News – Page 74

-

Article

Santander streamlines pensions admin

Santander UK has streamlined its pension administration services for around 100,000 employees across its UK trust-based defined contribution (DC) and defined benefit (DB) pension schemes.The bank previously used a number of different administrators for its pension schemes, but has now appointed JLT to administer all its UK schemes.Active, deferred and ...

-

Article

ArticleEuropean court rules DC pensions could be exempt from VAT

The Court of Justice of the European Union (CJEU) has ruled that defined contribution (DC) pension schemes could be exempt from value-added tax (VAT).In case of ATP Pension Services, the CJEU has concluded that a DC pension arrangement may qualify as a special investment fund, meaning that fees for managing ...

-

Article

ArticleABI sets out changes for annuities market

The Association of British Insurers (ABI) has announced a plan to ensure people get more help to achieve better outcomes when they turn their pension savings into a retirement income.The plan, which acts on challenges set out in a report from the Financial Conduct Authority on annuities, will be implemented ...

-

Article

ArticlePension charges cap could stifle industry

A cap on pension charges could stifle the innovation and creativity needed in pensions to provide better retirement outcomes for employees.Speaking in a session titled Does cheap mean low quality? at the National Association of Pension Funds (NAPF) Investment Conference on 6 March, James Churcher, pensions manager at Abbott Laboratories, ...

-

Article

ArticleSuppliers do not give value for money for pension plans

Nearly three-quarters (71%) of delegates at the National Association of Pension Funds (NAPF) Investment Conference do not believe pension funds are getting value for money from consultants, providers and active asset managers.During a panel debate, which followed the poll, Robert Brown, chairman of the Global Investment Committee at Towers Watson, ...

-

Article

ArticleStaff retirement income not a priority for employers

Only 15% of respondents said their main reason for providing a defined contribution (DC) pension scheme is to ensure their employees save for an adequate retirement, according to research by Towers Watson.Its DC pension strategy survey, which surveyed 126 employers, found that 65% of respondents cited market competition as their ...

-

Article

ArticleGovernment publishes response to auto-enrolment consultation

The government has published its response to a consultation on exceptions to the employer duties around pensions auto-enrolment.The consultation, Technical changes to automatic-enrolment: public consultation on draft regulations and other proposed changes, which was published in March 2013, described proposals to insert a clause in the Pensions Bill to provide ...

-

Article

ArticleAdvisers believe employers are disengaged with auto-enrolment

Two-thirds (65%) of respondents believe employers are disengaged with auto-enrolment, according to research conducted by financial research organisation Defaqto on behalf by Now: Pensions.The research, which surveyed 264 independent financial advisers, found that 89% of respondents are concerned that employers lack the knowledge to make informed decisions about the appropriate ...

-

Article

Nissan UK appoints DB pension administrator

Nissan UK has appointed Capita Employee Benefits to provide pensions administration services to its defined benefit (DB) pension scheme.The services, which are part of a five-year contract, went live on 3 February 2014. Nick Burns, chief executive of Capita Employee Benefits, said: “Working with Nissan is a significant new contract ...

-

Article

10% of Bayer pension members increased contributions

EXCLUSIVE: One in 10 (10%) of Bayer’s 9,000 pension scheme members have increased their pension contributions since the organisation re-branded its pension communications in 2013.More than 800 employees are members of the pharmaceutical organisation’s trust-based defined contribution (DC) pension, while 7,000 employees are members of its defined benefit (DB) pension, ...

-

Article

ArticleGovernment to add charges disclosure to Pensions Bill

The government has tabled an amendment to the Pensions Bill to require pension providers to disclose all transaction costs in workplace defined contribution (DC) pension schemes.This extra information is aimed at enabling employers to see exactly how much they are paying for asset management services to get the best value ...

-

Article

ArticleLinks of London sees 0.8% auto-enrolment opt out

EXCLUSIVE: Links of London has seen 0.8% of its auto-enrolled employees opt out of its new group personal pension (GPP) plan since its staging date on 1 November 2013.The British jeweler, which is part of the Folli Follie Group, has 75 outlets across the UK and employs around 500 employees.It ...

-

Article

ArticleEValue enhances financial planning products

EXCLUSIVE: EValue has enhanced its suite of financial planning and forecasting products, Moneybee.The products can be used as standalone financial planning and forecasting tools, or can be integrated into a portal that employers provide for staff.The updates include:A corporate individual savings account (Isa) fund picker. This provides the ability to ...

-

Article

ArticleAverage defined contribution pension charge is 0.75%

The average annual management charge (AMC) for trust-based defined contribution (DC) pension schemes is currently 0.75% of the fund per year, according to research by the Department for Work and Pensions.Its Landscape and charges survey 2013: charges and quality in defined contribution pension schemes comprised a combination of quantitative research ...

-

Article

ArticleMultinationals most likely to provide DC pensions for staff

Nine out of 10 (90%) global respondents provide employees with a defined contribution (DC) pension scheme as their main form of workplace retirement provision, according to research by PricewaterhouseCoopers (PWC).Its research, which surveyed 114 multinational employers, found that the same percentage (90%) still want to play a significant role in ...

-

Article

ArticleAverage combined DC pension contribution is 10%

The average combined employer and employee contribution to a defined contribution (DC) pension scheme now totals 10%, according to research by the Chartered Institute of Personnel and Development (CIPD).Its Employee outlook: focus on employee attitudes to pay and pensions survey, which surveyed nearly 2,700 employees, found that, on average, respondents ...

-

Article

Article81% concerned pensions change could impact service levels

More than three-quarters (81%) of respondents said the volume of change in the pensions sector in the next 12 months will adversely affect the level of services provided, according to research by the National Association of Pension Funds (NAPF).The survey, which questioned 108 respondents, found that 87% of employer respondents ...

-

Article

Benefits packages cost more than 20% of salary

More than a third of respondents said their overall benefits package costs more than 20% of salary, according to research by Towers Watson.Its Benefits health check survey, which questioned employers with between 500 and 2,000 employees, found that 60% of respondents have a consistent philosophy and strategy across their benefits, ...

-

Article

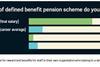

ArticleEmployers tackle defined benefit pension deficits

Its Pensions risk survey found that the accounting deficit for FTSE 350 companies stood at £97 billion at 31 December 2013, compared to £72 billion at 31 December 2012.Employers are using a variety of methods to fund, de-risk and manage these pension deficits.Ali Teyyebi, head of DB risk in the ...

-

Article

BT and BBC top pensions league table

BT and the BBC have topped a league table of the UK’s workplace pension schemes for responsible investment, according to research by charity ShareAction.BT and the BBC came joint top with a score of 35 out of a possible 40, followed by the universities’ superannuation scheme in third place.In contrast, ...