All Pensions articles – Page 143

-

Article

GeoPost UK prepares for auto-enrolment

EXCLUSIVE: GeoPost UK is encouraging employees to join its group personal pension (GPP) ahead of its auto-enrolment staging date of 1 August 2013.Under the banner ‘Last Chance Saloon’, the logistics organisation invited all employees who were not members of the pension scheme to join the GPP, which matches employee contributions ...

-

Article

Buy-out completed on Imperial Home Decor DC pension

Imperial Home Decor has completed an enhanced buy-out of the defined contribution (DC) section of its pension scheme.The scheme has been in wind up since October 2003 when the organisation was declared insolvent.The deal that has been secured will see almost 140 DC members benefit from an enhanced annuity deal ...

-

Article

NAPF calls for more support for prospective retirees

Prospective employees are not getting enough support with choosing an annuity, according to the National Association of Pension Funds (NAPF).The Supporting savers at retirment report, which looked into employer advice and the brokerage market used by employers in the private sector with staff in defined contribution (DC)pension schemes, highlighted a ...

-

Article

PPF compensation cap level to be increased

Pension scheme members whose employers go bust before reaching their scheme’s normal pension age will receive some relief after the pensions minister unveiled new rules on compensation paid by the the Pension Protection Fund (PPF).Steve Webb has announced his intention to increase the compensation cap for longer-serving members by 3% ...

-

Video

Debbie Harrison: Size of charges have huge impact on pensions

Debbie Harrison, senior visiting fellow at the Pensions Institute talks to Debi O’Donovan, editor of Employee Benefits, about the impact of higher charges on the eventual pension an employee will receive in retirement.“Value is much more difficult. This is where employers and their advisers really need to look at what ...

-

Article

DC pension schemes offering wider investment choices

Defined contribution (DC) pension scheme investors are now being offered a wider choice of funds, according to research by the Pensions Regulator (TPR).Its Scheme governance survey 2013 found that:The proportion of schemes offering just one investment fund has fallen from 32% in 2009 to 18% in 2012.In the past year, ...

-

Article

Government to set out plans for collective DC pensions

The government’s report on defined ambition pensions, which is expected this summer, will set out plans to introduce collective defined contribution (DC) pension schemes in the UK.The Department for Work and Pensions (DWP) has confirmed that pensions minister Steve Webb (pictured) has met with large employers that have expressed an ...

-

Video

VIDEO: Jonathan Lipkin: Take DC governance seriously

Governance in defined contribution (DC) pension schemes is going to move to the top of employers’ agendas as auto-enrolment accelerates, said Jonathan Lipkin, director of public policy at the Investment Management Association (IMA), during an interview with Debbie Lovewell, deputy editor at Employee Benefits at the Employee Benefits Pensions and ...

-

Article

Lack of understanding leads to lack of pensions saving

Half (50%) of respondents believe the main reason people do not save in pension schemes is because they do not know what retirement income their pension will give them, according to research by pensions and benefits consultancy Hymans Robertson.The research, which surveyed 101 UK employers, also found that:90% of respondents ...

-

Article

Lloyds TSB pension scheme sells securities portfolio

Lloyds TSB’s Group Pension Scheme No.1 has sold its share of a portfolio of re-securitised US residential mortgage-backed securites for £1.16 billion.The defined benefit (DB) pension scheme’s trustees were advised by law firm Sackers in the disposal of the portfolio. Law firm Slaughter and May worked alongside Sackers, advising the ...

-

Article

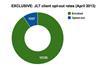

ArticleJLT sees 9.3% average auto-enrolment opt out

EXCLUSIVE: JLT Employee Benefits has recorded a 9.3% auto-enroloment opt-out rate among its employer clients.The employee benefits adviser used BenPal, its benefits management platform, to help 50 large employers auto-enrol their employees.The organisation assessed 287,712 candidates, enrolled 11,162 employees and saw 1,037 employees opt out of their employer’s auto-enrolment pension ...

-

Article

Ladbrokes pension awarded PQM

Ladbrokes has been awarded a Pension Quality Mark (PQM) for its stakeholder defined contribution (DC) pension scheme.The benchmark, awarded by the National Association of Pension Funds (NAPF), is given to employers that provide good quality defined contribution (DC) pension schemes to their staff. It recognises DC schemes that have total ...

-

Analysis

AnalysisKey issues for employers post auto-enrolment staging

IF YOU READ NOTHING ELSE, READ THIS…Post auto-enrolment staging date, employers must keep on top of a number of tasks to remain compliant.Having robust record-keeping and data processes in place is key.Employers must ensure they send relevant communications to their workforce at the required times.Preparing for auto-enrolment may feel like ...

-

Opinion

Pádraig Floyd: A pension warning for employers on 'pot follows member'

The Department for Work and Pensions (DWP) has now published details of rules to govern what must happen to an employee’s pension when they leave an employer. This regulation, generally referred to as ‘pot follows member’, makes provision for any pension pots of less than £10,000 to transfer with the ...

-

Article

Origen Investment Services to sell pensions admin businesses

Origen Investment Services is to sell its pensions administration businesses.Its specialist self-administered pensions service business is to be sold to consultancy Barnett Waddingham, while its self-invested personal pension (Sipp) business is to be transferred to Sipp provider and administrator Suffolk Life.Origen Investment Services made the decision to exit from the ...

-

Article

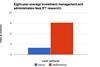

ArticleDisparities in local council pension fund fees

There are disparities in the fees that local council pension funds pay to their fund managers, according to research by the Financial Times (FT).The newspaper’s analysis of pension funds’ annual reports, which was conducted for the FT by consultancy Investor Data Services, revealed that some councils were paying three ...

-

Opinion

Gary Moore: Consultancy charge ban will cause problems

When the Financial Services Authority (FSA) launched its retail distribution review in 2006, it promised to make sure charges for advice were transparent and fair. As a result, the FSA banned charging by commission but allowed pension plans to take consultancy charges from individuals’ pension pots as long as they ...

-

Article

Debbie Lovewell: Transparency reveals concern over advice

Last month’s announcement that consultancy charging is to be banned for auto-enrolment schemes is good news for staff who, under this remuneration structure, could have seen high charges deducted from their pension pot.Along with the ban on commission for new schemes brought in by the retail distribution review, pension minister ...

-

Analysis

AnalysisHow transparent are benefits charging structures?

IF YOU READ NOTHING ELSE, READ THIS…Historically, commission-based and consultancy charges in the pensions market led to a lack of transparency in what employers were paying for.Now that both have been banned, with the exception of legacy commission schemes, the pensions market has moved towards a more transparent fees-based model.Adviser ...

-

Article

Concerns over consultancy charge ban

Consultancy charging, introduced under the retail distribution review, which came into effect at the end of last year, enabled employers to pay an adviser for some of its pensions management work out of the employee’s or employer’s contributions to a member’s fund.Jon Dixon, head of Chase de Vere’s auto-enrolment proposition, ...