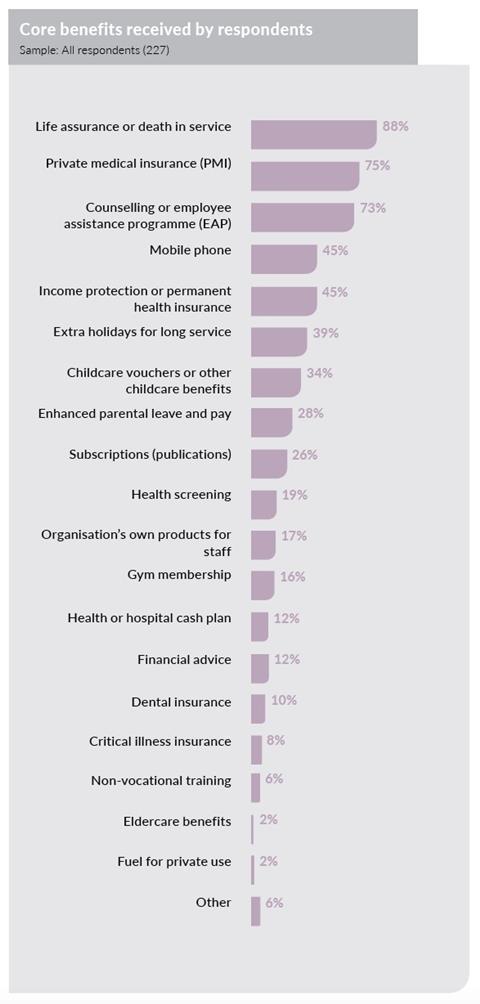

EXCLUSIVE: Almost nine in 10 (88%) HR and benefits professional respondents receive life assurance or death-in-service benefits, according to research by Employee Benefits.

The Salary survey 2017, which surveyed 249 HR, reward and benefits professionals in December 2016, also found that 75% of respondents' organisations offer private medical insurance (PMI).

These benefits also held the two top spots in the Employee Benefits Salary survey 2014, when 84% of respondents were offered life assurance or death in service, and 59% had access to PMI.

Employee assistance programmes (EAPs) and counselling (73%), mobile phones (45%), and income protection or permanent health insurance (45%) complete the top five core benefits received by respondents, outside of pensions, cars and share schemes. These benefits have also experienced an increase in popularity since 2014, when 43% of respondents had access to counselling or an EAP, 32% were provided with a mobile phone, and 28% received income protection or permanent health insurance as an employer-paid benefit.

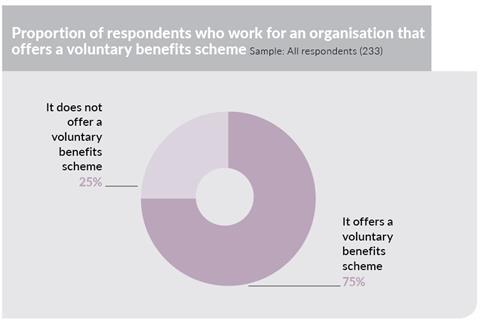

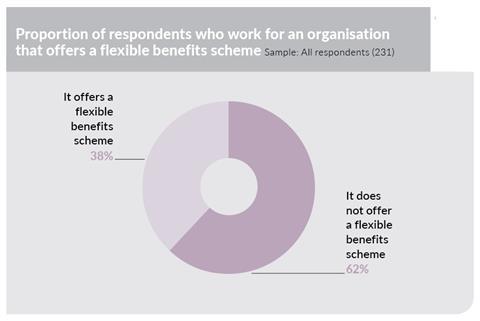

Three-quarters (75%) of respondents work for an organisation that offers a voluntary benefits scheme, and 38% of respondents have access to a flexible benefits programme.

The proportion of respondents with access to a voluntary benefits scheme has increased significantly since the Employee Benefits Salary survey in 2008 and 2009, when 46% and 59% of respondents had access to a voluntary benefits scheme, respectively.

The number of respondents that are employed by an organisation with a flexible benefits plan has also risen, albeit at a lesser rate; 21% of respondents' organisations had a flexible benefits plan in place in 2008, compared to 25% in 2009.

Click to download the full Employee Benefits Salary Survey 2017.