Need to know:

- Workplaces are becoming increasingly multi-generational.

- But this does not necessarily mean employee benefits should also become increasingly segmented and generation-specific.

- The answer is likely to lie more in segmentation and targeting of benefits communications than employee benefits themselves.

Many workplaces are becoming ever more age-diverse as the working population ages, and employers face five generations working side by side as generation Z now joins the workforce. But is this generational melting pot changing people’s priorities around electing and choosing benefits?

Against such a challenging and evolving demographic backdrop, how can benefits professionals create a strategy that is appropriate, and attractive, to five very different generations of employee, and should they even try? And where does this leave big-ticket benefits such as pensions and healthcare?

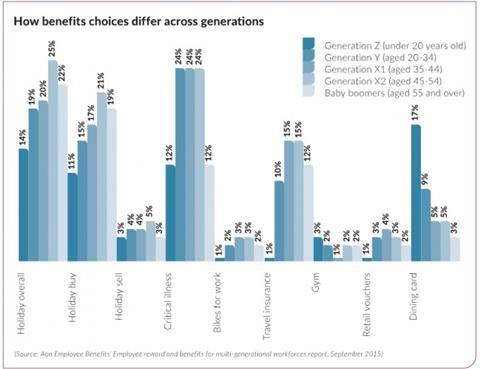

Martha How, reward partner at Aon Employee Benefits, led the study Employee reward and benefits for multi-generation workforces published in September 2015, which argued that traditional generational assumptions around benefits, for example, that older people will generally be more interested in and engaged with pensions and health-related benefits than younger employees, was often far too simplistic. In fact, the psychological forces that drive the choices people make around benefits are often nuanced and complex.

“We wanted to look at segmented employee choices through their flex platforms to see if there were any trends between the generations in terms of what they chose," How explains. “It was slightly complicated by the fact employers will often offer different levels of funding for different benefits, which can affect take-up. So we only looked at 100%-funded benefits, in this case holiday buying or selling, travel insurance, retail vouchers and critical illness. To my surprise, we did not see massive generational differences. We were expecting some sort of speculative news piece about generational segmentation, but what this told us instead was that people just relish choice.”

Communication is key

The answer to the challenge, or perhaps more accurately one answer, is not benefits at all, but benefits communications, says James Malia, managing director at P&MM Employee Benefits. “The key thing is how [an employer] communicates with the different demographics, and then simply to have as broad an offer as possible,” he says. “It is always going to be the case that some employees are interested in pensions and others are not. But if [the employer] can offer a broad spectrum of benefits, whether it’s gadgets, childcare vouchers, or extra holiday, wellbeing, education, cars, whatever it is, then [it is] going to be able to give people the opportunity to be interested in different things.”

Aon’s How adds. “I think the conclusion we have to draw is [employers] really need to offer everybody everything because it is dangerous to make assumptions about younger or older workers. But also recognise there are clear communications preferences between the generations.”

Younger employees are more amenable to SMS, Facebook and instant communication, says How. The older demographics, by and large, tend to prefer a benefits booklet, even if it is sent to them by email. “It is about offering everything to everyone, having a really good suite of products, but then segmenting communications,” she adds.

Comprehensive financial education

Alongside communication, richer financial education is going to be another key, says Mark Carman, director of communication services at Edenred. “It is about having benefits that appeal to all generations, but also ones that specifically appeal to younger-, middle- and older-age employees. And then it is just about better communications and education generally.”

Financial education can be implemented from the day an employee joins an organisation to the day they leave. It can help educate staff about how to make the money they have go that little bit further. “But, of course, the challenge for organisations here is that could be seen as a tacit admission on their part that they are not paying people enough money,” says Carman.

In an environment where working lives for all generations are becoming ever-more fluid, employers are going to need to completely rethink rigid conventional employee benefits models, including focusing more on ‘anytime’ benefits structures, says John Ritchie, chief executive at online group risk insurer Ellipse. “Even flex platforms, as they stand, are strangely inflexible,” he says. “[Employees] get a window opening once a year, generally at a time of year, three weeks in December [for example], when everyone is busy with other things. At that point, [they] can increase or decrease [their] cover, but it all still looks like the fixed benefits era.

“What we need is deep financial education so that people can start to make proper decisions for themselves. I think the future has got to be comprehensive financial education for all generations, and then the sort of open platform that is a fundamental part of an anytime benefits structure.”

SAS offers benefits to reflect lifestyle, not generation

With some 700 employees in the UK, software organisation SAS already has a five-generation workforce.

Chris Carter, head of reward, says: “The multi-generational issue is really coming to life now. It is becoming more and more relevant as we talk about how we look at, design and use benefits.

“SAS is quite paternalistic still and we offer a core set of benefits. But we are very conscious about needing to offer people opportunities that will allow them to retire at the earliest possible stage.”

For example, the organisation has deliberately kept employee contributions to its pension scheme as low as possible, both to make it attractive generally and a more compelling 'sell' for younger employees.

“Particularly for younger people we know they’re going to be coming into work with debt, so we don’t want to discourage them from joining the scheme," says Carter. “But, at the same time, we want to get them used to the idea of having to make an employee contribution.”

The organisation has also ensured there is built-in flexibility to many of its benefits. For example, life assurance is set at a standard four times salary, but employees can trade up to 10 times or down to two times. Income protection, too, is set at a minimum level but cover can be increased.

“While [we] can generalise about generations, it is more really about lifestyles," says Carter. "So, if [an employee is] in their 50s but single and without dependants, say, [they] are maybe not going to be that interested in even four times life assurance [cover].”

On top of this, a wide-ranging platform encompasses core and voluntary benefits such as private medical insurance, critical illness, travel insurance, bikes for work, holiday trading, gadgets, and salary sacrifice cars.

Carter believes it is important to continually communicate with employees in any way possible, which could include surveying staff about which benefits they want, or holding focus groups. This will then reveal what benefits they want and what they will value.

Viewpoint: Employers need to consider pick and mix reward strategies

Unless employers reconsider their workforce planning in the light of population ageing, they will face substantial personnel and skills shortages in future years. There are 9.2 million workers in the UK over the age of 50, many of whom will leave work permanently over the next 15 years, taking their acquired skills and experiences with them.

In the agriculture and real estate sectors over 40% of workers are aged over 50 but the overall number of people over 50 is small compared with other sectors, according to the Chartered Institute of Personnel and Development and International Longevity Centre UK’s Avoiding the demographic crunch: labour supply and the ageing workforce report, June 2015. There are over 1.5m workers over the age of 50 in health and social work and more than 1.2m over 50 in education and retail. There are also more than 1m in manufacturing and over 700,000 in the construction industry.

Yet many industries have a poor record on retaining older workers, seeing a large drop-off in the number of workers between the ages of 45-49 and 60-64. In particular, finance, public administration and ICT all see a drop of greater than 60% between the number of workers they employ in their late 40s and in their late 60s.If employers are to deliver a skilled workforce in an ageing society, they must do more to ensure that the retention of older workers is at the heart of any HR strategy. Employers need to start planning for the long term, ensure that recruitment is inclusive and not discriminatory, and better support line managers to deal with an ageing workforce.Many older people will not stay in the workforce for financial reward alone. Employers must look to reward that empowers and engages the older worker rather than a strategy that relies primarily on financial reward. Flexible working is likely to need be a key part of the offer for older workers. And employers will have to look at how reward can ensure that older workers are not forced out of work due to a need to care for a combination of parents and grandchildren.If we want a healthy older workforce, reward must better support employee health and wellbeing.Older workers are likely to want different reward to younger colleagues. In an ageing society where employers may be supporting people aged 16 and aged 70, the reward package of the future might need to be more of a pick-and-mix offer than a one size fits all.David Sinclair is director at the International Longevity Centre UK (ILC-UK)