News – Page 79

-

Article

Standard Life moves wealth division into investments

Standard Life Wealth is to move within the Standard Life group to its global fund manager Standard Life Investments with effect from 1 January 2014.Richard Charnock, chief executive officer of Standard Life Wealth, who will report to Keith Skeoch, chief executive officer of Standard Life Investments, will be appointed to ...

-

Article

TPR DC code comes into effect

The Pensions Regulator has published its regulatory guidance for defined contribution (DC) pension schemes to sit alongside its DC code, which came into effect on 21 November.The code, which was consulted upon earlier in 2013, sets out practical guidance on how pension trustees can meet the underlying requirements of pensions ...

-

Article

Aberdeen confirms acquisition of Scottish Widows’ investment business

Aberdeen Asset Management has confirmed that it is to acquire Scottish Widows Investment Partnership (SWIP), as well as its private equity and infrastructure fund management businesses.The acquisition, which was first proposed in October, includes a long-term strategic relationship with SWIP’s parent company, Lloyds Banking Group.The consideration for the acquisition of ...

-

Article

Pension comparison service launched

Pension PlayPen has launched an online service to help UK employers choose a workplace pension.The service, Cap (choose a pension), gives employers direct access to all major providers of contract- and trust-based pension schemes.The free service allows employers to access quotes, compare offerings and decide on the workplace pension that ...

-

Article

Pension funds are unaccountable to savers

Pension funds are unaccountable to the savers whose money they invest, according to a report by ShareAction, the public campaign for the ethical investment of UK pension funds. Its Our money, our business report found that, although company directors are increasingly expected to be accountable to their shareholders, shareholders themselves, ...

-

Article

Barclays C&ES launches DC investment consultancy

Barclays Corporate and Employer Solutions (C&ES) has launched a defined contribution (DC) investment consultancy for employers and pension trustees. The consultancy forms part of the organisation’s pensions platform, which was launched in September with Aegon and Zurich.Its aim is to improve the investment outcomes and structure for employees, provide a ...

-

Article

Three raises pensions take up to 80%

EXCLUSIVE: Three has increased its pension scheme take up from 68% of staff to 80% following auto-enrolment.The mobile phone organisation auto-enrolled 702 eligible employees on 1 October after it had postponed from 1 July to align the process with its flexible benefits enrolment window.Seth Russell, director of reward at Three, ...

-

Article

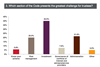

ArticleGuaranteed pensions would see higher staff take up

Six out of 10 respondents said there would be a significant difference in the number of employees who would consider joining, or staying in, a defined contribution (DC) pension scheme or who would pay higher contributions if the qualifying default fund secured a guaranteed pension income building up year on ...

-

Article

Article25% of pensions not compliant with DC code of practice

A quarter (25%) of pension trustees surveyed believe their scheme is not at all compliant with The Pension Regulator’s (TPR) new code of practice for trust-based defined contribution (DC) pensions, according to research by law firm Sackers.Its research, which surveyed 44 pension trustees at the 2013 National Association of Pension ...

-

Article

Government consults on defined ambition pensions

The government has published a consultation into its defined ambition pension scheme.The Department for Work and Pensions (DWP) introduced its proposals for a defined ambition pension in November 2012 in its paper, Reinvigorating workplace pensions.The defined ambition pension is designed to reshape workplace pensions for future generations, create more certainty ...

-

Article

Aon Hewitt launches guide to DC pensions

Aon Hewitt has launched a guide to defined contribution (DC) pension schemes.Achieving better member outcomes – a practical guide to DC pensions provides an overview to employers and trustees of all aspects of DC pensions.The guide covers:Understanding the plan and setting priorities.Improving savings rates.Investment strategies.Designing the default option.Making the right ...

-

Article

DWP launches consultation on money purchase pensions

The Department for Work and Pensions (DWP) has launched a consultation on money purchase pension schemes.The consultation, which is open to pension industry bodies, trustees or scheme managers, pension scheme members and employers, seeks to clarify the definition of money purchase included in section 29 of the Pensions Act 2011.The ...

-

Article

Standard Life Investments to launch new default fund

Standard Life Investments is to launch a new default fund for defined contribution (DC) pension scheme members.The Enhanced-Diversification Growth Fund (EDGF) is a lower volatility diversified growth fund, which is designed to generate equity-like returns with lower volatility than investing in equity markets.The fund, which will be launched in the ...

-

Article

Lloyd’s Superannuation Fund insures DB pension

The Lloyd’s Superannuation Fund (LSF) has concluded a pension insurance buyout for its defined benefit (DB) pension scheme.The transaction, in conjunction with provider Pension Insurance Corporation, covers £40 million of pension liabilities.The LSF is a multi-employer pension scheme that was established in 1929.Its members are employees and former employees of ...

-

Article

FTSE 350 pension deficit decreases

The pension deficits of the FTSE 350 reduced from £115 billion at 31 July 2012 to £58 billion at 31 July 2013, while aggregate market caps increased from £1,800 billion to £2,100 billion over the same period, according to research by Hymans Robertson.Its annual FTSE 350 pensions analysis report found ...

-

Article

Lorica adds master trust to auto-enrolment product

EXCLUSIVE: Lorica Employee Benefits has partnered Now: Pensions to add a master trust to its integrated auto-enrolment and pensions product, Littleblue.Littleblue, which also includes a group personal pension (GPP) plan, is designed to suit employers with between five and 250 employees, but can be used by both larger and smaller ...

-

Article

Pension Protection Fund reports £1.8bn surplus

The Pension Protection Fund (PPF) has reported a surplus of £1.8 billion in its 2012/13 annual report.It also stated the probability of meeting its long-term funding target by 2030 has increased to 87%, an increased from 84% at 31 March 2012.According to the PPF report, its performance owed much to ...

-

Article

Ipswich Town FC to launch master trust

Ipswich Town Football Club is to launch a master trust to comply with pensions auto-enrolment.From 1 November, Now: Pensions will provide the pension, which will be available to the football club’s 600 eligible employees, including office staff and match-day stewards.Denise Booth, management accountant at Ipswich Town Football Club, said: “We ...

-

Article

Employers should provide wider insurance benefits

The majority (92%) of respondents believe employers have a role to play in the provision of wider insurance benefits, according to research by Swiss Re.Its Insurance report 2013: Connecting generations – protecting generations found that, although two-thirds of respondents see the value of insurance, many of them find financial services ...

-

Article

NAPF launches Stewardship Disclosure Framework

The National Association of Pension Funds (NAPF) has launched a Stewardship Disclosure Framework.It aims to provide pension funds with greater transparency around the stewardship policies and activities of the 206 asset managers who are signatories of the Stewardship Code.The framework, which is based around the seven principles of the Stewardship ...