All Article articles – Page 688

-

Article

ArticleYoung people could lose £100,000 on pensions

Young people who delay saving for a pension until they reach middle age could lose up to £100,000 in employer pension contributions and tax relief, according to research by pension consultancy Barnett Waddingham.The research found that a 25-year-old, earning £25,000 per year, who delays joining a generous workplace pension scheme ...

-

Article

Mattioli Woods acquires Atkinson Bolton

Pensions and wealth management firm Mattioli Woods has acquired employee benefits and wealth management business Atkinson Bolton.The deal will see an additional £420 million of funds under management and advice, with 50 employees added to the group, which now employs more than 300 staff and has more than £4 billion ...

-

Article

Consultation published on variable pay for bankers

The European Banking Authority (EBA) has launched a consultation on the instruments that can be used by banks to satisfy the standards of its bankers’ bonus cap legislation.The EBA’s draft Regulatory Technical Standards, which includes the requirement for banks to pay 50% of variable remuneration in non-cash instruments, is expected ...

-

Article

Average annual salaries down by 2.1%

The average advertised annual salary in June 2013 stood at £33,414, 2.1% lower than in June 2012, according to research by Adzuna.co.uk.Its UK Job market report, which collected online job vacancies and analysed data in real time, found that this equates to a drop of more than £700 over the ...

-

Article

ArticleEmployee Benefits magazine – August 2013

Editor’s note:We spotted that trust is becoming a hot topic in HR circles. So in this August issue of Employee Benefits we opted to look at it through a benefits prism in our cover story Position of trust (see page 20).We were also pleased to get time with HSBC’s head ...

-

Article

Former MI5 head to deliver keynote at Employee Benefits Live

Manningham-Buller, who headed Britain’s Security Service from 2002 to 2007, led the organisation though substantial change in the wake of 9/11 and the threat from Al-Qaeda. During this time, MI5 also doubled in size and altered its approach to the professional development of staff.For more information and to register to ...

-

Article

More than £35bn paid into FTSE 350 pensions

FTSE 350 organisations have paid more than £35 billion into their pension schemes over the last three years with little effect on overall deficits, according to research by pension consultancy Barnett Waddingham.The research, which highlights the impact defined benefit (DB) pension schemes are having on FTSE 350 organisations, found that ...

-

Article

Zenith launches wellbeing seminars for staff

Zenith has extended its employee wellbeing programme with lunchtime seminars for employees.The seminars will cover a range of topics, including stress awareness, building resilience, positive thinking, and the link between nutrition and mental health.The fleet management organisation, which has 210 employees, has added the seminars to its package of wellbeing ...

-

Article

Workplace flexibility in the spotlight

The Flex Factor report, published by think-tank RSA and Vodafone UK in July, found that UK employers could see cost reductions and productivity gains worth up to £8.1 billion by optimising their approach to flexible working.Dr Steven Poelmans (pictured), professor and director of the Coaching Competency Centre at the EADA ...

-

Article

Royal Mail privatisation is landmark for employee ownership

Vince Cable, business secretary, confirmed that Royal Mail staff would be given 10% of the organisation’s shares after its flotation on the London Stock Exchange, planned for later this year. The government has hailed the move as the second biggest employee share scheme in 30 years in terms of the ...

-

Article

Lifting Nest restrictions should create a level playing field

The pensions industry, including Nest, has widely supported the move. Logan Anderson, head of customer relations at The Pensions Trust, said: “The removal of Nest’s restrictions is a good thing, because these act as a barrier to encourage greater savings among employers and their employees. [Prior to lifting the restrictions] ...

-

Article

Employers must take care on pay promises

In the High Court case of Attrill and others v Dresdner Kleinwort, employees succeeded in their argument that their employer was contractually obliged to pay bonuses from a guaranteed minimum bonus pool of €400 million (£343 million) it had promised to set up. The court ruled that the bank had ...

-

Article

Compliance round-up for July

It is to axe automatic annual pay rises in the civil service as part of a pledge to make £11.5 billion worth of public sector savings in 2015/16. The proposed legislation, announced in the Spending Review 2013 confirmed that public sector pay rises will be limited to an average of ...

-

Article

Duncan Brown: Engagement through reward: impossible or essential?

In the last couple of weeks, I have been talking about the links between performance, reward and values with the NHS Pay Review Body; moves towards more market-driven reward with the Universities and Colleges Employers’ Association (UCEA); and the links between reward and engagement at an Aon Hewitt seminar.Whatever the ...

-

Article

Debi O'Donovan: How social networks impact on trust

In the eyes of many commuters, the number of minutes that had to pass before a ‘minor’ or a ‘severe’ delay was declared was too high. Accusations were thrown around that LU was trying to do something underhand to improve its delays record.What this showed up was how quick people ...

-

Article

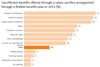

ArticleBuyer's guide to salary sacrifice car schemes

The factsWhat is a salary sacrifice car scheme?This is a car scheme for which an employee forgoes a portion of their gross salary in exchange for a car, and receives tax and national insurance breaks.Where can employers get more information?www.employeebenefits.co.uk/benefits/company-cars-and-fleetwww.hmrc.gov.ukWho are the main providers?ALD Automotive, Alphabet, Fleet Evolution, Fleet Hire, ...

-

Article

ArticleAuto-enrolment opt-out rates as expected

David Tildesley, director of client partnerships at Capita Employee Benefits, said: “When the project first started for auto-enrolment, all sorts of financial modelling assumptions were made by employers. They started off with assumptions of opt-outs of around 50% of the workforce, but I don’t think any of them ended up ...

-

Article

Auto-enrolled employers likely to contribute less

The research, conducted among 370 HR and benefits managers, found 21% of those that have auto-enrolled staff are paying in a 1% pension contribution, but only 7% of those still to auto-enrol pay in at this low level.In turn, 23% of those still to auto-enrol pay in a 5% employer ...

-

Article

ArticleGroup personal pensions most popular among employers

Almost half of the respondents (48%) to the Employee Benefits/Capita Pensions Research 2013 still offer a group personal pension (GPP) as their primary pension plan.This is in line with Employee Benefits’ 2011 pensions research, in which 54% of respondents said a GPP was their primary plan choice. Similarly, GPPs were ...

-

Article

ArticleEmployee share schemes see great activity

Employees at Sports Direct were among those to enjoy a shares payout. Under the organisation’s 2009 bonus scheme, which is set to mature this month, staff will receive a payout worth 75% of their base salary in shares priced at £1.25.It is estimated that a Sport Direct shop assistant on ...