All articles by Rebecca Patton – Page 7

-

Article

Tax legislation for share plans set out

The government has published draft tax legislation around share schemes, which will be included in the Finance Bill 2013.This includes measures announced in, and following, the March 2012 Budget and the Autumn Statement announced in December 2012. It is open for technical consultation until 6 February 2013.The measures include:Changes to ...

-

Article

Ernst and Young named inclusive employer

Ernst and Young has been named one of the UK’s most admired employers for its approach to diversity and inclusiveness, according to a report by the Chartered Institute of Personnel and Development (CIPD) and Bernard Hodes.Respondents to the Diversity and inclusion – fringe or fundamental? report also named BT, Barclays, ...

-

Article

Friends Life enhances critical illness product

Friends Life has enhanced its group critical illness offering with improved product terms, greater flexibility for members of flexible benefits schemes, and access to the Best Doctors’ service.The insurance provider has also added cardiac arrest to its standard cover, along with enhanced definitions for cancer, major organ transplant, multiple sclerosis, ...

-

Article

Santander launches support for carers

Santander has launched a support scheme for employees with caring responsibilities outside of work.The scheme will provide employees with access to practical support through an online portal, which includes guides, training programmes and a variety of consultancy services.It will be provided through the bank’s membership of Employers for Carers, an ...

-

Article

The Co-operative Group enhances carer policy

The Co-operative Group has launched an enhanced people policy to support employees who are unpaid adult carers.Research into its workforce found that one in 10 of the group’s 100,000 employees are caring for a family member or friend because of illness, frailty or disability.The policy consolidates a range of flexible ...

-

Article

New PQM brand for multi-employer pensions

The Pension Quality Mark (PQM) is to launch a brand for multi-employer pension schemes in January 2013.The PQM Ready brand is aimed at enabling employers to identify multi-employer schemes that have good governance, good member communications and low charges.Employers that use a PQM Ready multi-employer scheme will be able to ...

-

Article

Towers Watson to acquire Oxford Investment Partners

Towers Watson is to acquire Oxford Investment Partners to expand its investment capabilities and strengthen its leadership position in the fiduciary management market.The deal is for an undisclosed sum and subject to regulatory approval. Oxford Investment Partners (OXIP) will become part of Towers Watson’s investment business through the transfer of ...

-

Opinion

Debbie Harrison: Changes to DC auto-enrolment schemes in 2013

The new year will witness a sea-change in the distribution of defined contribution (DC) auto-enrolment pension schemes. The government, backed by the Labour party, will introduce a cap (probably 1%) on member charges for all auto-enrolment schemes, driving medium-sized employers to go directly to a multi-employer trust-based scheme with low ...

-

Article

Employers given extension before RTI penalities begin

HM Revenue and Customs (HMRC) will not charge employers a penalty for late or inaccurate in-year full payment submissions until April 2014 as part of real-time information (RTI) reporting.The current penalty policy process will continue to apply at the tax year’s end, with a penalty being charged if the relevant ...

-

Article

Origen launches pensions product for SMEs

Origen Financial Services has launched a restricted advice pensions and benefits product for small to medium-sized enterprises (SMEs).Origen Workplace Solutions offers a package of modules on pension, risk, benefits, governance, advice and education. It also provides a core auto-enrolment pension product, provided by Aegon, a range of risk benefits at ...

-

Article

Staff engagement important in investor choice

Investors should look at an organisation’s employee engagement activity when considering its investment value, according to the Local Authority Pension Fund Forum (LAPFF).Its People and investment value guide encourages pension fund trustees and asset managers to consider the employee value proposition a business uses to engage staff beyond monetary rewards ...

-

Article

The cost of Christmas

Something for the weekend…The annual Christmas party is always a high point for employees, and there are few who have not had the pleasure of working the day after with a festive hangover.But could this jolly holiday fun be leading to an extra cost for employers and the economy?According to ...

-

Article

Employers not communicating auto-enrolment

Only 4% of respondents who do not currently have a pension have had their employer discuss auto-enrolment with them, according to research by Canada Life.Its research, which surveyed 1,635 UK workers, found that 96% of respondents who do not already have a pension have not had the change discussed with ...

-

Article

Nomura outsources health function

EXCLUSIVE: Nomura has outsourced its corporate health function to consolidate its healthcare benefits under one provider.The investment bank offers its UK employees access to an on-site GP, nurse, physiotherapist, osteopath and occupational health programme, as well as off-site health screening.Previously, the services were handled in-house and through a number of ...

-

Article

ABI calls for simplified executive remuneration

Organisations should simplify executive remuneration structures to incorporate one annual bonus and one long-term incentive plan, according to the Association of British Insurers (ABI).The ABI has published its updated Principles of remuneration 2012,which call for remuneration committees to strip away complexity and make executive remuneration more transparent.The guidelines also recommend ...

-

Article

Tax relief overhaul could encourage saving

The pensions tax relief provided by the Treasury has largely failed to encourage people to save for retirement, according to a report by Michael Johnson, pensions analyst at the Centre for Policy Studies.The report, Costly and ineffective: why pensions tax relief should be reformed, found relief on income tax and ...

-

Article

MPs push for action on expenses schemes

Five members of Parliament (MPs) have introduced an Early Day Motion calling on the government to take action on tax avoidance through travel and subsistence expenses schemes.According to the motion, the schemes are often used by temporary labour providers and involve the employer ‘artificially’ classifying part of a worker’s pay ...

-

Article

Women face lifetime pay gap

And the gap could begin when a woman graduates, according to separate research by the University of Warwick.The CMI 2012 National management salary survey, published in November, found the average male executive earned a basic salary of £40,325 over the last 12 months to August 2012, while a female executive ...

-

Analysis

AnalysisStep-by-step guide to auto-enrolment compliance

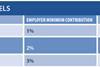

IF YOU READ NOTHING ELSE, READ THIS…Employers should identify their staging date as soon as possible.A project team should be appointed to manage systems and processes.Any systems developed or redesigned for auto-enrolment purposes should be future-proofed.Auto-enrolment communications must be clear and easy to understand.1. STAGING DATEEmployers must first ascertain their ...

-

Analysis

AnalysisKnow the facts on auto-enrolment

There are key facts that all employers planning for auto-enrolment should know. Gillian McNamara, policy lead, employer compliance regime at The Pensions Regulator (TPR), says: “There is one crucial figure to know even before developing a plan to comply with the new duties, and that is the number of people ...