy, which has around 350 employees, reached its auto-enrolment staging date on 1 February 2014.Charlotte Koch (pictured), head of HR at Hay Group, said: “Auto-enrolment allowed us to take ...

-

Analysis

AnalysisKey issues around fleet salary sacrifice schemes

Estimates for the number of cars covered by salary sacrifice schemes vary, but a realistic figure would be 50,000-75,000, and this figure is expected to grow in coming years.The number of providers has also increased significantly and recent focus has been on the ‘employee experience’. Many suppliers are concentrating on ...

-

Analysis

AnalysisAll employers need to know about car salary sacrifice schemes

If you read nothing else, read this…Salary sacrifice car schemes are typically low-cost or cost-free for an employer to introduce.Low-emission cars are popular in schemes because of available tax breaks.Employers can put buffers in place to protect themselves from early termination fees and long-term absence of scheme members.Knowing how to ...

-

Analysis

AnalysisKey messages for staff about car salary sacrifice schemes

If you read nothing else, read this…Employers should tell staff about potential savings on income tax and national insurance.Employees need to know that company car tax bands will change every year until 2016-17, which could affect a scheme’s cost.Employees may incur early termination costs if they leave the scheme or ...

-

Article

ArticleCompany car tax rates to increase from 2017

Budget 2014: The government has increased the company car tax rates by two percentage points.In tax year 2017-18 and 2018-19 the appropriate percentage of list price, subject to tax, will increase by two percentage points (to a maximum of 37%) for cars emitting more than 75g of carbon dioxide per ...

-

Article

ArticleFuel duty to be frozen until 2015

Budget 2014: The government has confirmed fuel duty will remain frozen until spring 2015.Chancellor George Osbourne cancelled the fuel duty increase planned for September in his 2014 Budget. This was previously announced in the Autumn Statement.It means employees with company cars will save £11 every time they fill up their ...

-

Article

ArticleOnly 16% of employees would consider an electric company car

Only 16% of respondents would consider an electric car as their next company car, according to research by the Leasedrive Group.Its research, which surveyed 534 employee drivers, found that 51% of respondents would not consider an electric car, while 33% were unsure.More than a third (35%) of respondents cited a ...

-

Article

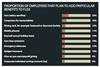

ArticleSalary sacrifice cars to see big growth in flex

Some 22% of respondents plan to add this perk to flex, while 10% of employers plan to add low-emission cars to their plans.Some 18% of employers currently offer salary sacrifice cars and 11% of employers currently offer low-emission cars through their flex plans. Dining cards, such as Tastecard and Gourmet ...