All articles by Jennifer Paterson – Page 29

-

Analysis

AnalysisFacts and figures on health cash plans

Read the digital edition of our Health cash plans supplement 2014 in full.

-

Article

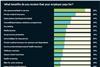

ArticleLife assurance most popular benefit given to HR professionals

This is in addition to salary, bonuses, pensions, share schemes and company cars.The Employee Benefits Salary survey 2014, which questioned 361 people esponsible for managing benefits and reward in UK organisations, found that life assurance is followed by private medical insurance schemes (59%), subscriptions to professional bodies (47%), employee assistance ...

-

Article

Ian Wright: How will the changing state pension age affect employers?

Our employees are fortunate enough to be relatively high earners and most take part in the organisation’s pension scheme. This means that, as they approach their 60s, most should have personal savings, investments and assets, and should have built up a fairly substantial pension fund rather than be reliant on ...

-

Article

Simon Nash: How will the changing state pension age affect employers' pension strategies?

On 11 December 2013, the Office for National Statistics released an update to its projected mortality figures, predicting that girls born in 2013 would live to, on average, 94 years of age, with boys still living slightly shorter average lives.What is more, these statistics reveal that more than one-third of ...

-

Article

Michelle Cracknell: How will the changing state pension age affect employers' pension strategies?

With all of us living longer, the state pension is no longer affordable on its current terms. For those of us in the industry, the rise in the state pension age was confirmation of the inevitable, but was it expected by the public?The Pensions Advisory Service takes more than 80,000 ...

-

Article

David Fairs: How will the changing state pension age affect employers' pension strategies?

Saving longer and retiring later should make for higher pensions. But employees who want to retire earlier than state pension age, or indeed need to retire earlier because they are in a physically demanding job, will face some difficult choices. With the average pension pot of £30,000 currently providing an ...

-

Article

Article91% of HR professionals are pension scheme members

The Employee Benefits Salary survey 2014 , which questioned 361 people with responsibility for managing benefits and reward in UK organisations, found that three-quarters (75%) of respondents are active members of a defined contribution (DC) scheme , while just over a quarter (27%) are active members of a defined ...

-

Article

Article5% DC pension contribution most common for HR professionals

The Employee Benefits Salary survey 2014 , which questioned 361 people who are responsible for managing benefits and reward in UK organisations, found that 9% pay in 10% or more of salary. Under auto-enrolment legislation, current minimum contribution levels are set at 1% for employees and 1% for employers. But ...

-

Article

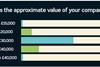

Article39% of benefits professionals receive car or allowance

The Employee Benefits Salary survey 2014 , which questioned 361 people responsible for managing benefits and reward in UK organisations, found that, of this 39%, more than one-third (38%) receive a company car rather than a car allowance.The average approximate value of company cars for 62% of respondents in ...

-

Article

Article27% of benefits professionals are share scheme members

The Employee Benefits Salary survey 2014 , which questioned 361 people who are responsible for managing benefits and reward in UK organisations, found that the most common type of share scheme is an all-employee sharesave plan (46%), followed by a long-term incentive plan (29%).Just under a quarter (22%) of respondents ...

-

Article

Teachers' performance-related pay could reach £70,000

The best performing teachers could be paid as much as £70,000 a year under the government’s new system of performance-related pay in schools, according to a report by Policy Exchange.According to the report, under the performance-related pay system, which took effect from September 2013, top teachers would be able to ...

-

Article

Hargreaves Lansdown launches workplace savings iPad app

EXCLUSIVE: Hargreaves Lansdown has launched a free iPad application (app) for members of its workplace savings platform.The app, HL Live, is a DIY investment tool, which allows members to view their pension and other savings via their tablet.It is designed to provide investors with the tools and research needed to ...

-

Article

Bonus cap for bankers takes effect

New legislation to cap European bankers’ bonuses took effect from 1 January 2014.The legislation, which was agreed in March 2013 by the European Parliament and European Commission, will apply to bonuses paid in 2015.The law means that:A salary/bonus ratio of 1:1 can be raised to 1:2 with a shareholder vote ...

-

Article

Reed Smith staff move to online savings platform

EXCLUSIVE: Law firm Reed Smith has seen 89% of employees register to manage their savings and benefits online since it launched an integrated workplace savings and flexible benefits platform.It introduced its platform, Path, in May 2013 because benefits take-up rates were low and the benefits were spread across different providers ...

-

Article

Trident Reach offers financial wellbeing kiosk

Charity Trident Reach has launched a touch-screen kiosk to help employees access financial and wellbeing benefits.The kiosks provide staff with access to a range of products and services, such as healthcare policies and discounts from health insurer and employee benefits provider BHSF, as well as existing savings accounts with Citysave ...

-

Article

Fujitsu uses flex to communicate auto-enrolment

EXCLUSIVE: Fujitsu has used its annual flexible benefits enrolment process to continue its pensions auto-enrolment communications.The technology organisation, which has 15,000 employees, opened its flexible benefits window in November 2013, with employees’ benefits choices taking effect from January 2014.It included details of pensions auto-enrolment in this year’s communications, in order ...

-

Article

Airbus streamlines health cash plans

Airbus has launched an employee-paid health cash plan for its 10,000 UK employees.The aircraft manufacturer previously offered its staff a range of legacy health cash plans from a number of suppliers, but these plans were not promoted to employees.It decided to streamline the offering to a single cash plan, provided ...

-

Article

Easyjet switches share plan administrators

Easyjet has changed providers for the administration of its employee share plans.The airline awarded the contract to Equiniti following a tender process.Equiniti has provided the airline’s share plan registration since 2000. But under the new contract, it will also be the sole provider for Easyjet’s share plan administration for five ...

-

Article

Network Rail appoints pension administrator

Network Rail has appointed Capita Employee Benefits to provide pension administration services for two of its three pension schemes.Capita will be responsible for administering the train operater’s trust-based defined contribution pension scheme, which has around 15,000 members, and its career average re-valued earnings (Care) pension, which has around 3,500 members. ...

-

Article

DC pension contributions increase little in past 10 years

Average rates of contributions into defined contribution (DC) pension schemes have changed very little over the last decade, according to research by the Association of Consulting Actuaries (ACA).The 2013 ACA Pension trends survey, which questioned 308 employers with more than 430 pension schemes, found that contribution rates are generally failing ...