Need to know

- When calculating the return on investment on group risk benefits, organisations need to start with accurate employee data.

- The value-added products available through group risk products can deliver cost savings.

- Non-financial returns such as engagement are of increasing interest.

Employee benefits professionals are under increasing pressure from their finance directors to demonstrate a return on investment (ROI) for their benefits packages, particularly for higher-cost products such as group risk provision.

Ultimately, employers are trying to understand how much greater their sickness absence-related costs would have been had their group risk benefits not been in place. However, this simple objective belies the sizeable challenges involved in the calculation.

Direct costs are relatively straightforward and may include occupational and statutory sick pay, contracted overtime and pension contributions. But indirect costs can range from the cost of replacing temporary staff to administrative costs around, for example, the time required by HR and benefits staff to deal with third parties involved in supporting employees back to work and return-to-work interviews, which can be difficult to quantify.

It may be equally difficult for organisations to measure the possible impact of, say, any mistakes a temporary staff member may make due to lack of experience, or low staff morale resulting from the absence of a key staff member such as a line manager.

Making effective use of data

Despite the challenges, calculating ROI is possible and should start with employers ensuring that they hold clean data. This means data that is accurate and up to date, particularly around sickness absence reporting systems, which may take some time for large, global organisations with staff deployed across the world.

A clear measure can also help to focus employers’ minds. For example, organisations could consider the extent to which group risk benefits help their business to boost staff retention and in the process reduce recruitment costs. Paul Avis, marketing director at Canada Life Group Life Insurance, says: “If an employer is losing 20% of staff and that costs [the organisation] £1m a year, then that is its starting point if it is looking at its attrition rate and the costs of recruitment and retention.”

From there, an employer could focus its communications strategy on its group risk benefits over a sustained period of time, say two years, and during that time track benefits take-up and staff retention rates. This would enable the organisation to examine the correlation between group risk benefits take-up and its talent management strategy.

Of course, it is impossible for employers to know what would have happened had their group risk benefits not been in place. Would the organisation with high recruitment costs have seen its retention rates improve without the benefits in place anyway?

Calculating a group risk benefits ROI is particularly difficult for employers with legacy packages because of the lack of comparative data showing the impact of not having a package in place. James Walker, head of workplace product and proposition at Legal and General, says: “We don’t want to say to half our employers that we want to work out whether this [benefit] pays for itself or not, so we need a group of them not to get it. We’d have to compare two groups: one that gets it and one that doesn’t and they have got to be big enough [sample groups].”

Nevertheless, a number of providers have attempted to give employers an idea of the cost savings that can be made through group risk benefits cover. For example, according to the study Income protection and rehabilitation, written by economist Kyla Malcolm and published by Zurich in December 2015, every £1 spent on rehabilitation to support employees on long-term sick leave generates cost benefits totalling £16.80 for employees, the taxpayer, employers and insurers because of the speed with which employees return to work.

The add-on products and services that most group risk providers now offer as part of their group income protection (GIP) cover for free can help employers to boost these savings. These include employee assistance programmes (EAPs), legal support and second medical opinion services, such as Best Doctors.

“If employers reviewed the third-party services available from group risk insurers, all of which are subsumed within their premium, then they could reduce their direct EAP costs, their legal costs, and if they use a second medical opinion service, have a reduction in private medical costs, too,” says Canada Life’s Avis.

Looking beyond monetary value

Yet not all employers are interested in financial-based ROIs. A growing number of organisations are more interested in understanding group risk ROI in the context of non-financial measures, such as employee engagement and the extent to which they are perceived as an employer of choice.

Lee Christian, principal consultant, group risk at JLT Employee Benefits, says: “The old way of looking at ROI was to talk about it in terms of pounds, shillings and pence, but employers are increasingly looking for more than a monetary return. They are now looking for a return in the form of employee engagement and increased loyalty.”

But soft measures such as employee engagement can bring with them their own complexities. For example, calculating an ROI in this context is only possible if staff value the group risk benefits their employer has on offer.

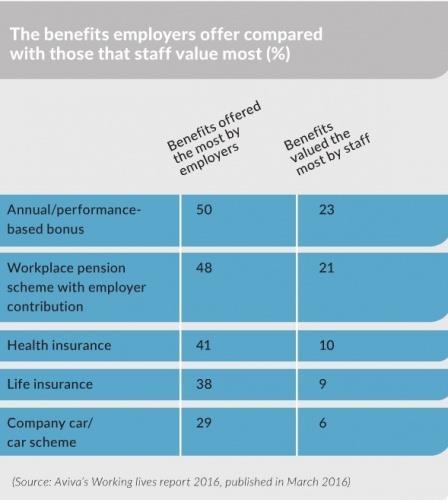

According to Aviva’s Working lives report 2016, published in March 2016, health insurance ranked third in the list of benefits valued most by staff after a bonus and a defined contribution pension scheme. But this represents just 10% of 2,000 employees working in around 500 organisations.

Also, the qualitative nature of soft measures such as engagement and loyalty is difficult to measure.

Katharine Moxham, spokesperson for industry body Group Risk Development (Grid), says: “One of the things that group risk benefits enable employers to do is to position themselves as a caring organisation, but what ROI can they put on that? How do they measure employee satisfaction and engagement? I think this is actually a really difficult thing to do.”

But that should not be a reason for employers to avoid the calculation. If nothing else, the process will enable organisations to re-evaluate whether or not their group risk benefits are fit for purpose in light of their current workforce demographics.

Samsung offers group risk benefits in line with corporate culture

Samsung offers its workforce group income protection (GIP) and life insurance in line with its paternalistic corporate culture.

Jo Bean, head of reward, UK and Ireland at Samsung, says: “We’re quite a paternalistic [employer], so we’ve always offered [GIP] as a core benefit. I particularly like the fact that our [policy] covers staff up to the age of 65 rather than just for a short-term period.”

The cost benefits of the organisation’s group risk benefits are less of a concern for Bean. “[Return on investment is] very difficult to measure because we don’t have access to any [take-up] data because it’s completely confidential. And I wouldn’t want to know who’s using [the policy].

“It’s more about the fact we offer it to everybody and that they have access to it,” adds Bean. “The fact that [it is] there and we know referrals are being made is enough for me.”

The organisation works hard to ensure that employees know that the group risk benefits exist, so they are able to get help when they need it most.

A comprehensive communications campaign promoting the benefits includes posters on the organisation’s office toilet doors, advertising on its on-site television screens and intranet site, as well as on-site events hosted by Canada Life and Best Doctors.

Samsung appointed Canada Life to provide its group risk benefits following an internal group risk market review in 2014. The organisation particularly values the add-on benefits, such as the employee assistance programme (EAP) and Best Doctors referral scheme, that form part of its GIP policy.

GIP is offered to all 1,400 UK staff and their family and friends, with EAP access extended to the employer’s 150-strong temporary workforce.