IF YOU READ NOTHING ELSE, READ THIS…

- Employers with early or imminent staging dates say they underestimated the complexities of auto-enrolment.

- A first step is to define qualifying earnings, and it is up to the employer to take a view on each component of pay.

- Opt-out forms must be issued by the pension scheme, not by the employer.

As any employer that had an auto-enrolment staging date in October 2012 will already know, managing and maintaining accurate data is a major challenge.

The Pensions Regulator (TPR) has published a guide to what records employers must keep. For example, they must keep a record of the national insurance (NI) number, date of birth, gross qualifying earnings, and amount and date of contributions of each scheme member for six years, apart from opt-out notices for jobholders, which must be kept for four years.

Earnings figures must relate to each relevant pay reference period, so it can be continually compared against the definition of qualifying earnings.

Employers also need to hold an opt-out notice or an opt-in notice for jobholders, plus the contributions to which they are entitled, to demonstrate that the scheme qualifies. Crucially, the opt-in and opt-out notices must be retained in their original format. John Wilson, head of technical at Jardine Lloyd Thompson, says: “There has been some debate about whether Nest (national employment savings trust) and others selling autoenrolment middleware can accept opt-out notifications over the phone using voice recognition technology. You don’t need to produce paper, but you do need to be able to produce some form of record that is legible.”

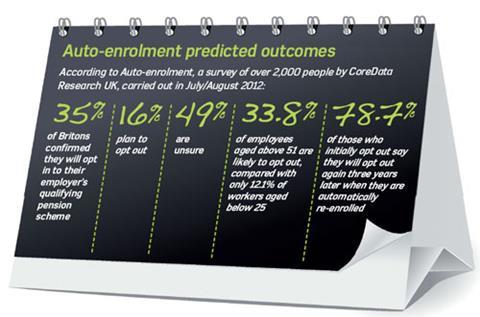

A common misconception about opt-in dates is that each individual will be re-enrolled three years after they first opt out. In fact, the three-year period relates to the organisation, so, apart from new joiners, most staff will be re-enrolled three years after the employer’s original staging date. Strictly speaking, this means individual opt-out dates do not need to be retained if an employer does not want to hold that level of granular information.

Qualifying earnings

A record must be kept of each employee’s qualifying earnings, which for many employers is one of the first big hurdles to overcome. This is because this data field does not currently exist and the definition of qualifying earnings is not straightforward. The term basically covers overtime, bonuses, commission and statutory maternity pay, but it can exclude a car allowance, for example, if a car is perceived as a necessity for the job, or perks that amount to only a tiny part of remuneration.

Martin Thompson, director of Premier Benefit Solutions, says: “There are grey areas, such as shift allowances and home-working allowances. Many employers are putting everything in at the moment because they do not want to be caught out. Others are going down the self-certification route and using basic salary, particularly if they don’t have a cost issue with auto-enrolment. For some employers, it will be difficult. If take-up of their pension scheme is currently low, auto-enrolment could be a major cost.”

Product providers and payroll system suppliers have been busy building middleware that automates the auto-enrolment process. Friends Life’s hub, for example, is based on 37 data fields that it believes are necessary to certify that an employer is meeting its auto-enrolment duties.

One such field is the state pension age, which is not currently captured by most payroll systems, but is one of the definitions of eligible jobholders, says Mark Futcher, associate at Barnett Waddingham. Middleware relies on accurate data and periodic data cleansing of existing staff records is a good discipline, says David Woodward, Ceridian’s chief product and innovation officer.

Current data protection legislation came into force in March 2000, so employers will know they must comply with their statutory auto-enrolment duties in a way that is fair, ensuring records are lawful, adequate, relevant and no more than needed. Employers also need data protection agreements with third-party administrators or external payroll providers to ensure they comply with the legislation.

A separate legal requirement covers employers where there has been a ‘relevant transfer’ involving the Transfer of Undertakings (Protection of Employment) Regulations (Tupe).

The receiving employer has a duty to provide a pension, and in a money purchase scheme it must match employee contributions up to 6% of remuneration, far more than auto-enrolment’s initial contribution of 2%.

The Department for Work and Pensions has promised that the position on this will be clarified by October 2013.

CASE STUDY: ISS UK

Interaction between pension provider and payroll is vital

Danish-owned facilities management company ISS UK has a turnover of over £1 billion and 42,000 staff, of whom 21,000 will be eligible for auto-enrolment. Its staging date was 1 January 2013, but it has postponed it to March as January is its financial year-end.

ISS appointed Now:Pensions to manage 25 to 30 schemes, which are active with between five and 1,000 members. It outsources its payroll functions to Ceridian.

Fergus O’Connell, UK group financial controller, says: “One key to getting this right has been the interaction between payroll and pension provider. Each pension provider has different information requirements, so we had to invest in bespoke software to transfer the data to Now:Pensions. Taking a simple example, each holds data, such as job titles, dates of birth and national insurance numbers in a different format, and all that had to be tested with the new interface.”

ISS has taken a prudent approach to the defi nition of qualifying earnings, says O’Connell. “We received little help from The Pension Regulator on this. We asked a question and just got the standard default reply back. What can be included will probably end up being defined by case law.”

ISS will send letters outlining its auto-enrolment plans to scheme members at Christmas, following this up in the run-up to implementation. “Despite the communication, it will only become real for people when they see a deduction in their pay packets,” says O’Connell.