All Pensions articles – Page 115

-

Article

ArticlePension schemes fall behind with DC governance requirements

Pension schemes are behind with their work on defined contribution (DC) governance requirements, according to research by pensions law firm Sackers. Its survey, which was conducted among trustees and pension professionals, found that more than two-thirds (69%) of pension schemes have not carried out a value-for-money assessment, a new standard ...

-

Article

ArticleDOD’s blog: The holiday pay debacle

Unless you have been hiding under a rock this week, you will be fully aware that on 4 November the Employment Appeal’s Tribunal (EAT) has made a hugely significant ruling about how holiday pay is calculated.Every law firm in the country, along with several unions, were quick to issue email ...

-

Article

ArticleLicensed Trade Charity boosts pension take up

Nick Funnell, head of LVS Ascot Junior School, with studentsThe Licensed Trade Charity has seen take up increase in its pension schemes following auto enrolment.The organisation offers three schemes. Firstly, a money purchase defined contribution (DC) scheme, provided by Legal and General, which was introduced for auto enrolment. It has ...

-

Article

ArticleUK universities strike over pensions dispute

Employees at a number of UK universities including Oxford and Cambridge have gone on strike in a long-running pensions dispute.Employees are in dispute over proposed changes to the Universities Superannuation Scheme, which could see the existing defined benefit (DB) pension scheme axed and around 150,000 active scheme members moved to ...

-

Article

ArticlePension reforms drive staff need for guidance

More employees will want and need guidance around their pension decisions both at retirement and throughout their career as a result of the government’s pension reforms.Just under half (48%) of respondents felt that this would be the case at retirement, while 43% said staff would require guidance throughout their career, ...

-

Article

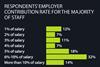

ArticleGPPs remain employers' most popular pension scheme

Group personal pension (GPPs) plans remain the most commonly offered type of scheme by employers.More than three-quarters (78%) of respondents now offer a GPP as their primary pension scheme, according to the Employee Benefits/Close Brothers Pensions research 2014, which surveyed 216 respondents in September 2014.Although the numbers have fluctuated over ...

-

Article

Buyer's guide to group personal pensions

Under a group personal pension (GPP), an employer agrees to make monthly contributions into the scheme, but the contract is between the employee and the pension provider. Currently, a GPP ends when the member retires and buys an annuity with the proceeds, so there is no obligation on the employer ...

-

Article

ArticlePension scheme membership lowest among 16 to 21 year olds

Employee membership of a workplace pension is at its lowest at the beginning of an employees’ working life, according to research by the Office for National Statistics.Its Pension scheme membership report found that among employees aged 16 to 21, around 10% of both men and women belonged to their employer’s ...

-

Article

ArticleThe Pensions Regulator issues first auto-enrolment fines

The Pensions Regulator (TPR) has issued its first fines to employers for failing to meet auto-enrolment duties.It has issued three fixed penalty notices were issued, each levying fines of £400 on employers, according to the TPR’s latest automatic-enrolment Compliance and enforcement bulletin.TPR has not revealed details of the nature of ...

-

Article

ArticleMG Rover Group reaches £8m pension settlement

MG Rover Group has reached an £8 million pension settlement with The Pensions Regulator (TPR) following an investigation into its senior pension scheme.More than 100 former employees, who were members of the scheme, will now receive a cash bonus almost ten years after the car manufacturer collapsed in April 2005.In ...

-

Article

ArticleNine out of 10 small employers want auto-enrolment delay

Nine out of 10 small employers that have not reached their pensions auto-enrolment staging date yet want the process to be delayed until the new raft of pension reforms are complete, according to research by the Association of Consulting Actuaries (ACA).The ACA 2014 Smaller firms’ pension survey, which surveyed 414 ...

-

Article

Article47% of auto-enrolment probes result in breaches

The number of investigations into auto-enrolment compliance by The Pensions Regulator (TPR) that result in potential and actual breaches has more than doubled this year, according to a Freedom of Information request by Creative Auto Enrolment.The request by the auto-enrolment services organisation found that investigations resulting in potential or actual ...

-

Article

Article62% of staged employers positive about pensions auto-enrolment

Nearly two-thirds (62%) of staged employers feel positive about auto enrolment, and the impact it will have on their business, according to research by Close Brothers Asset Management.Its Business barometer survey, which surveyed more than 900 UK employers, also found that the majority of employers which have staged for auto-enrolment ...

-

Article

ArticleWarburtons increases staff pension contributions

Warburtons has seen more than 376 pension scheme members of staff increase contributions in the last year following the introduction of its three-year engagement plan.The family-owned baking organisation also reduced its auto-enrolment opt-out rates to 1%, down from 2.6% in October 2013.Speaking at the annual National Association of Pension Funds ...

-

Article

ArticleOfcom enters into fifth pension buy-in

Ofcom has continued to manage its defined benefit (DB) pension scheme deficit with a buy-in contract to help de-risk its scheme liabilities.The buy-in arrangement with Legal and General, which is the fifth contract between the insurer and the communications regulator, covers a further £50 million of Ofcom’s (Former ITC) staff ...

-

Article

ArticleNAPF and PMI to discuss merger

The National Association of Pension Funds (NAPF) and The Pensions Management Institute (PMI) have announced their formal intention to discuss the possibility of merging the two organisations.The possibility of a merger will be discussed over the next six to nine months, after which both organisations will update their members and ...

-

Article

Article23% saving the most they can afford for retirement

Less than a quarter (23%) of respondents are saving the most they can afford into a pension, according to research by Friends Life. Its UK Retirement savings map, which surveyed 18,000 UK adults, benchmarked how active respondents are in saving into a pension. The North East, Scotland and the North ...

-

Article

ArticleMost talked-about news in September

The government has confirmed its intention to remove the annual contribution limit and transfer restrictions on the National Employment Savings Trust (Nest). The restrictions on annual contributions, which currently stand at a maximum of £4,600, and bulk transfers will be lifted on 1 April 2017.?We fully welcome proposals to remove ...

-

Article

ArticleGovernment confirms action to cap pension charges at 0.75%

The government has confirmed it will continue to press ahead with action to cap pension scheme charges at 0.75% from April 2015.Its draft regulation paper Better workplace pensions putting savers’ interests first has confirmed charges to invest and manage the default funds of all qualifying schemes will be capped at ...

-

Article

Article200,000 staff plan to cash in retirement savings

More than 200,000 employees plan to cash in all their retirement savings next year when new pension reforms giving greater flexibilities come into effect, according to research by Hargreaves Lansdown.The research, which surveyed more than 1,247 people, found that more than one in 10 (12%) respondents with a defined contribution ...