News – Page 9

-

Article

ArticleQ Care launches car pool scheme

EXCLUSIVE: Q Care has launched a car pool scheme for its 600 employees. The domiciliary care organisation is offering staff a contract hire agreement with provider Lex Autolease, leasing 28 cars with plans to extend this to 100.Its previous travel arrangement meant employees had to use personal cars for business ...

-

Article

Article89% of fleet drivers have faked mileage claims

Nine out of 10 (89%) respondents have submitted an inaccurate mileage claim to their employer, according to research by car hire organisation Flexed.co.uk.Its research, which surveyed 1,200 company car drivers, found that 63% of respondents had added personal miles to their work driving total for personal gain.The research also found:20% ...

-

Article

Capital One awarded best staff travel policy

Capital One won the award for Best staff travel policy at the Employee Benefits Awards 2014.Read why the organisation won the award.The Employee Benefits Awards 2014 were held on 27 June 2014 at the Artillery Garden at the HAC London.

-

Article

ArticleGuide Dogs Association launches salary sacrifice cars

The Guide Dogs for the Blind Association has launched a salary sacrifice car scheme for 1,200 eligible employees.The UK-wide charity has signed a four-year contract with Leasedrive, which will supply its Mycar scheme to the organisation.As a registered charity, Guide Dogs is also able to make use of the benefits ...

-

Article

ArticleHMRC loses company car tax case

Six companies in the Newell and Wright group, including Apollo Fuels, provided cars to managers and salesmen under an arrangement whereby it leased the cars to the workforce in an ’arm’s length’ hire rental.Employees were paid for business mileage at the same rate as colleagues who used their own cars ...

-

Article

ArticleKFC launches salary sacrifice car scheme

EXCLUSIVE: KFC has launched a salary sacrifice car scheme for more than 950 eligible employees.The restaurant chain has included an emissions cap at 130g/km to help improve the organisation’s green credentials and help employees to make tax savings.The current lowest tax band, of 5%, is applied to all cars emitting ...

-

Article

Rugby union shortlisted for best travel policy

Capital One and The Rugby Football Union are among the employers that have been shortlisted for the award ‘Best staff travel policy’ at the Employee Benefits Awards 2014.For this award, the judges were looking for a successful strategy that has made company cars and travel benefits effective in an organisation.The ...

-

Article

ArticleOnly 16% of employees would consider an electric company car

Only 16% of respondents would consider an electric car as their next company car, according to research by the Leasedrive Group.Its research, which surveyed 534 employee drivers, found that 51% of respondents would not consider an electric car, while 33% were unsure.More than a third (35%) of respondents cited a ...

-

Article

ArticleCompany car tax rates to increase from 2017

Budget 2014: The government has increased the company car tax rates by two percentage points.In tax year 2017-18 and 2018-19 the appropriate percentage of list price, subject to tax, will increase by two percentage points (to a maximum of 37%) for cars emitting more than 75g of carbon dioxide per ...

-

Article

ArticleFuel duty to be frozen until 2015

Budget 2014: The government has confirmed fuel duty will remain frozen until spring 2015.Chancellor George Osbourne cancelled the fuel duty increase planned for September in his 2014 Budget. This was previously announced in the Autumn Statement.It means employees with company cars will save £11 every time they fill up their ...

-

Article

ArticleHay Group reviews benefits to fund auto-enrolment

EXCLUSIVE: Hay Group has undertaken a full review of its employee benefits to help fund the cost of auto-enrolment.The global management consultancy, which has around 350 employees, reached its auto-enrolment staging date on 1 February 2014.Charlotte Koch (pictured), head of HR at Hay Group, said: “Auto-enrolment allowed us to take ...

-

Article

ArticleSalary sacrifice cars to see big growth in flex

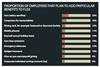

Some 22% of respondents plan to add this perk to flex, while 10% of employers plan to add low-emission cars to their plans.Some 18% of employers currently offer salary sacrifice cars and 11% of employers currently offer low-emission cars through their flex plans. Dining cards, such as Tastecard and Gourmet ...

-

Article

RSA staff take up salary sacrifice car scheme

EXCLUSIVE: RSA has seen 1.5% of its employees take up its car salary sacrifice scheme, meaning it is halfway towards its first-year target of 3%.The insurance organisation launched the scheme for its 7,500 eligible employees in September 2013 and has currently seen more than 110 employees take up the benefit.The ...

-

Article

ArticleBenefit-in-kind tax most influential for company car choice

More than a third (39%) of respondents cited benefit-in-kind tax as the most influential factor when selecting a company car, according to research by ALD Automotive.Its research, which surveyed 1,000 fleet drivers, found that 25% of respondents chose car specification and 17% chose fuel economy as the most influential factors.Benefit-in-kind ...

-

Article

Article39% of benefits professionals receive car or allowance

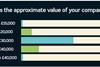

The Employee Benefits Salary survey 2014 , which questioned 361 people responsible for managing benefits and reward in UK organisations, found that, of this 39%, more than one-third (38%) receive a company car rather than a car allowance.The average approximate value of company cars for 62% of respondents in ...

-

Article

Leasedrive Group partially acquired by HgCapital

Leasedrive Group has been 80% acquired by private equity investor, HgCapital.The fleet group’s management team has rolled 20% of their own investment and equity into the new financial structure.David Bird, managing director of Leasedrive Group, said: “This new investment, which sees the senior management team retain equity and shareholding, demonstrates ...

-

Article

OTS publishes details of benefits tax quick wins

The Office for Tax Simplification (OTS) has published the details of its nine ‘quick wins’, which aim to simplify the tax efficiencies on employee benefits and expenses.The ‘quick wins’, which will come in from January 2014, were identified in the OTS’ interim report on employee benefits and expenses in August ...

-

Article

Fuel duty increase cancelled

Autumn Statement 2013: The government is to cancel the fuel duty increase which was planned for 1 September 2014.The rise was expected to be 1.61 pence per litre but the cancellation means the price of fuel will be frozen until 2015.It is the second time the government has scrapped a ...

-

Article

HMRC changes company car advisory fuel rates

HM Revenue and Customs (HMRC) has announced a change to its company car advisory fuel rates.The changes, which relates to some petroleum, diesel and low petroleum gas (LPG) cars, include reductions of 1p per mile in the rate paid to drivers using diesel, and 2p per per mile for employees ...

-

Article

Leicester City Council launches salary sacrifice cars

Leicester City Council has launched a salary sacrifice car scheme for 13,600 eligible employees.The scheme, which is operated by Tusker, includes motor insurance, servicing and maintenance, roadside assistance, tyres and glass, plus protection against redundancy, resignation and maternity leave.Leicester City Council already provides employees with salary sacrifice arrangements on a ...