Two-thirds of young employees, who are ready to save for retirement, lack the opportunities to do so, according to research by Aegon UK.

Its Changing face of retirement: the young, pragmatic and penniless generation survey, which had 10,800 global respondents, including 2,722 employees between the ages of 20 and 29, found that more than a third (37%) of respondents aged between 20 and 29 believed that they will fall short of their retirement needs by at least half of what they estimate they will need. As a result, 44% are pessimistic about when they will retire.

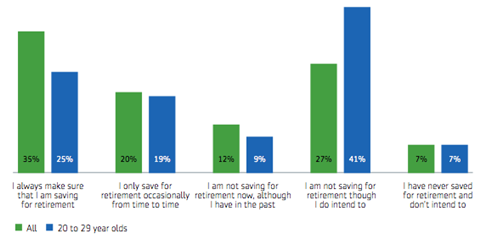

A quarter (25%) of young respondents always make sure they are saving, but 41% still intend to start saving.

The research also found that:

- 59% of respondents expected to be worse off in retirement than their parents.

- 57% of young respondents believed that saving for a pension is important, but not a priority.

- 47% do not know if they are on course to reach a desired retirement income.

- 26% said more frequent information about retirement savings would encourage them to save.

But just over one-fifth (22%) would be interested in financial education.

Angela Seymour-Jackson, managing director of workplace solutions at Aegon UK, said: “Unlike older workers, young employees have decades in which they can plan, save, invest, and adjust course as necessary.

”They just need the opportunity and know-how to get started down the right path. Young employees are asking for help from employers, the government and our industry.

”They’re looking for financial information that is straightforward and user-friendly, flexible financial products that meet modern lifestyles, more generous tax breaks on long-term savings and retirement plans, and more benefits from employers who are engaged in retirement initiatives.”